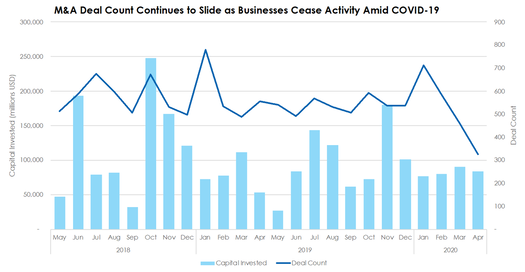

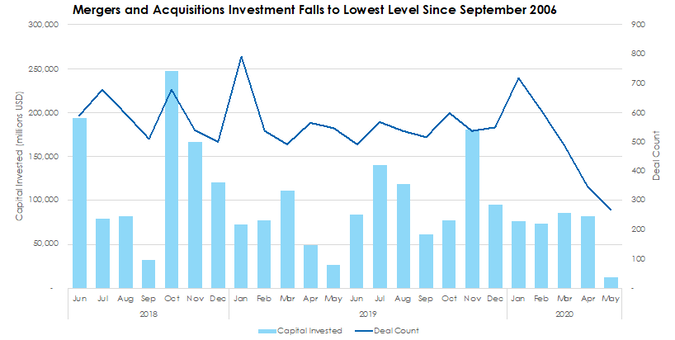

Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

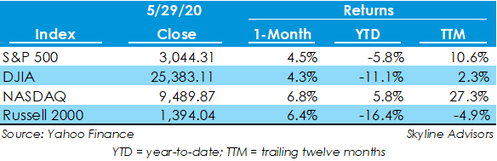

Stock Markets Stage Sharp Rebound in May  Easing of quarantine restrictions and hopes for a vaccine gave US equities a boost during May, adding on to strong year-to-date performances in large cap indices. Year-to-date, the S&P 500, Nasdaq, and Dow Jones gained 10.6%, 27.3%, and 2.3%, respectively, while the Russell 2000, a small cap index, is down 4.9%. In May alone, the large cap S&P 500 and Dow Jones gained 4.5% and 4.3%, and the tech-heavy Nasdaq and small cap Russell 2000 gained 6.8% and 6.4%, respectively. Optimism surrounding reopening economies supported equities during May.

As we publish our Economic and Public Market Update for the first quarter of 2020, it is obvious that the first quarter was a wild ride. It included US stock markets reaching all-time highs and ended with the fastest 20% market drop on record. The drop, spurred on by the coronavirus pandemic, put an end to the longest bull market in history.

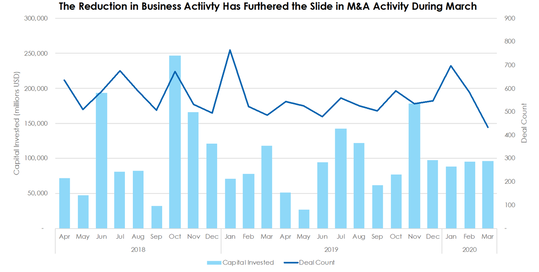

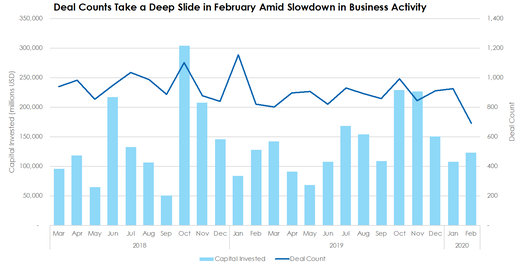

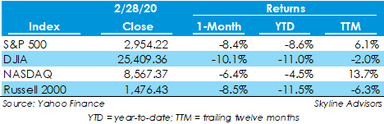

While nothing compares to the loss of human life, the economic toll of the pandemic and the practical shutdown of the economy has been significant to say the least. The full impact is still playing out, including whether we can achieve the V-shaped recovery we all hope for, but the economic results began to deteriorate in the final weeks of the first quarter. Advanced estimates of the first quarter GDP came in at -4.8%, marking the first quarterly decline since 2014. Estimates for second quarter GDP project a decline of more than 30%. M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month.  After starting February with strong gains in the 4-6% range for the major US indices, the market collapsed from record highs and into correction territory within the last six trading days of the month. The market sustained gains during the first half of the month as government and economic officials around the globe seemed to be taking appropriate action to insulate economies from the effects of the novel coronavirus outbreak. However, by the last two weeks of February, investors were spooked by weak economic data domestically and abroad, stoking fears of a global economic slowdown.  Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

Skyline Advisors Releases its Third Quarter 2019 Capital Markets Review: Midwest Edition Report12/6/2019

Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for the third quarter of 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

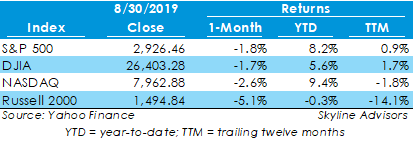

Major stock indices fell in August for the first time since May, in which indices lost in excess of 6%. In August, the S&P 500 declined 1.8%, falling to 2,926.46, while the Dow Jones Industrial Average (DJIA), Nasdaq, and Russell 2000 each declined 1.7%, 2.6%, and 5.1%, respectively. The month was characterized by excess volatility, as each index counted 10 or more days of 1%-or-greater swings. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed