|

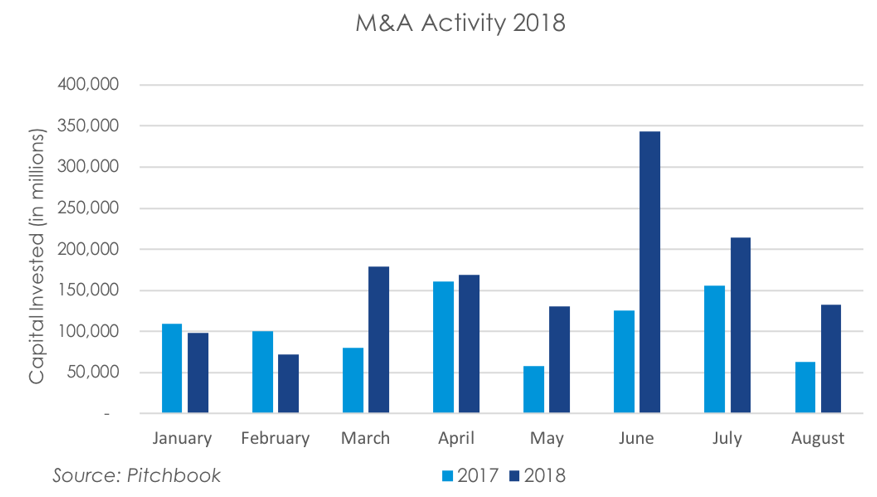

For August 2018, mergers and acquisitions (M&A) activity sharpened its downward trend from annual highs set in June. According to data from Pitchbook, total disclosed capital invested for mergers & acquisitions and buyouts reached $132.1 billion in August, down 38.3% from the $214.0 billion invested in July and down 61.5% from the 2018 high of $343.2 billion invested in June. August was up 110.6% from the $63.0 billion invested in August 2017. M&A capital investment now totals $1.34 trillion year-to-date, up 59.6% from $837.8 billion in the same period of 2017. Financial services companies captured the bulk of invested capital in August, recording nearly $35.5 billion, or 26.9% of total invested capital. Business-to-business (B2B) companies continued the trend by leading in total deals completed, comprising 36.8% of the targets so far in 2018 and 35.9% of the targets in August alone. As forecasted at the end of July, deal making has begun to slump as the summer winds down and the benefit of the corporate tax cut becomes less prominent. Furthermore, it is becoming more expensive to borrow as the Federal Open Market Committee has continued to raise their target Federal Funds Rate. Also, the market has tapered off from the splash of investment following a few major antitrust approval cases.

Highlights from our weekly M&A market updates during August 2018 included:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed