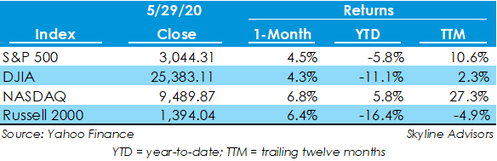

Stock Markets Stage Sharp Rebound in May  Easing of quarantine restrictions and hopes for a vaccine gave US equities a boost during May, adding on to strong year-to-date performances in large cap indices. Year-to-date, the S&P 500, Nasdaq, and Dow Jones gained 10.6%, 27.3%, and 2.3%, respectively, while the Russell 2000, a small cap index, is down 4.9%. In May alone, the large cap S&P 500 and Dow Jones gained 4.5% and 4.3%, and the tech-heavy Nasdaq and small cap Russell 2000 gained 6.8% and 6.4%, respectively. Optimism surrounding reopening economies supported equities during May.

As we publish our Economic and Public Market Update for the first quarter of 2020, it is obvious that the first quarter was a wild ride. It included US stock markets reaching all-time highs and ended with the fastest 20% market drop on record. The drop, spurred on by the coronavirus pandemic, put an end to the longest bull market in history.

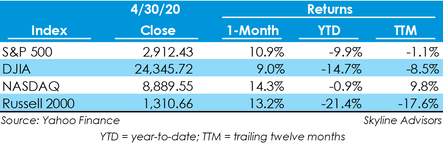

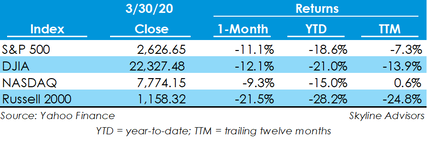

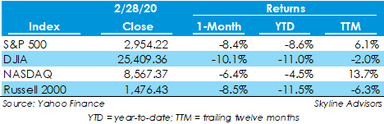

While nothing compares to the loss of human life, the economic toll of the pandemic and the practical shutdown of the economy has been significant to say the least. The full impact is still playing out, including whether we can achieve the V-shaped recovery we all hope for, but the economic results began to deteriorate in the final weeks of the first quarter. Advanced estimates of the first quarter GDP came in at -4.8%, marking the first quarterly decline since 2014. Estimates for second quarter GDP project a decline of more than 30%.  The effects of the novel coronavirus have continued to disrupt financial markets worldwide. Uncertainty over how long the pandemic will last has kept markets in flux, with the CBOE Volatility Index (VIX) averaging 41.45 points in April, which is down from March’s average but significantly greater than the 2019 average of 15.39 points. Moreover, unprecedented activity in oil markets added more context to the possible depth of the economic slowdown. However, during the month, markets seemed to rebound from a major pullback in the first quarter, with three of the four major indices growing by double-digit percentages.  The effects of coronavirus on business and consumer activity has completely disrupted financial markets in the U.S. During March, the S&P 500 and Dow Jones Industrial Average indices each fell by at least 25% at one point, while the Nasdaq fell by roughly 20% at its lowest point. The Russell 2000, a small-cap index measuring market values of the smallest 2,000 U.S. stocks, lost nearly one-third of its value, representing the disproportionate toll coronavirus will have on smaller U.S. businesses. The stock market had begun to make a recovery at the end of the month, after Congress approved a $2-trillion stimulus package to bolster struggling consumers and businesses.  After starting February with strong gains in the 4-6% range for the major US indices, the market collapsed from record highs and into correction territory within the last six trading days of the month. The market sustained gains during the first half of the month as government and economic officials around the globe seemed to be taking appropriate action to insulate economies from the effects of the novel coronavirus outbreak. However, by the last two weeks of February, investors were spooked by weak economic data domestically and abroad, stoking fears of a global economic slowdown. Skyline Advisors Releases its Third Quarter 2019 Capital Markets Review: Midwest Edition Report12/6/2019

Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for the third quarter of 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

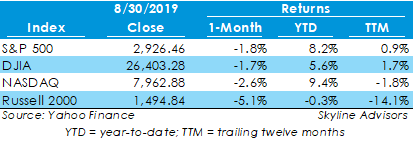

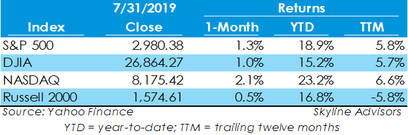

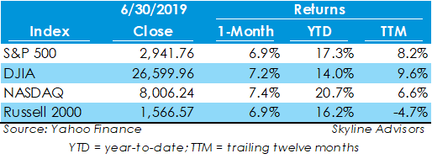

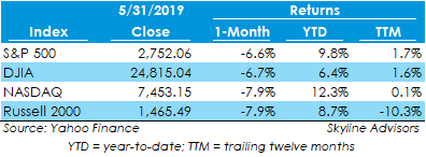

Major stock indices fell in August for the first time since May, in which indices lost in excess of 6%. In August, the S&P 500 declined 1.8%, falling to 2,926.46, while the Dow Jones Industrial Average (DJIA), Nasdaq, and Russell 2000 each declined 1.7%, 2.6%, and 5.1%, respectively. The month was characterized by excess volatility, as each index counted 10 or more days of 1%-or-greater swings.  Major stock market indices advanced in July, building upon a strong year for market returns. The Nasdaq advanced the most, gaining 2.1% to 8,175.42, while the S&P 500 gained 1.3% to 2,980.38. The Dow Jones Industrial Average and Russell 2000 also closed the month in positive territory. Only the Russell 2000 has a negative return through the last twelve months.  The stock market rebounded strongly in June from a weak May performance, with major indices increasing approximately 7% on the back of increased hope for a trade truce with China and signals from the Federal Reserve that a rate cut may come this year. The month closed out the best first half market performance since 1997  Stock markets dropped in May due to the on-going trade tensions with China. The S&P 500 dropped 6.6% to 2,752, while the Dow Jones Industrial Average, NASDAQ, and Russell 2000 each declined 6.7%, 7.9%, and 7.9%, respectively. May marked the first month of broad index declines for the year, though returns are still up considerably year to date. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed