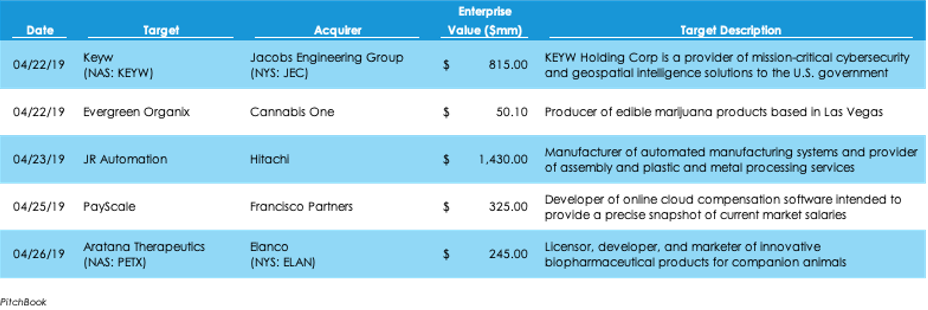

Cannabis M&A Spiked Last Week with Four Deals in the U.S.Pitchbook data shows M&A activity slowing last week, with $3.6 billion invested across 24 deals, $11.2 billion capital and seven deals fewer than the week prior. Japanese multinational conglomerate Hitachi shelled out $1.43 billion for Michigan-based industrial robotics integrator JR Automation in the week’s largest deal. Deal making in the cannabis space was hot last week, with four U.S. cannabis producers and distributors being acquired.

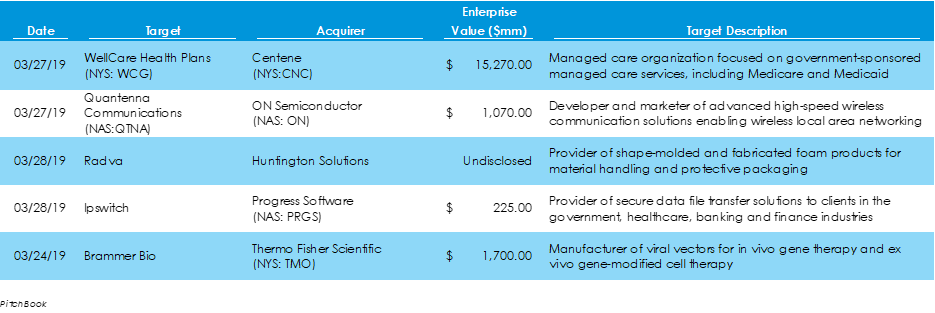

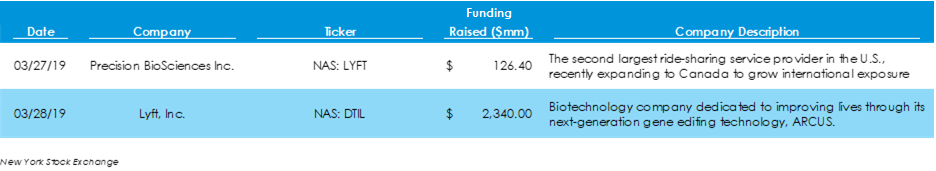

Mergers & Acquisitions: Manufacturing Sector Sees Continued Strong Activity in the M&A SpacePitchbook data reveals that $19.6 billion of capital was invested across 27 M&A transactions last week, twelve more deals but $17.2 billion less capital than in the week prior. The largest deal was publicly traded Centene’s corporate acquisition of WellCare Health Plans, also a publicly traded company, for $15.3 billion. The manufacturing vertical has been busy in 2019 through the end of last week, posting 48 transactions and $19 billion capital invested in LBOs and corporate acquisitions. Initial Public Offerings: Lyft Follows Through with Long-Awaited IPO According to the New York Stock Exchange website, two companies went public last week, the same figure as the week before. However, those two companies, Lyft and Precision BioSciences, combined raised more than in the prior week, raising $2.3 billion and $126 million, respectively. Lyft has been a highly anticipated IPO since the beginning of 2018, and the results of its IPO are indicative of it. The company priced its IPO at $72 per share, well above its initial estimates after a roadshow in which the firm received commitments in excess of expectations. As of trading close on Friday, Lyft was valued at approximately $26.5 billion. Economy: U.S. Fourth Quarter Economic Growth Revised Downward Among news last week:

The Federal Reserve’s January 2019 Beige Book shows a general increase in economic activity, while the labor market remains tight and input costs are on the rise. The University of Michigan revealed that consumer sentiment fell to its lowest level in over two years, according to its Survey of Consumers. The ongoing government shutdown and market volatility were the leading factors. Also, the Labor Department released its import- and export-price indices for December, which both fell during the month. Year over year, import prices had their largest drop since September 2016.

Initial claims for unemployment benefits fell by a marginal amount last week, continuing a downward trend towards the 49-year low set in September. Chicago’s manufacturing activity slowed last month, although only slightly, due to slip-ups in new orders, employment and supplier deliveries indices. The Conference Board’s December consumer confidence index revealed a sharply lower measure from November, as market volatility and lower economic growth expectations alarm consumers.

November’s final Consumer Sentiment reading fell more than expected to 97.5 points, continuing a slide off of March’s fourteen-year-high reading of 101.4. New housing starts grew last month amid rising tariff-related costs for builders, driven by new construction of multi-family housing units. Lastly, initial unemployment claims rose suddenly to a four-month high of 224,000, despite continuing claims falling to 1.67 million, a level not seen since the early 1970s.

Last week’s economic news showed consumer confidence reaching a sudden 18-year high, lending hope to the possibility of continued economic expansion. Also, worker productivity grew only slightly in October, thanks in part to employers’ need to hire lower-skilled workers. On Friday, the Labor Department announced job growth far exceeded expectations, unemployment held constant, and wage growth also increased.

Last week, data showed that retail spending declined in August, jobless claims rose for the week ending September 22nd, the personal consumption expenditures index hit the Fed’s targets, and consumer sentiment rose.

Weekly jobless claims fell to their lowest level since December of 1969, showing signs of continued labor market strength. The U.S. trade gap narrowed in the second quarter thanks to increased foreign demand for U.S. goods and services, as well as repatriated cash. Lastly, Merrill Lynch’s survey of money managers revealed increased investor pessimism about the outlook of the economy for the next twelve months.

Last week, the Bureau of Economic Analysis updated its original estimate of second-quarter GDP growth, the U.S. Census Bureau announced the July trade deficit reversed its spring and summer trend to widen to a five-month high, and the Consumer Confidence Index for August spiked dramatically to an 18-year high.

A larger jump in retail sales proved to be one of very few optimistic highlights in last week’s economic news. The week entailed mostly negative news, as housing starts increased less than expected, the Philly Fed’s Manufacturing Index slipped significantly, and the University of Michigan Consumer Sentiment Index fell unexpectedly.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed