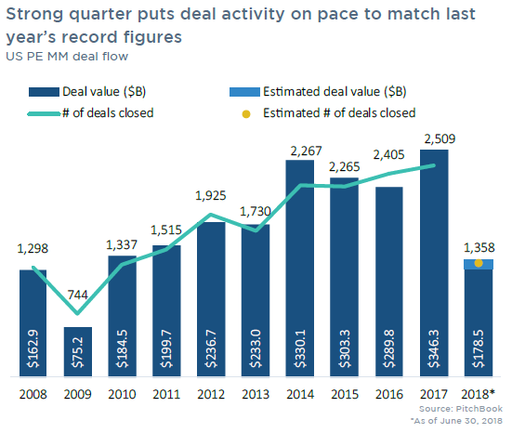

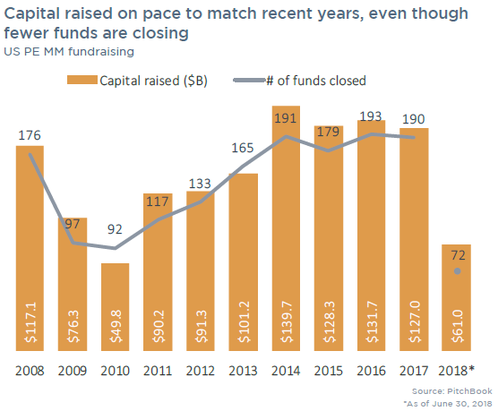

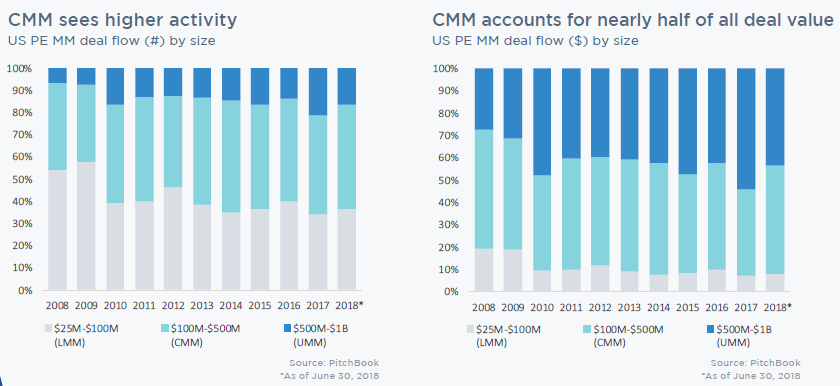

According to data provider Pitchbook, 654 US middle-market private equity (PE) transactions closed in the second quarter, with a total value of $87.6 billion. This represents decreases of 7.0% and 3.6%, respectively, from the first quarter. Through the first half of 2018, PE firms invested in 1,358 middle-market deals worth a combined $178.5 billion, or increases of 16% and 5%, respectively, over the first half of 2017. The middle market accounted for 68% of total US PE-backed deals year to date, up from 2017’s 58%, and the highest proportion of PE deal flow in more than a decade. Investors have shifted preferences to larger deals within the core middle market, which Pitchbook defines as companies valued from $100 million to $500 million. The core middle market accounted for 47% of all middle-market deals thus far in 2018, and the year-to-date median core middle-market deal size came in at $245 million, or a 18% over the median value of $207.6 million in 2017.  Strong fundraising efforts have continued into 2018, with 72 funds raising $61 billion in the first half of the year. A growing trend has evolved around increasing fund sizes as a result of larger deals and larger exits – general partners need to stay competitive in bidding for larger deals and want to avoid overconcentration. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed