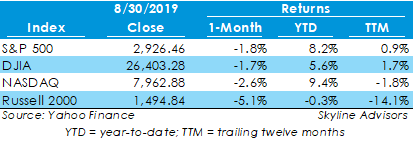

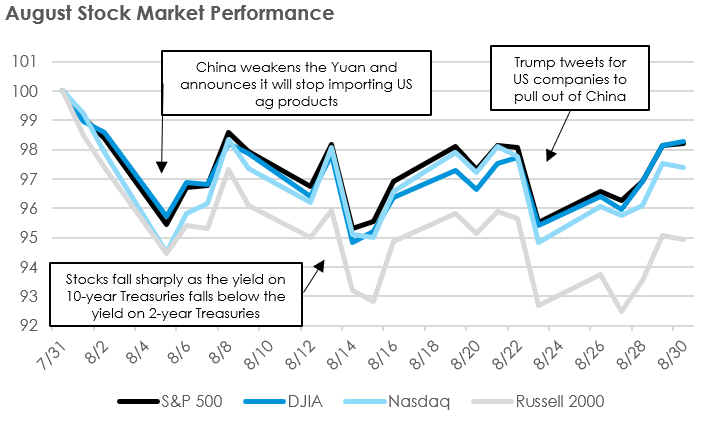

Major stock indices fell in August for the first time since May, in which indices lost in excess of 6%. In August, the S&P 500 declined 1.8%, falling to 2,926.46, while the Dow Jones Industrial Average (DJIA), Nasdaq, and Russell 2000 each declined 1.7%, 2.6%, and 5.1%, respectively. The month was characterized by excess volatility, as each index counted 10 or more days of 1%-or-greater swings. Two primary factors affecting stock market performance in August were the US-China trade war and a recession warning from the bond market. Notable days of the month included:

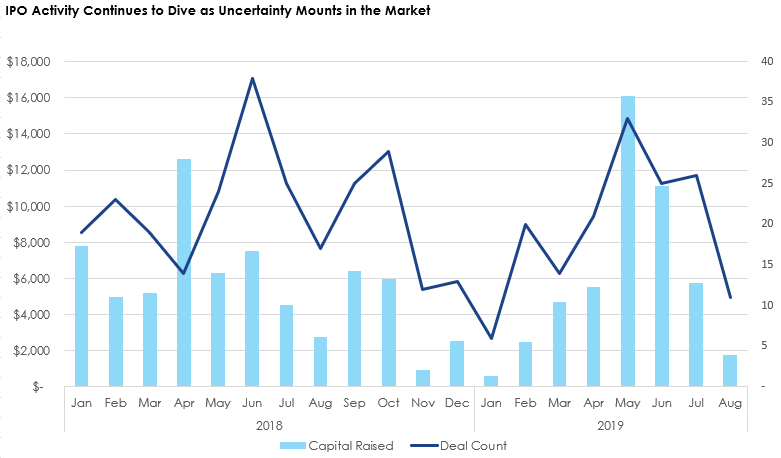

IPOs Still on Pace for Record Year despite Slow August U.S. IPO activity continued its downward trend in August, falling to $1.7 billion in capital raised, representing a 69% decline from July levels, and is down 89% from May’s peak of $16 billion. The largest IPO during the month was a $569.8-million IPO from Dynatrace, a Massachusetts-based company that develops software intelligence for the enterprise cloud.

A number of factors are suppressing filings for new issuances, namely a lack of Chinese filers due to the ongoing trade dispute, uncertainty about the U.S. economy in the near-term and general market volatility. This year is shaping up to be one of the largest years for IPOs on record, on pace to threaten 2014’s record year. However, a slowdown in the global economy and trade uncertainty could place a cap IPOs for the last four months. That said, in August two more major companies revealed publicly their filings to go public, WeWork and Peloton, which could help boost 2019 totals. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed