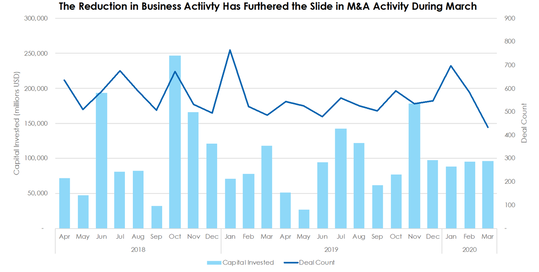

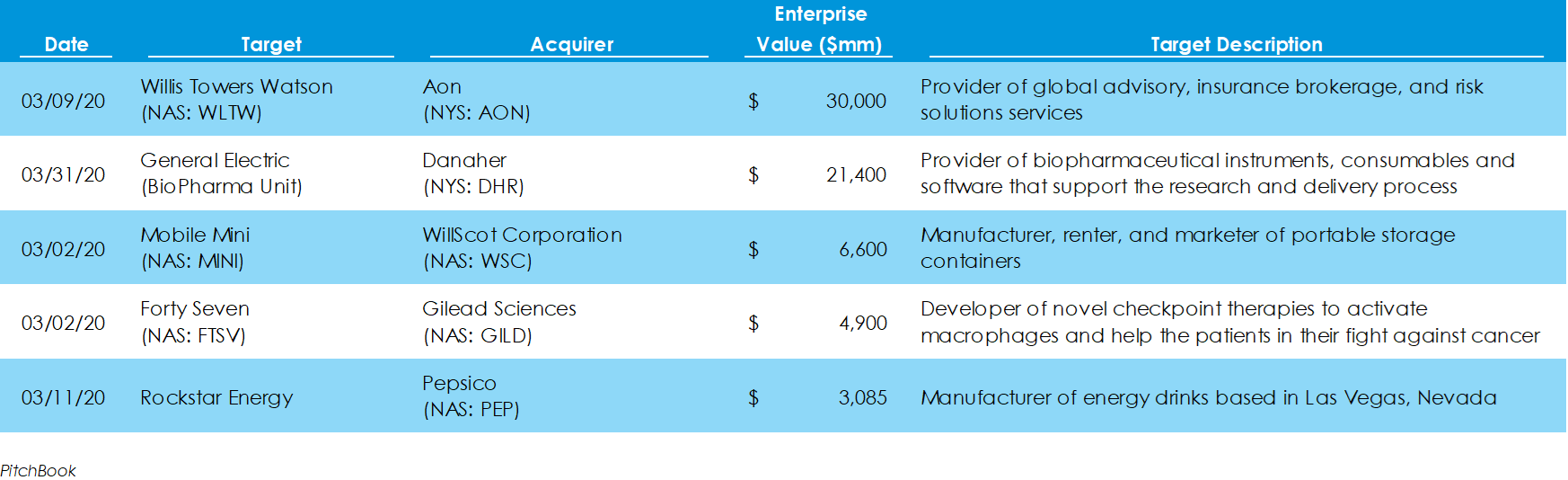

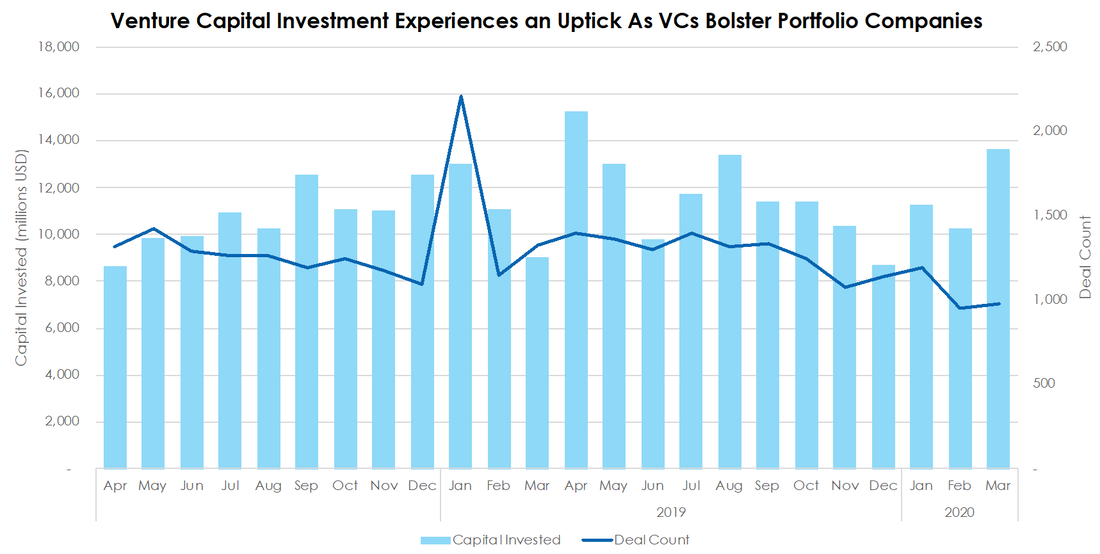

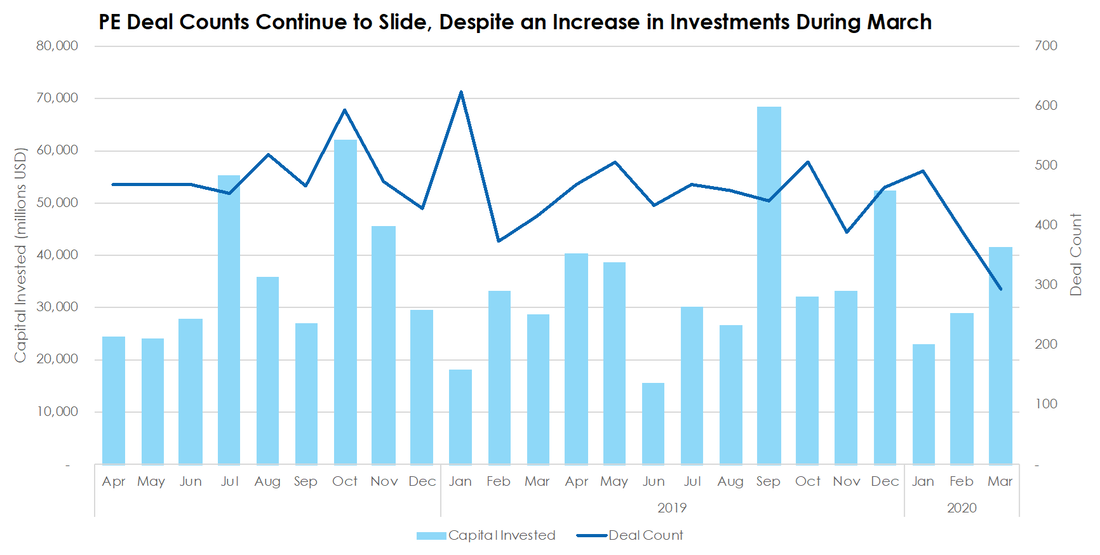

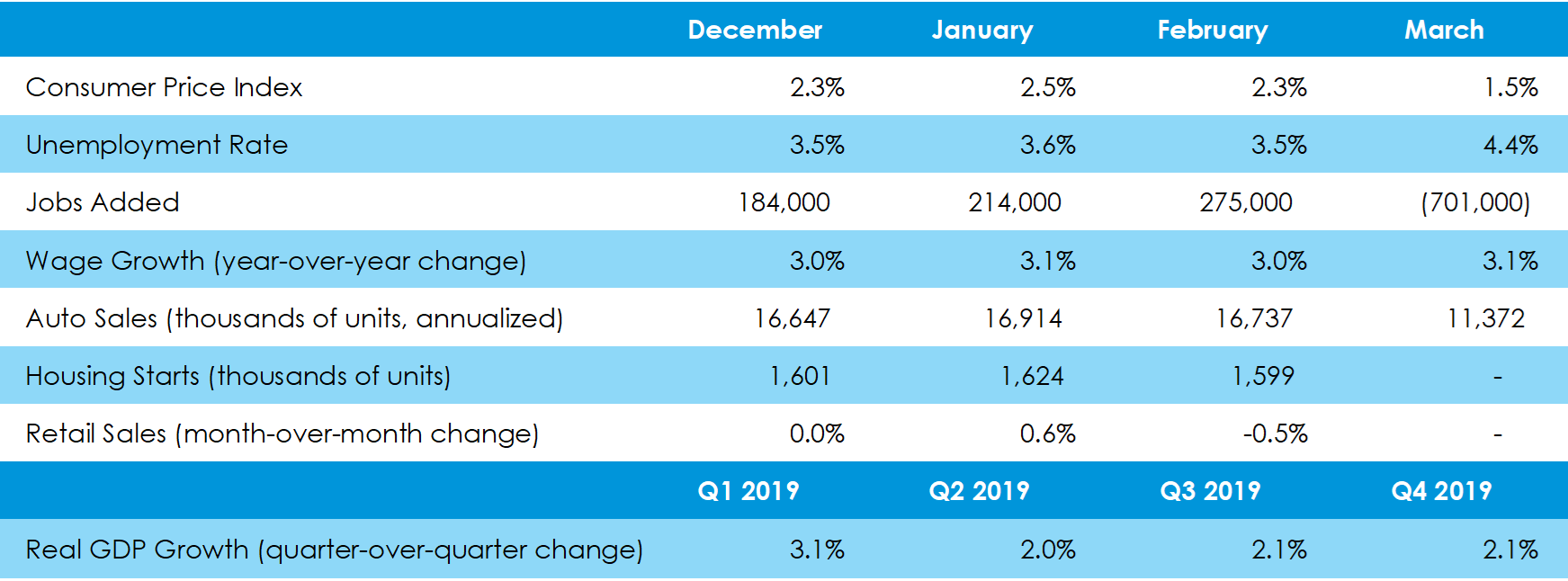

M&A Deal Counts Continues to Fall Along with a Slide in Business Activity  Merger and acquisition deal count figures continued to slide in March as COVID-19’s impact unfolded across the United States. During the month, deal count totaled 433, representing a 25.9% decline from February, while invested capital grew 0.6% to $96.4 billion. For the first quarter, deal count is down 3.11% compared with 2019, while invested capital is up 5.06%. The largest deal in March was insurance provider Aon’s $30-billion acquisition of London-based insurer Willis Towers Watson. The second acquisition was yet another divesture from General Electric of its $21-billion biopharmaceutical business unit. The segment manufactures consumables, instruments, and software for the biopharmaceutical industry. Venture Capital Investment Surges as VCs Support Portfolio Companies’ Liquidity Needs Venture capital activity experienced an uptick in investments and deal count, as VC firms support their portfolio company’s cash balances in this time of economic crisis. Compared with February, deal count and invested capital increased 2.20% and 33.48%, respectively, with invested capital reaching $13.6 billion, its highest level since last August. The largest deal of the month was a $2.25 billion fundraising round by self-driving automaker Waymo. The investment was led by a group of large-scale investors, such as Silver Lake Management, the Canadian Pension Plan, and the Mubadala Investment Company. Other notable rounds were raised by Quibi, Impossible Foods, SpaceX, and Chime. Private Equity Investment Rises as Firms Decide Which Portfolio Companies to Keep Alive During March, buyouts and add-ons by private equity firms fell to 294 during March, a 25% decline from February and a 29% decline since last March. However, invested capital levels by these firms have increased over the last two months, growing 80% to $41.5 billion since January. According to Pitchbook, given the current economic conditions, many financial sponsors are providing capital to their portfolio companies to extend cash runways. The largest buyout of March was a $14.3-billion public-to-private LBO of Zayo Group, an owner and operator of 130,000 route miles of underground fiber optic cables serving 400 markets in North America and Europe. Providing the capital are EQT and Digital Colony. Another large deal in the month was Silver Lake Management’s $1 billion in development capital funding for Twitter to partially fund a share repurchase program. Coronavirus Forces the Federal Reserve to Cut Rates to Zero and the Treasury to Widen the Deficit

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed