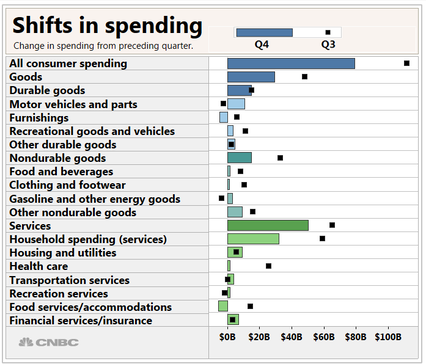

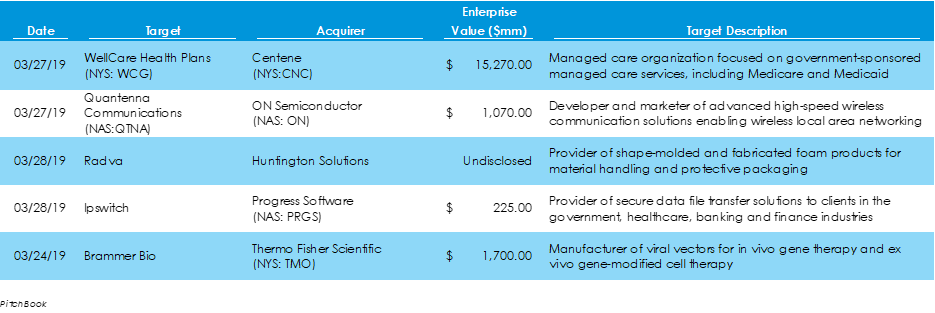

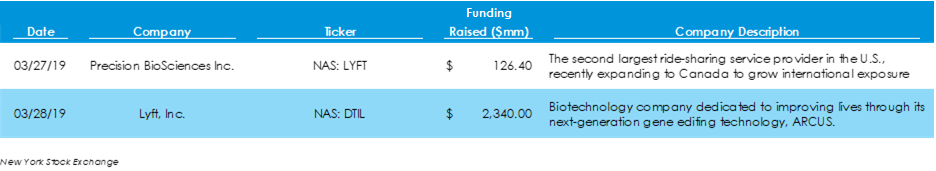

Mergers & Acquisitions: Manufacturing Sector Sees Continued Strong Activity in the M&A SpacePitchbook data reveals that $19.6 billion of capital was invested across 27 M&A transactions last week, twelve more deals but $17.2 billion less capital than in the week prior. The largest deal was publicly traded Centene’s corporate acquisition of WellCare Health Plans, also a publicly traded company, for $15.3 billion. The manufacturing vertical has been busy in 2019 through the end of last week, posting 48 transactions and $19 billion capital invested in LBOs and corporate acquisitions. Initial Public Offerings: Lyft Follows Through with Long-Awaited IPO According to the New York Stock Exchange website, two companies went public last week, the same figure as the week before. However, those two companies, Lyft and Precision BioSciences, combined raised more than in the prior week, raising $2.3 billion and $126 million, respectively. Lyft has been a highly anticipated IPO since the beginning of 2018, and the results of its IPO are indicative of it. The company priced its IPO at $72 per share, well above its initial estimates after a roadshow in which the firm received commitments in excess of expectations. As of trading close on Friday, Lyft was valued at approximately $26.5 billion. Economy: U.S. Fourth Quarter Economic Growth Revised Downward Among news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed