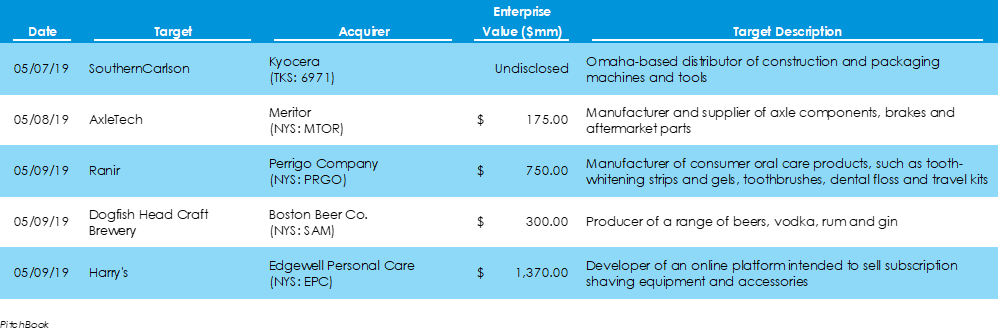

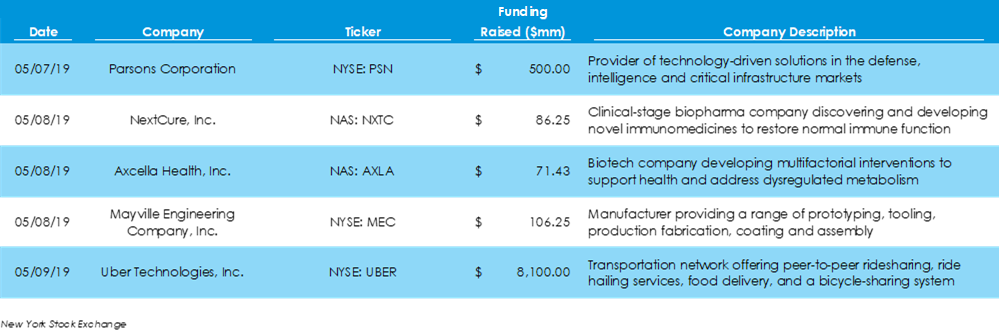

Maker of Samuel Adams Buys Delaware Craft BreweryData from Pitchbook shows that $84.5 billion was invested in 33 deals across American M&A markets last week, 10 more deals and $71.1 billion capital than the week prior. Four of those deals were for over $2.5 billion, including $38-billion and $23.3-billion-dollar deals, both of which were in the energy space. Another deal that caught significant media coverage was that of Boston Beer Co., the brewer of Samuel Adams brand beers, which paid $300 million to acquire Dogfish Head Brewery, a craft beer maker from Milton, Delaware. Dogfish produces over 250,000 barrels of beer annually. Uber Finally Goes Public Alongside Eleven Other FirmsLast week, according to the NYSE, U.S. public exchanges saw a flurry of IPO activity, 12 offerings that raised $9.4 billion in funding. Uber was one of those twelve firms, raising $8.1 billion of funding. Other large IPOs of the week include HeadHunter Group, a Russian online recruitment platform, and Parsons Corporations, a technology solutions group for the defense and infrastructure industries. Inflation Holds at a Neutral Level in April; Mortgage Applications Increase on Lower Borrowing CostsAmong economic news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed