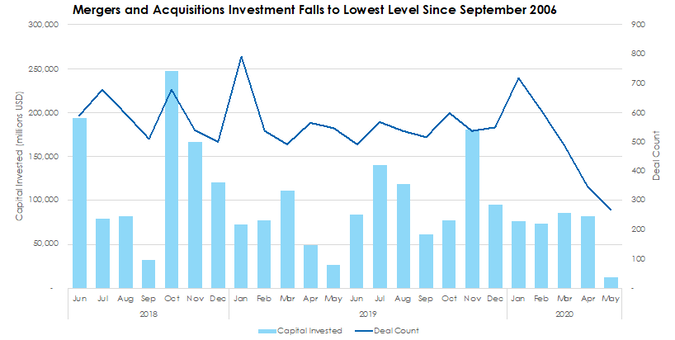

Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

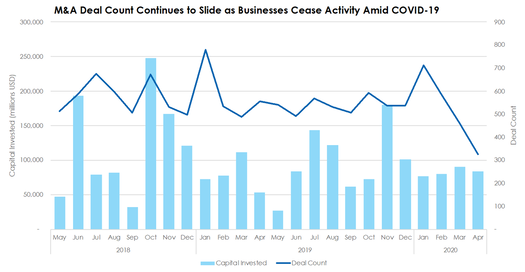

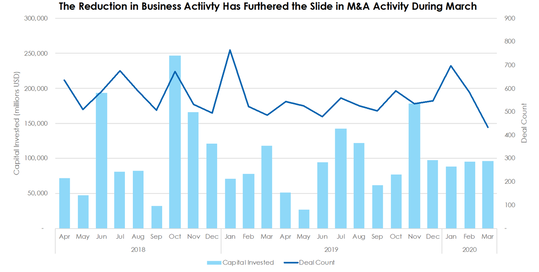

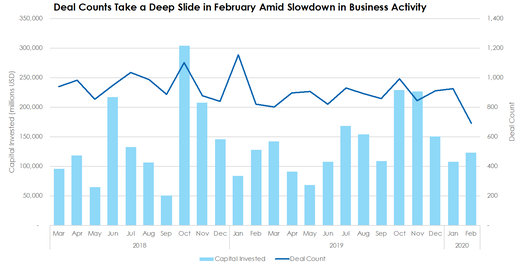

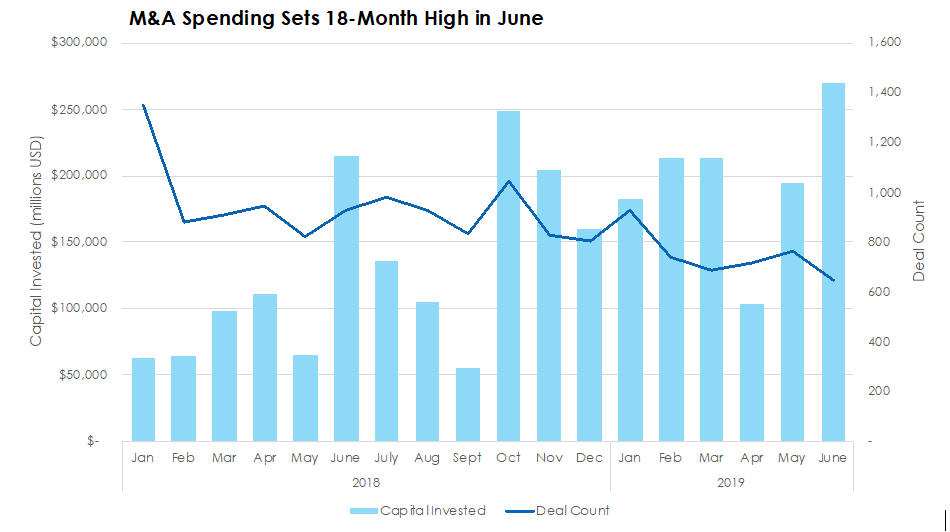

M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month. M&A Activity Spikes in June on the Back of Mega Deals In June, there were 643 deals in M&A capital markets worth a combined $270 billion, the highest level since the start of the decade in 2010. However, 45% of that value is attributable to United Technologies’ blockbuster acquisition of defense contractor Raytheon. In fact, the deal is the largest since Time Warner acquired AOL in January 2001.

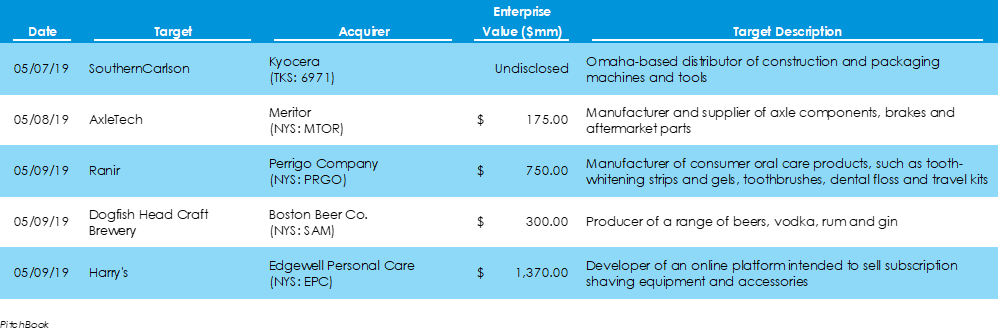

Maker of Samuel Adams Buys Delaware Craft BreweryData from Pitchbook shows that $84.5 billion was invested in 33 deals across American M&A markets last week, 10 more deals and $71.1 billion capital than the week prior. Four of those deals were for over $2.5 billion, including $38-billion and $23.3-billion-dollar deals, both of which were in the energy space. Another deal that caught significant media coverage was that of Boston Beer Co., the brewer of Samuel Adams brand beers, which paid $300 million to acquire Dogfish Head Brewery, a craft beer maker from Milton, Delaware. Dogfish produces over 250,000 barrels of beer annually.

The minutes from the Federal Open Market Committee’s December meeting were released, showing the board’s reluctance to increase interest rates amid weakening inflationary pressures and slowing global growth. The Bureau of Labor statistics furthered this point when releasing its December Consumer Price Index, which revealed the first monthly decrease in prices in nine months. The inflationary gauge did rise on an annualized basis, albeit slower than in prior months. Also, unemployment insurance claims fell unexpectedly in the first week of the new year.

Last week, the Commerce Department’s retail spending report showed a notable gain in retail spending for the trailing twelve months through November, showing strong consumer demand heading into the holidays. Also, the Institute for Supply Management (ISM) released its semi-annual economic growth survey, revealing that although purchasing and supply managers expect revenue and investment growth, they believe 2019 will be a weaker year than 2018. Lastly, the Labor Department shared the November Consumer Price Index, which showed flat growth from October and a 2.2% annual increase. This week, the Federal Open Market Committee will meet on Tuesday and Wednesday to determine whether a rate hike is justified.

The week ending November 17 revealed Consumer Price Index data that surpassed the Fed’s 12-month 2% inflation target. Also, the Treasury Department says that the Government recorded a $100.5 billion deficit in October 2018, a 60% increase from a year before. Lastly, the New York Federal Reserve reported that U.S. household debt rose to $13.51 trillion, the 17th consecutive quarter of increasing household debt.

Last week brought third quarter GDP results that narrowly beat economists’ expectations, thanks, in part, to strong annualized consumer spending and low inflation. The Personal Consumption Expenditure price index, which is used by the Fed, underperformed the Fed target in October. However, the Producer-Price Index grew 2.9% annually, driven by producer and supplier margin increases. The JOLT Survey revealed that job openings decreased slightly in September, while the economy yielded a significant net employment gain.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed