|

The spread between ten- and two-year treasuries flattened to its narrowest margin in more than a decade last week, falling as low as 0.19. The yield curve is a major market-driven economic leading indicator. The NY Fed’s reduction in their GDP estimate on Friday may have contributed to the decline. In other news, jobless claims fell slightly, once again showing continued strength of the labor market, and Creighton University released their monthly Mid-America Economic Index for the month of July and their Rural Mainstreet Index for the month of August. Both Creighton indices showed general economic strength but pointed to some concerns, including effects from trade wars.

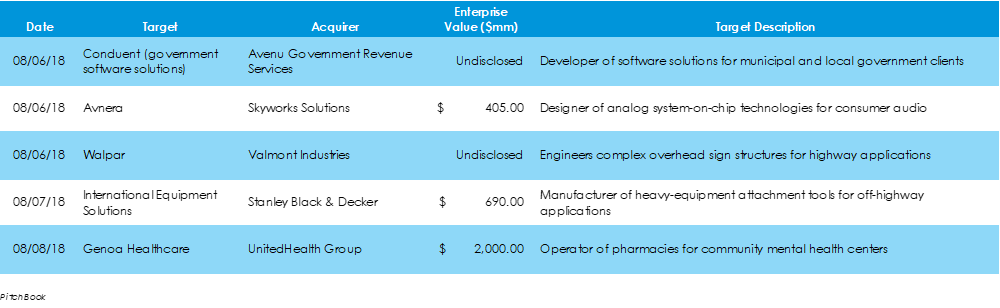

Last week, 107 M&A deals were announced or completed, representing $19.355 billion of invested capital, according to Pitchbook. Business-to-business companies were involved in 35 of those deals, the most of any sector, and energy firms spent the most on M&A last week at $4.792 billion. Some noteworthy transactions from the week are listed below:

Last week, a single U.S. company, BioNano Genomics, made its initial public offerings on U.S. exchanges, raisig a total of $20.6 million in capital in the process. Despite seeing only a single debut share offering last week, capital markets still had some noteworthy news. Saudi Aramco officially called off its IPO hopes and Eventbrite filed for its IPO later this year with the SEC.

A larger jump in retail sales proved to be one of very few optimistic highlights in last week’s economic news. The week entailed mostly negative news, as housing starts increased less than expected, the Philly Fed’s Manufacturing Index slipped significantly, and the University of Michigan Consumer Sentiment Index fell unexpectedly.

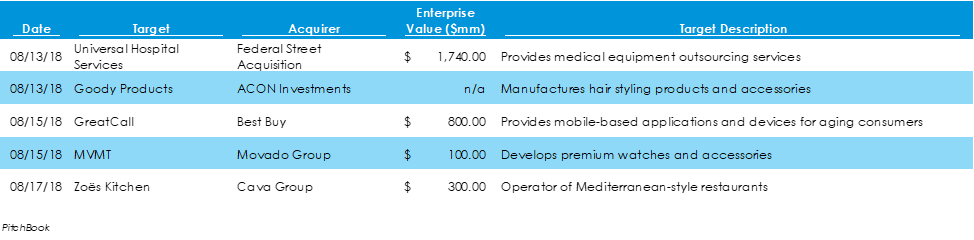

Preliminary data from Pitchbook indicates that nearly 70 M&A transactions took place last week, with total consideration at nearly $14 billion. Some of the more notable deals, highlighted below, are heavily focused on consumer industries.

In a quiet week for IPO activity, Amalgamated Bank closed its IPO, and biotechnology-focused Aridis Pharmaceuticals began trading on the NASDAQ. Renaissance Capital, a manager of IPO-focused exchange-traded funds, noted that 60 IPOs have raised a combined $13.1 billion in the second quarter of 2018, and that small-cap healthcare companies – mostly biotechs – have accounted for 40% of these IPOs.

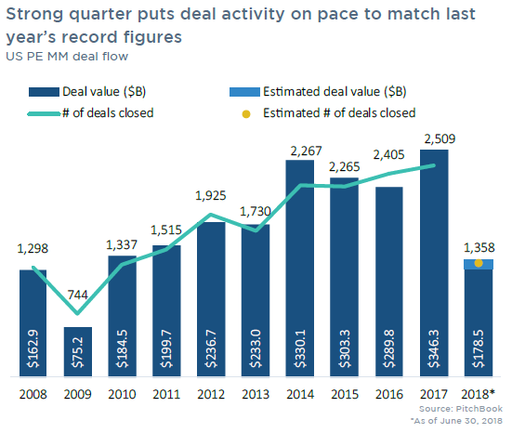

According to data provider Pitchbook, 654 US middle-market private equity (PE) transactions closed in the second quarter, with a total value of $87.6 billion. This represents decreases of 7.0% and 3.6%, respectively, from the first quarter. Data released by the Labor Department last week showed consumer prices rising dramatically, producer prices stagnating from the prior month, and job vacancies increasing to 6.7 million in the second quarter.

UnitedHealth Group Continues Insurer-Pharmacy Merger Trend with Acquisition of Genoa Healthcare8/14/2018

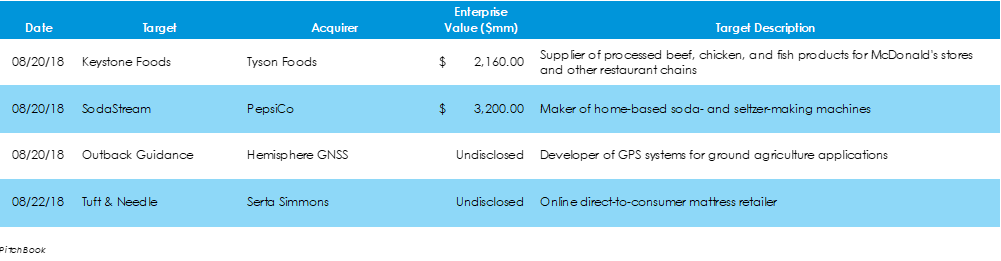

Last week, there were 38 M&A deals, comprising over $23.26 billion of capital invested, according to data from Pitchbook. Business-to-business companies led activity with 11 deals, totaling $4.3 billion, while financial services firms were responsible for the most capital invested at $6.88 billion. The following are notable transactions from the week:

Last week, the single IPO on U.S. public exchanges was for pharmaceutical company Vaccinex, which raised roughly $40 million.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed