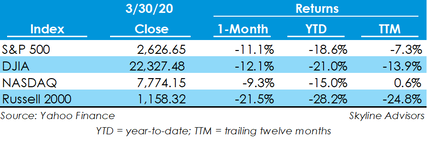

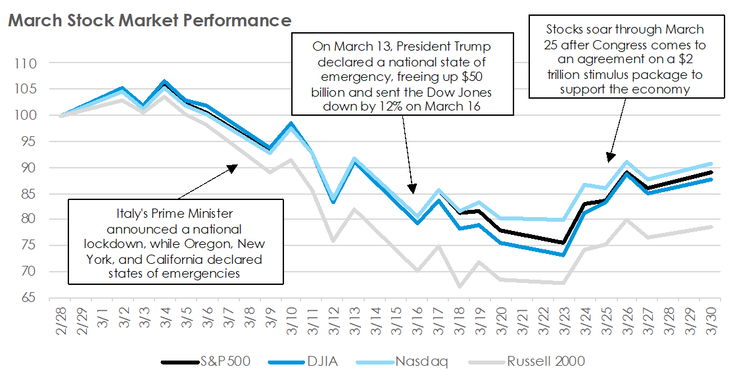

The effects of coronavirus on business and consumer activity has completely disrupted financial markets in the U.S. During March, the S&P 500 and Dow Jones Industrial Average indices each fell by at least 25% at one point, while the Nasdaq fell by roughly 20% at its lowest point. The Russell 2000, a small-cap index measuring market values of the smallest 2,000 U.S. stocks, lost nearly one-third of its value, representing the disproportionate toll coronavirus will have on smaller U.S. businesses. The stock market had begun to make a recovery at the end of the month, after Congress approved a $2-trillion stimulus package to bolster struggling consumers and businesses.

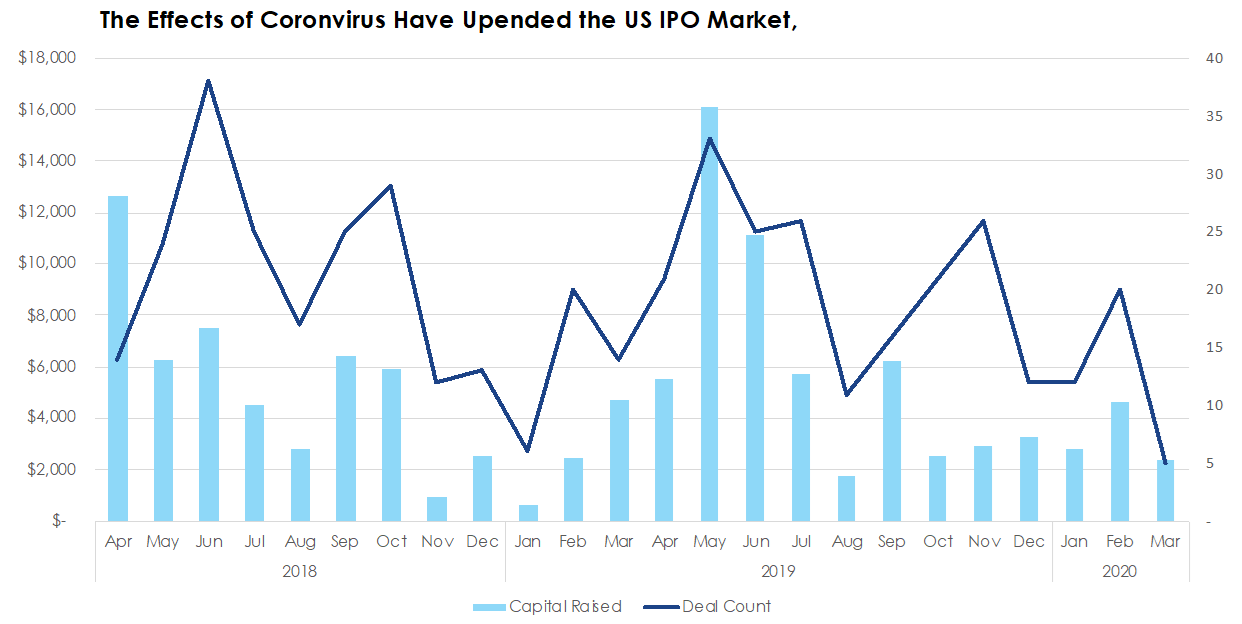

COVID-19’s Impact on Equity Markets has Reduced Investor Confidence in IPO Fundraising The coronavirus’s negative impact on U.S. equity markets has put the brakes on the IPOs. Last month U.S. markets saw only five initial offerings worth $2.4 billion, three of which were in the healthcare industry. This represents a 75% reduction in IPOs and a 50% decline in funds raised since February. Year to date, fundraising is still up 26.7% compared with 2019, despite the total number of IPOs falling 7.5%. With the rise of the coronavirus and its impact on financial markets, U.S. IPOs in 2020 can be expected to underperform compared to recent years.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed