|

Weekly jobless claims fell to their lowest level since December of 1969, showing signs of continued labor market strength. The U.S. trade gap narrowed in the second quarter thanks to increased foreign demand for U.S. goods and services, as well as repatriated cash. Lastly, Merrill Lynch’s survey of money managers revealed increased investor pessimism about the outlook of the economy for the next twelve months.

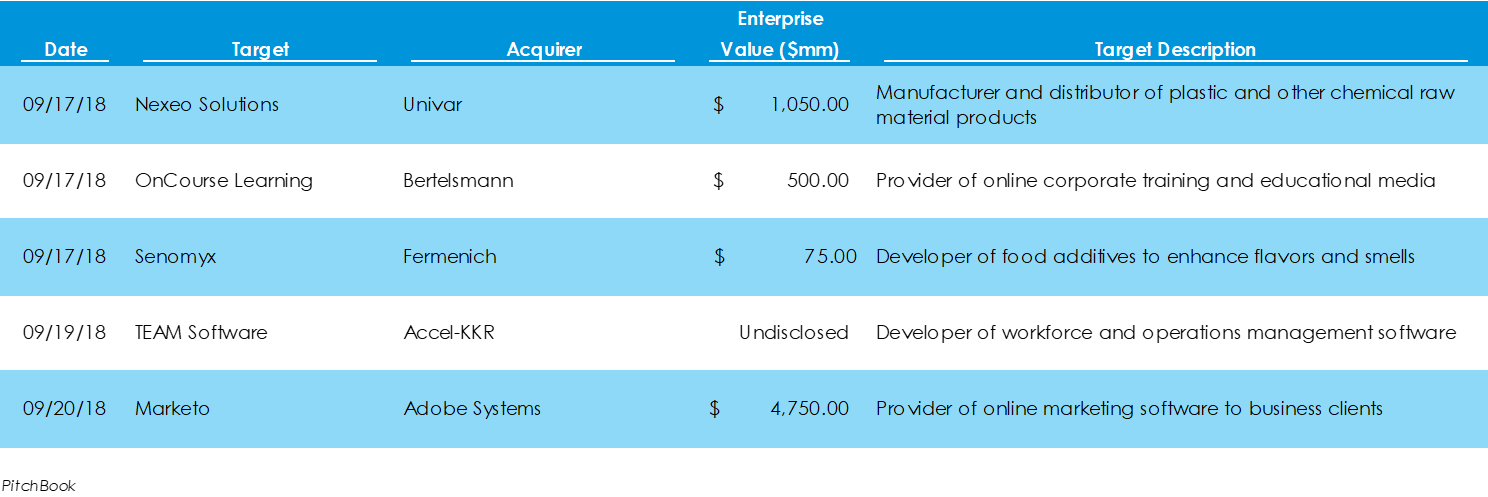

In U.S. M&A markets last week, a total of 35 deals took place, accounting for $10.19 billion in capital invested. Approximately $5 billion of the capital came from five deals in the information technology sector. The business-to-business industry engaged in eight transactions, totaling $1.70 billion of capital invested. The following are a list of transactions that fall in Skyline’s key market focuses:

According to the New York Stock Exchange, last week a total of six initial public offerings were priced on U.S. exchanges for $3.16 billion in capital raised. Healthcare had two of the six and raised $1.85 billion. The following are four of the notable IPOs last week, headlined by Eli Lilly’s spin off of Elanco Animal Health:

Last week, the Census Bureau announced that Americans’ incomes are growing and poverty is shrinking. The Federal Reserve announced that consumer credit grew more than expected in July. Lastly, the Labor Department concluded that job openings increased to a record-high level.

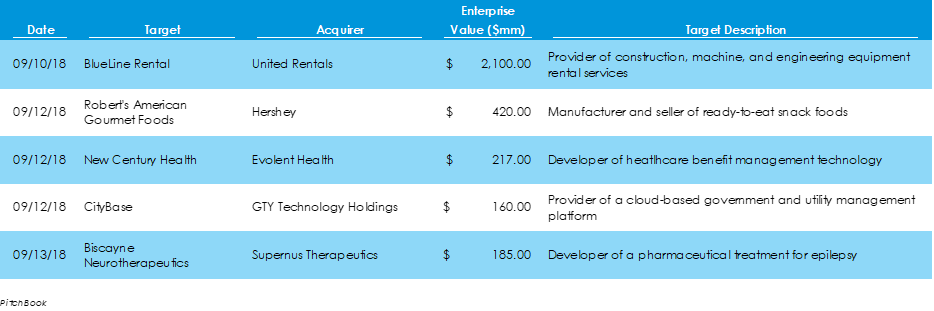

According to PitchBook, for the week ending September 15, a total of 40 mergers and acquisition deals were announced for a total of $22.44 billion in capital invested. The information technology sector experienced the largest share of the action with 12 deals for $8.47 billion. Business-to-business firms saw the largest share of capital with $9.1 billion on 7 deals. The following are a selection of the transactions within Skyline’s core industry focuses:

In capital markets last week, two companies priced their IPOs and debuted shares: 111, Inc. and NIO, Inc. The two companies raised $100.45 million and $1 billion, respectively. Further, British car-maker Aston Martin has made news ahead of its London IPO

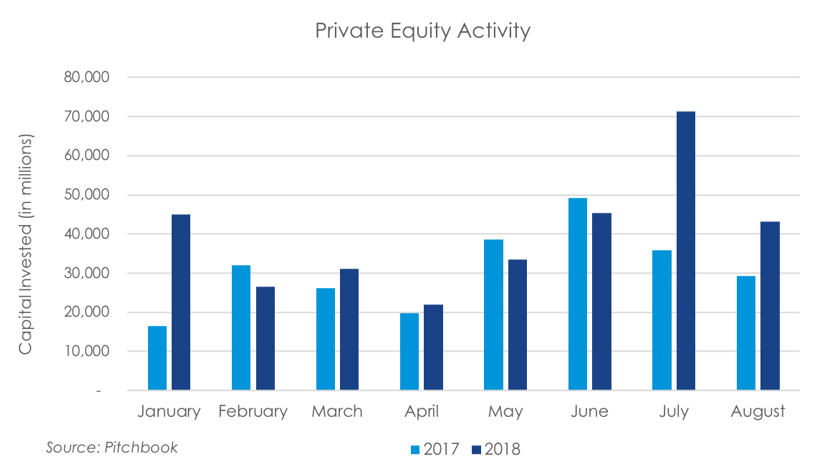

In August, private equity deal making fell from the 2018 highs set in July, according to Pitchbook data. For the month, private equity investment for U.S. companies totaled $43.1 billion among 379 deals. This is down 39.6% from $71.26 billion invested in July but up 46.8% from $29.35 billion invested in August 2017. For the year through August, PE investment has totaled $317.69 billion among 3,382 deals, an increase of $70.23 billion over the same period of 2017.

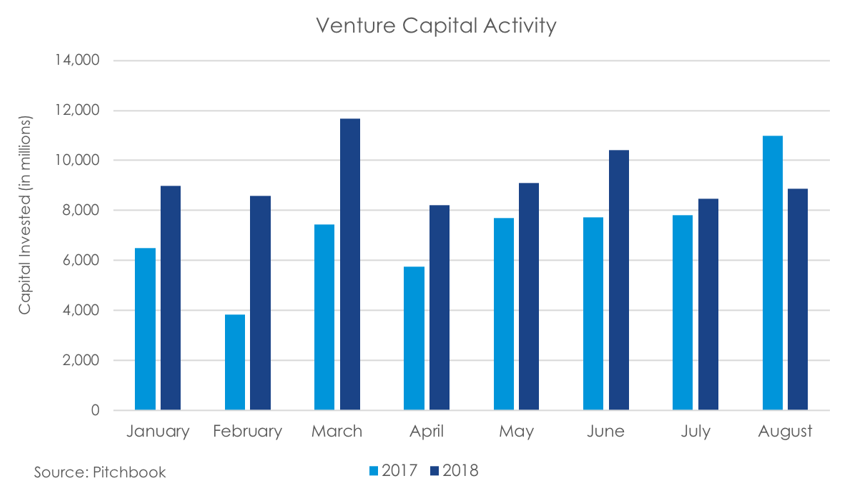

According to data from Pitchbook, venture capital firms (VCs) invested a total of $8.86 billion into 768 U.S. companies in August. These numbers are down 19.3% from the $10.97 billion invested by VCs in August 2017 but are up 4.70% from the total invested capital in July 2018.

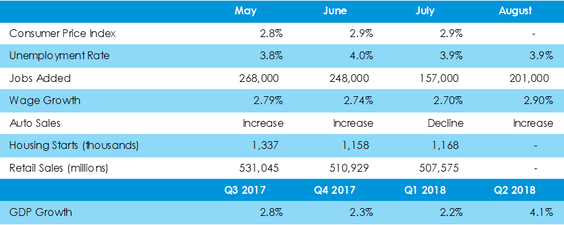

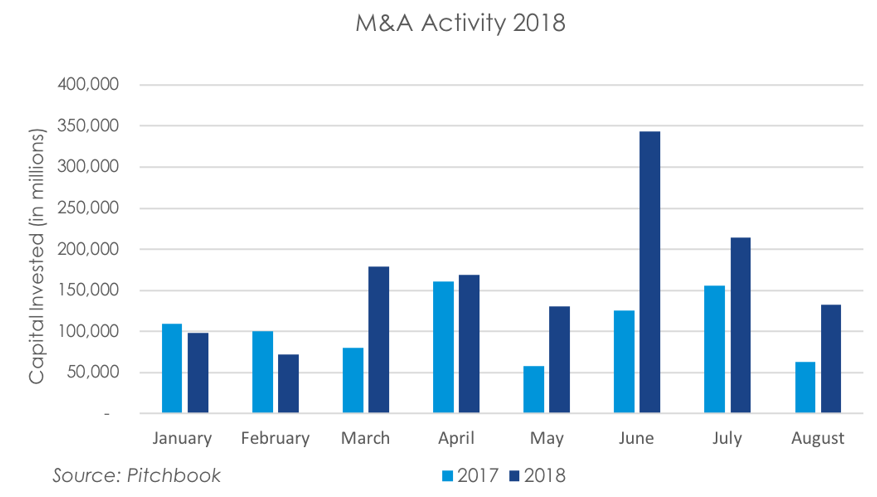

Sources: Commerce Department, Department of Labor, Federal Reserve, National Association of Home Builders, major automaker reports Sources: Commerce Department, Department of Labor, Federal Reserve, National Association of Home Builders, major automaker reports The U.S. economy has begun to show signs of slight stagnation in August; however, most readings continue to remain strong. The employment figures, released by the Bureau of Labor Statistics, showed that the labor market found room to expand, despite being historically tight. The U.S. added 201,000 jobs in August, up 28.0% from July, and maintained the unemployment rate at 3.9%. Furthermore, wages grew at 2.9%, their fastest annualized rate since before the Great Recession For August 2018, mergers and acquisitions (M&A) activity sharpened its downward trend from annual highs set in June. According to data from Pitchbook, total disclosed capital invested for mergers & acquisitions and buyouts reached $132.1 billion in August, down 38.3% from the $214.0 billion invested in July and down 61.5% from the 2018 high of $343.2 billion invested in June. August was up 110.6% from the $63.0 billion invested in August 2017. M&A capital investment now totals $1.34 trillion year-to-date, up 59.6% from $837.8 billion in the same period of 2017.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed