|

In a slow week of initial public offerings (IPOs), a Washington-based company broke a 14-year dry spell of tech IPOs in the Silicon Forest, and a Minnesota company broke the State’s largest IPO record.

In a relatively slow week for economic news, retail sales reversed a downward trend and home buyers began shopping as weather improved. Yet, the markets paid close attention to the yield of the 10-year Treasury and its approach to 3%.

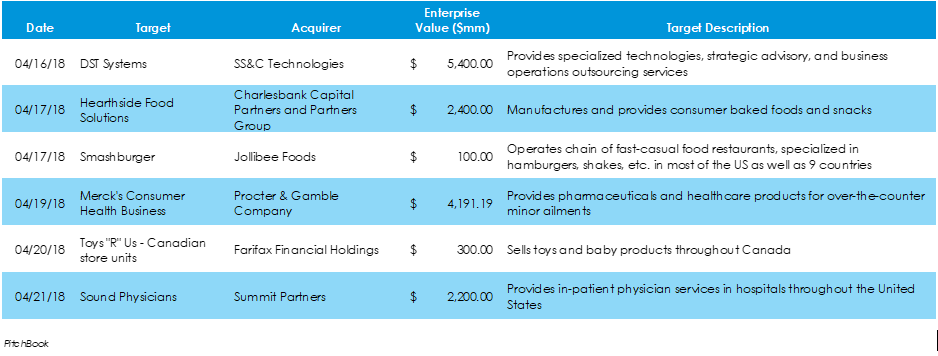

Last week, there were a number of M&A deals that fell in Skyline's industries of focus: food and agriculture, technology, healthcare, and industrials, broadly speaking. Within technology, one of the week's largest valued deals was SS&C Technologies acquisition of DST's financial services and healthcare segments. Within domestic healthcare, Tacoma-based Sound Physicians agreed to be bought out by Boston-based PE firm, Summit Partners. Within food, Hearthside Food Solutions and Smashburger engaged in transactions. Notable global market deals include Procter & Gamble’s acquisition of Merck's consumer health business and the liquidation auction of Toys "R" Us' Canadian stores.

This past week saw initial public offerings from technology, industrials, and healthcare industries. Pivotal and GrafTech led IPOs with multi-billion-dollar valuations.

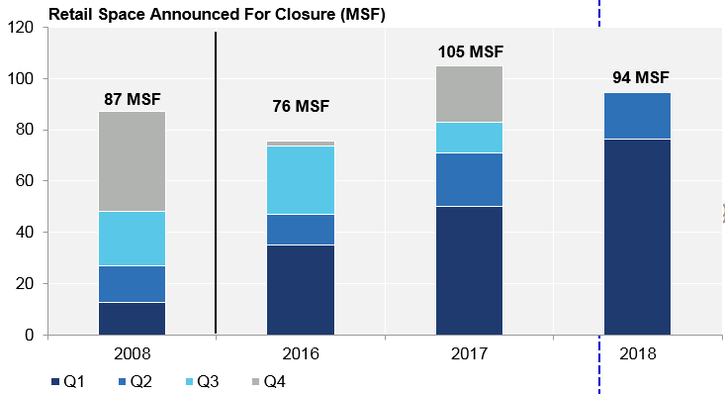

Four months into 2018 and more than 90 million square feet of retail space is set to close during the year. CoStar Group, which tracks square footage captured from retail store closings, has already noted 94 million square feet set to close in 2018, approximately 24 million of which is from the liquidation of more than 200 Bon-Ton stores.

Last week, several key indicators indicated cooling in the US economy. Primarily led by consumer-focused indicators, other softening indicators included small business optimism, which hinted at decreasing confidence of an improving economy. Inflation also ticked up, but the increase was largely driven by plunging wireless services prices in the year-ago period.

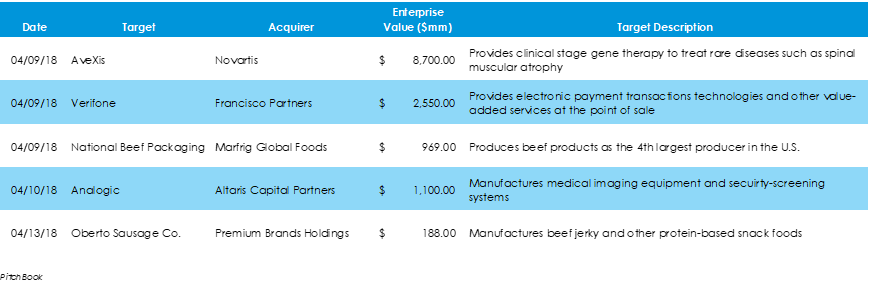

The past week included a number of multi-billion-dollar deals: Novartis' $8.7 billion bid for AveXis, Franciso Partners’ public-to-private deal for Verifone, Altaris Capital's acquisition of a medical imaging manufacturer, Brazilian Beef Producer Marfrig's hope of entering into outside markets, and Premium Brands' buyout of meat snacks provider Oberto Brands.

Last week, the National Center for the Middle Market published its quarterly Middle Market Indicator (MMI) report, the March jobs report showed closer-to-normal job gains and low unemployment, and the ongoing trade tension between the U.S. and China continued with more imposed tariff exchanges.

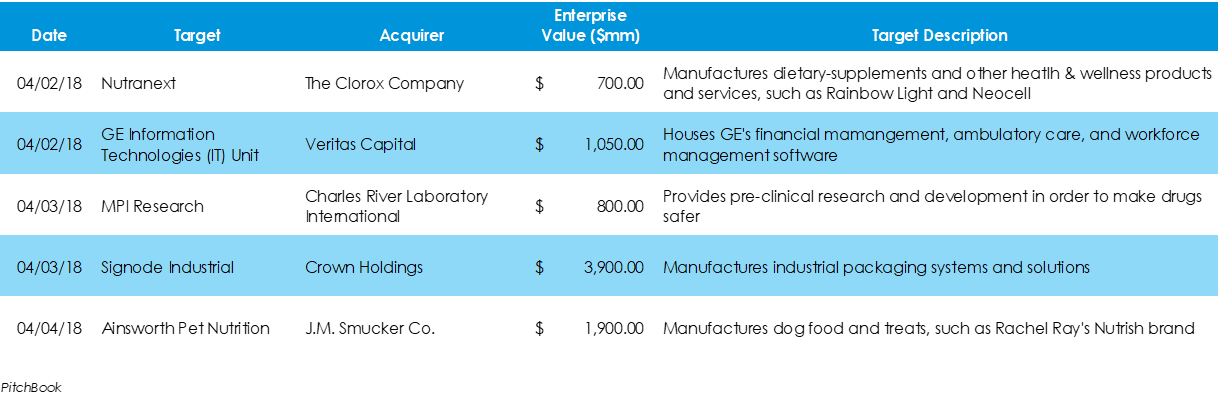

Last week, the deals market saw major developments within pet foods, technologies, and healthcare. The highlight of the week was J.M. Smucker's add-on acquisition of another pet foods provider.

The past week was relatively quiet for IPOs. Most notable, however, was, Spotify Technology SA's (NYSE: SPOT) unique direct listing, which resulted in first-day stock appreciation. The previously detailed direct listing by the Stockholm-based music-streaming company was the largest of its kind and might pave the way for other firms looking to enter public markets through the non-traditional route.

During the past year, many notable U.S. retailers have been significantly derailed by the consumer spending shift to e-commerce and their heavy debt burdens. Since the start of 2018, Toys-R-Us, iHeartMedia, and Claire's have all filed for bankruptcy. During the past two weeks, two more recognizable companies have filed bankruptcies: Remington Outdoor Co. and Nine West Holdings, Inc. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed