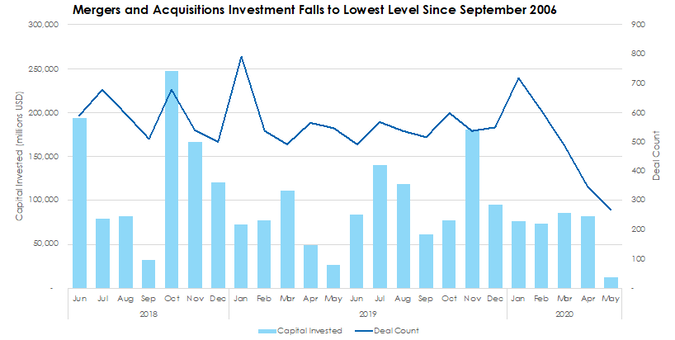

Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half.

As we publish our Economic and Public Market Update for the first quarter of 2020, it is obvious that the first quarter was a wild ride. It included US stock markets reaching all-time highs and ended with the fastest 20% market drop on record. The drop, spurred on by the coronavirus pandemic, put an end to the longest bull market in history.

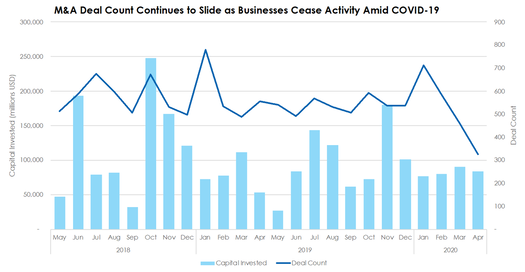

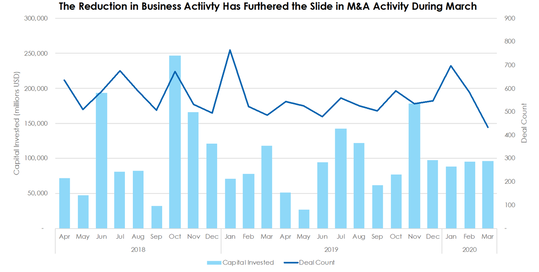

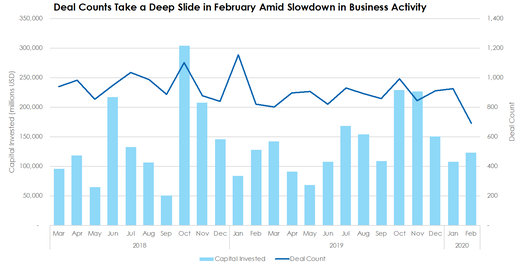

While nothing compares to the loss of human life, the economic toll of the pandemic and the practical shutdown of the economy has been significant to say the least. The full impact is still playing out, including whether we can achieve the V-shaped recovery we all hope for, but the economic results began to deteriorate in the final weeks of the first quarter. Advanced estimates of the first quarter GDP came in at -4.8%, marking the first quarterly decline since 2014. Estimates for second quarter GDP project a decline of more than 30%. M&A Deal Counts Down 11% in the US in 2020  Mergers and acquisitions have decreased – or at least paused temporarily - as the coronavirus has kept businesses shuttered and dealmakers at home or focused on other matters. Deal counts are down 54% since COVID-19’s most recent peak in January and invested capital figures have remained roughly constant. Year-to-date compared with 2019, deal count is down 11.4% and total invested capital is up just 4%. M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month. Skyline Advisors Releases its Third Quarter 2019 Capital Markets Review: Midwest Edition Report12/6/2019

Skyline Advisors has released its latest Capital Markets Review: Midwest Edition for the third quarter of 2019. The report details activity and trends for mergers and acquisitions, private equity deals, and venture capital deals for both national and Midwest geographies. Key highlights include:

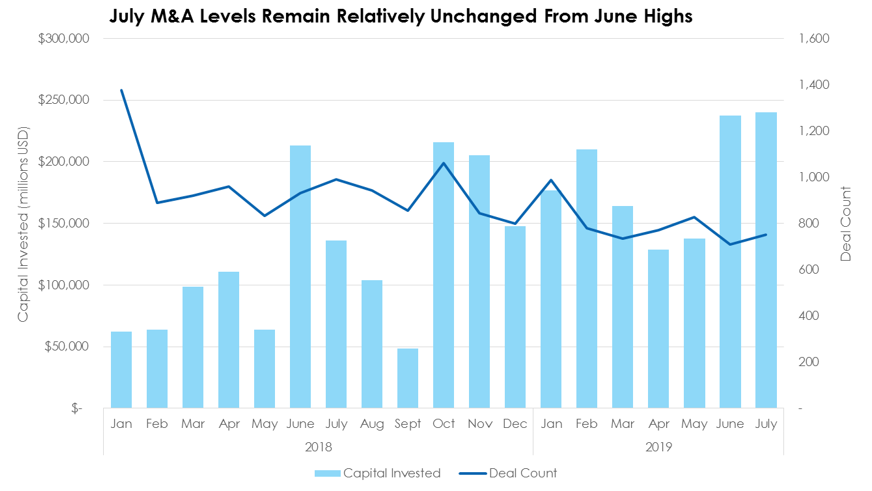

Acquisition Investment is Lifted to a Two-Year High on the Back of Five Out-sized DealsAccording to preliminary data from Pitchbook, there were 752 M&A deals worth a total of $240 billion in July, remaining relatively unchanged from the $237 billion spent on corporate acquisition and leveraged buyout deals in June. Over 60% of the deal value is comprised of the buyouts of five target companies: Worldpay, L3 Technologies, Red Hat, First Data, and Array BioPharma.

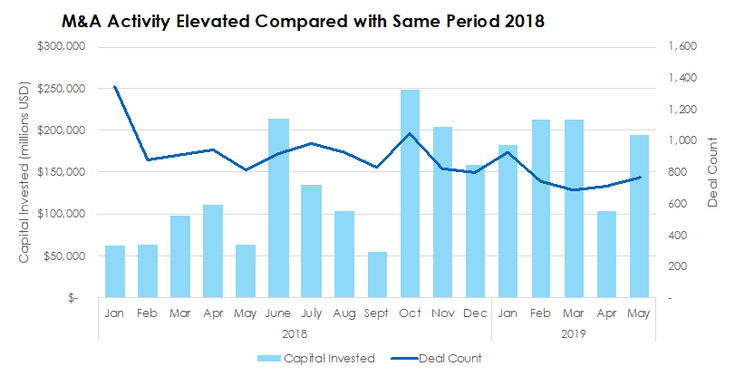

M&A Activity Picks Up in May Despite Weaker Year than 2018There were 720 M&A deals valued at a combined $194 billion in May, according to Pitchbook. For the year through the end of the May, there were 3,756 deals for $906 billion capital, roughly 1,140 fewer deals and $506 billion less value for the same period in 2018.

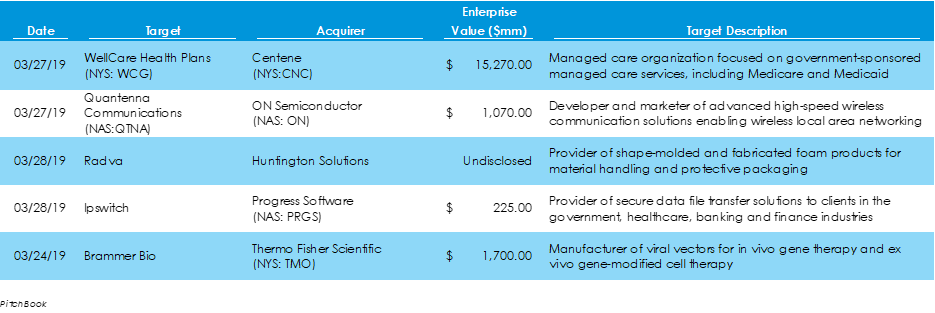

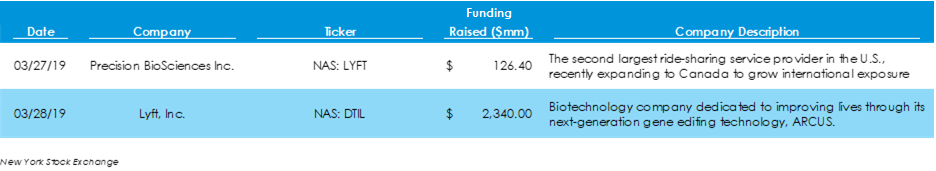

Mergers & Acquisitions: Manufacturing Sector Sees Continued Strong Activity in the M&A SpacePitchbook data reveals that $19.6 billion of capital was invested across 27 M&A transactions last week, twelve more deals but $17.2 billion less capital than in the week prior. The largest deal was publicly traded Centene’s corporate acquisition of WellCare Health Plans, also a publicly traded company, for $15.3 billion. The manufacturing vertical has been busy in 2019 through the end of last week, posting 48 transactions and $19 billion capital invested in LBOs and corporate acquisitions. Initial Public Offerings: Lyft Follows Through with Long-Awaited IPO According to the New York Stock Exchange website, two companies went public last week, the same figure as the week before. However, those two companies, Lyft and Precision BioSciences, combined raised more than in the prior week, raising $2.3 billion and $126 million, respectively. Lyft has been a highly anticipated IPO since the beginning of 2018, and the results of its IPO are indicative of it. The company priced its IPO at $72 per share, well above its initial estimates after a roadshow in which the firm received commitments in excess of expectations. As of trading close on Friday, Lyft was valued at approximately $26.5 billion. Economy: U.S. Fourth Quarter Economic Growth Revised Downward Among news last week:

Last Tuesday and Wednesday, the Federal Open Market Committee held their December meeting. The board elected to raise rates for the fourth time this year, although the median governor is anticipating one less rate hike in 2019. The Commerce Department made downward revisions to its third quarter GDP estimates, knocking a tenth of a percent off its previous estimates. Lastly, the Kansas City Federal Reserve released its December Manufacturing Survey and Index, showing a slowdown in manufacturing activity during the month due to declines in production, shipments and new orders for exports.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed