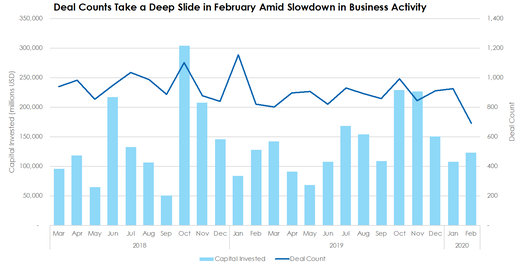

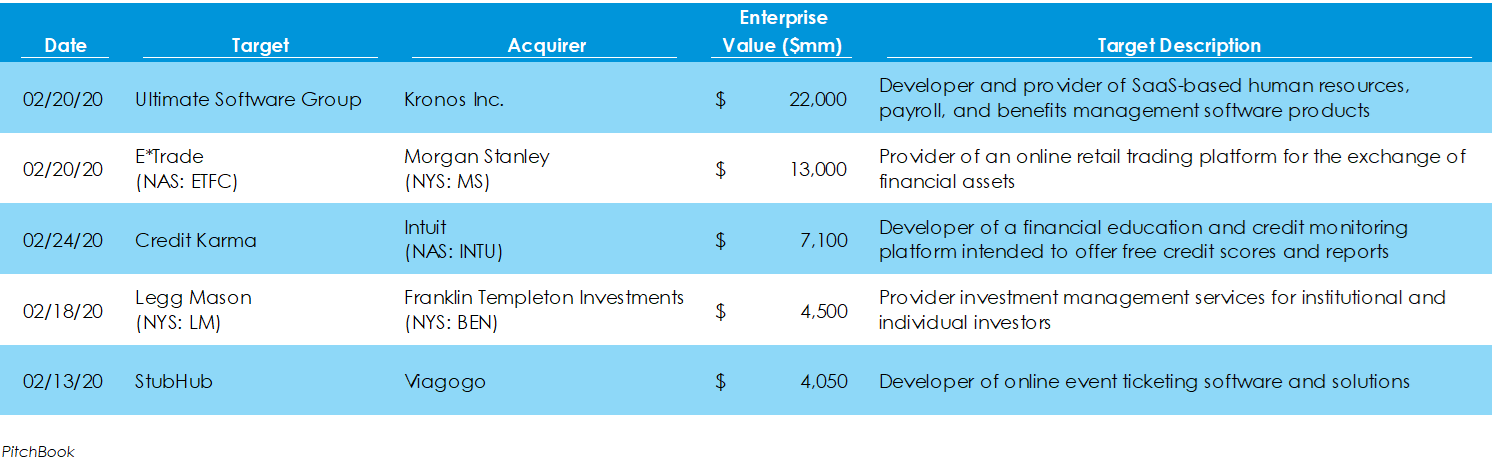

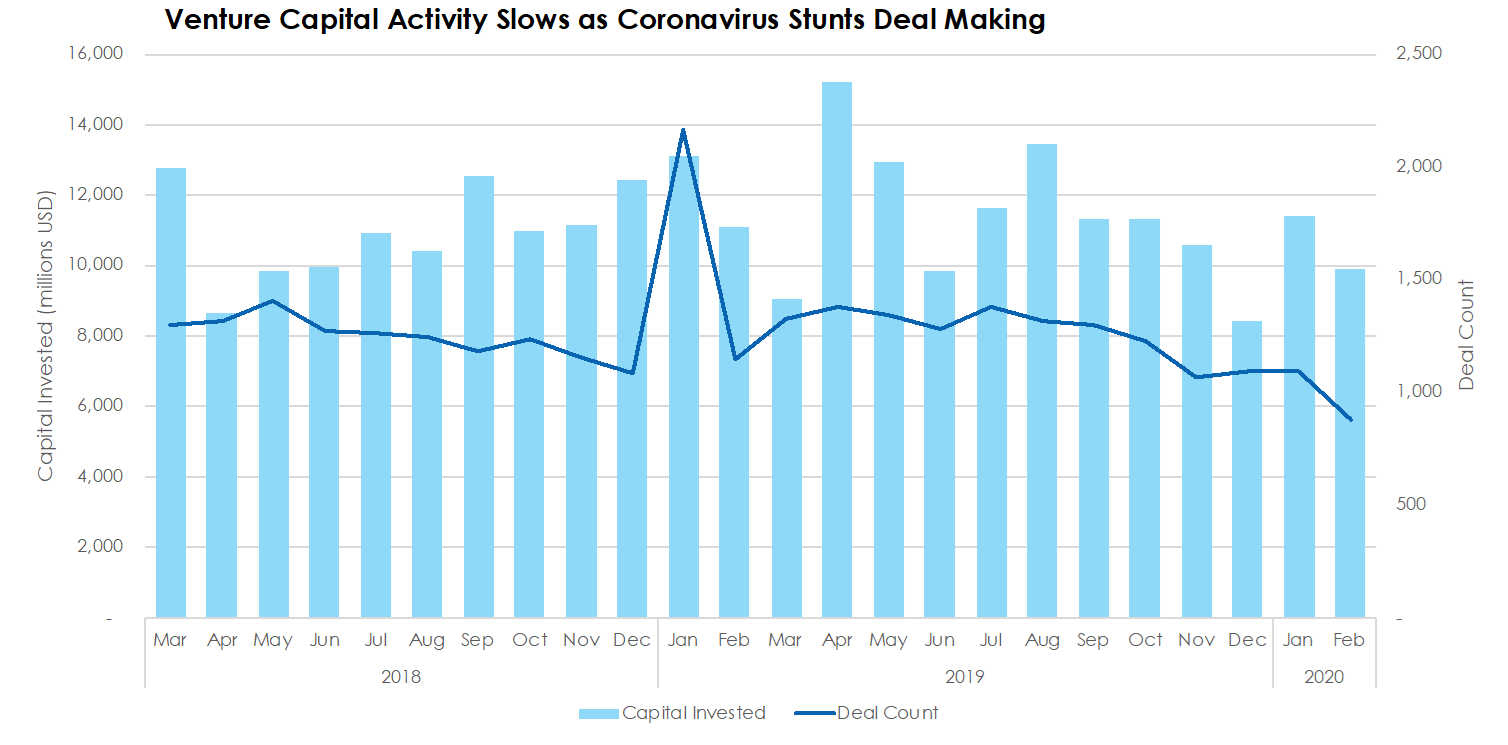

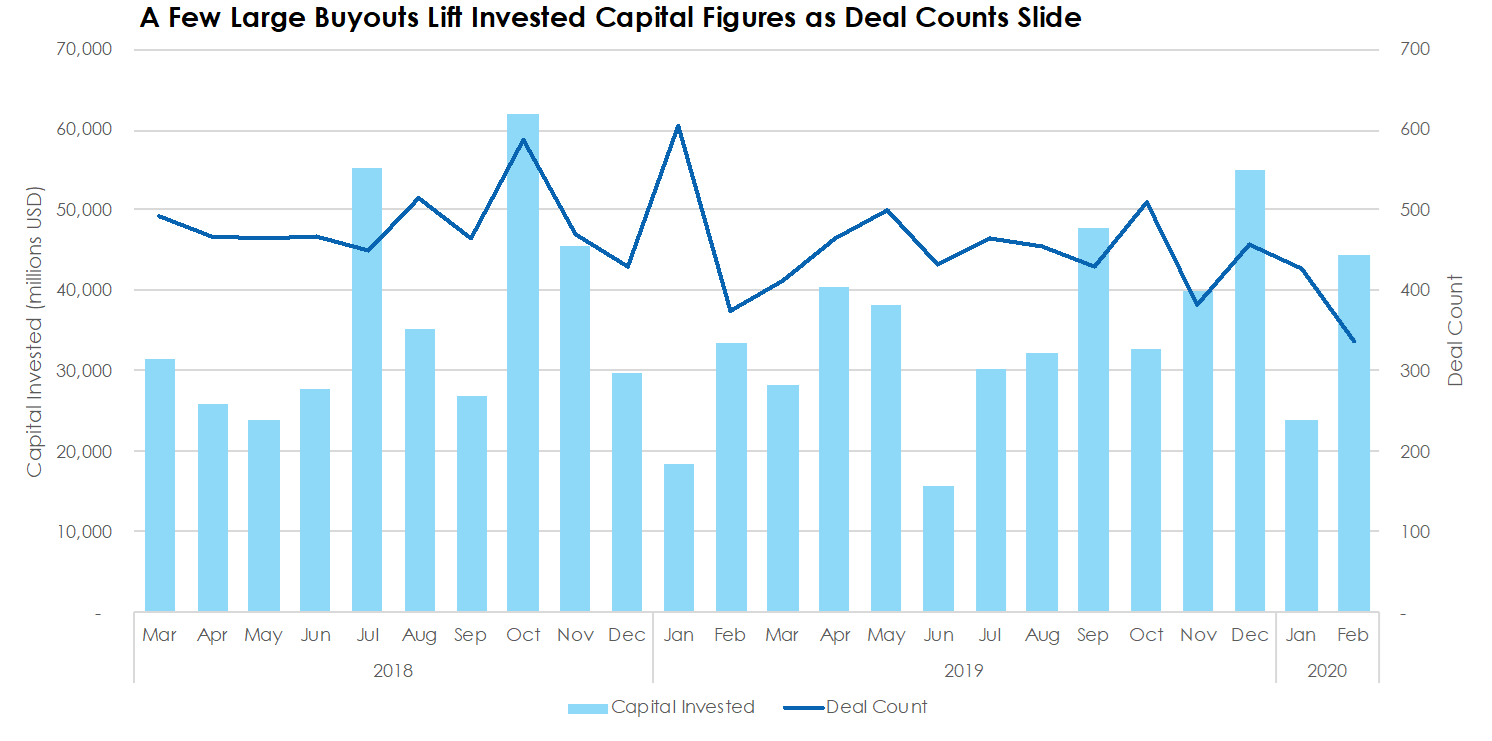

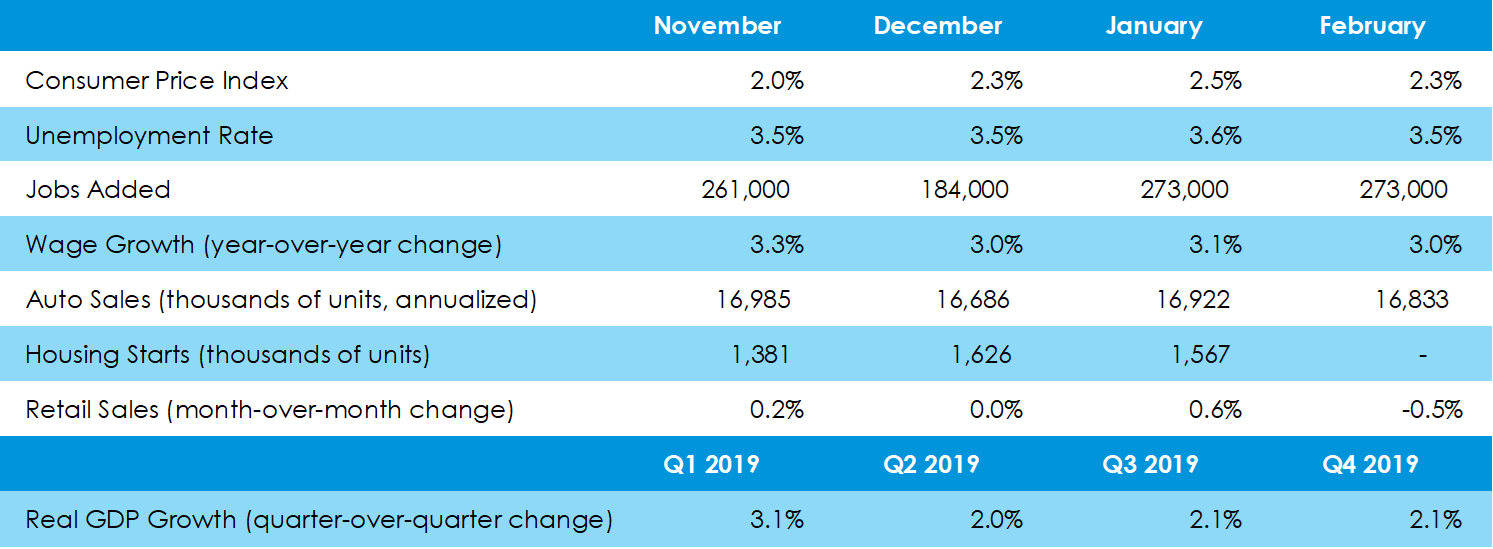

Morgan Stanley Continues the Brokerage Industry Shake-Up By Acquiring E*Trade While M&A Deal Counts Decline Sharply  A handful of large-scale M&A deals kept total spending levels afloat in February, despite declining deal count figures. During the month, there were 691 corporate M&A deals, 25% lower than January, and $123 billion in spending, which is 14% greater than the month before. Moreover, median deal size and post-valuation figures are up 21% and 35%, respectively, month over month. February’s largest deal was a merger of two HR software firms, Ultimate Software Group and Kronos, both of which are held by private equity firm Hellman and Friedman. The combined company is valued at $22 billion. The retail brokerage industry continues to be shaken up, as Morgan Stanley acquired E*Trade for $13 billion during the month. Venture Capital Deal Counts Fall Below 1,000; The Lowest Level Since the Start of 2018 Venture capital deal counts fell to 24-month lows in February, with VC’s and startups closing only 877 deals, the only month with fewer than 1,000 deals since the start of 2018. While deal count fell 20% from January, capital investment in VC deals fell only 13%, resulting in a 24% and 63% increase in median deal size and post-valuation, respectively. Notable companies to receive venture funding last month include JUUL Labs, which raised $700 million in convertible debt. Toast POS, a Boston-based company, raised $400 million in 6th-round funding, and Pony.ai, a developer of autonomous driving technology, raised $462 million in 4th-round funding. Larger Real Estate Deals Boost Investment in Private Equity Despite Slumping Deal Counts In February, roughly 30 private equity deals sized over $100 million, including brand names such as MGM Resorts, Victoria’s Secret, and Skydance Media, lifted invested capital up 86% from January levels to $44 billion. However, deal counts fell to 336 for the month, ultimately lifting median post-deal valuations from $201 million in January to $500 million in February. Many of the larger deals of the month were for infrastructure and real estate properties, including MGM Resorts’ sale of its Las Vegas resorts to The Blackstone Group (NYSE: BX) for $4.6 billion. Also, Vantage Data Centers sold for $400 million, Phoenix Tower International, a wireless infrastructure operator, sold for $1.4 billion, and Verso Corp sold two Wisconsin paper mills for $400 million. Economic Activity Shows Signs of Lagging as Virus Fears Diminish Consumer and Business Confidence

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed