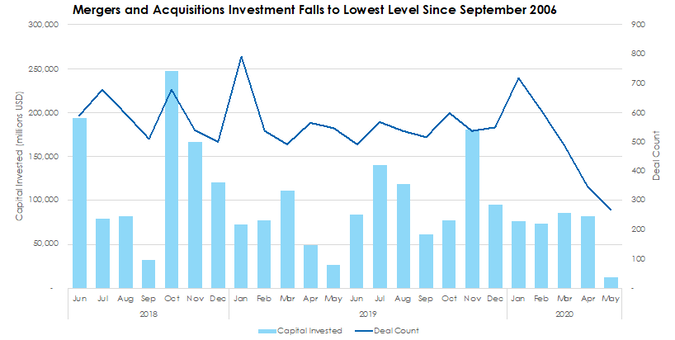

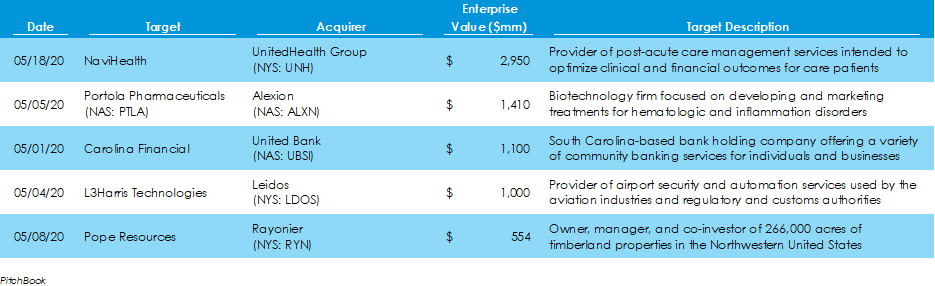

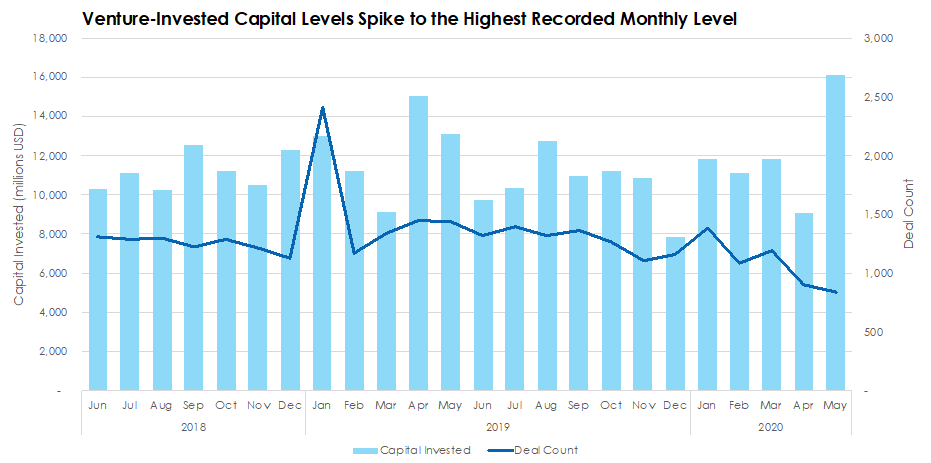

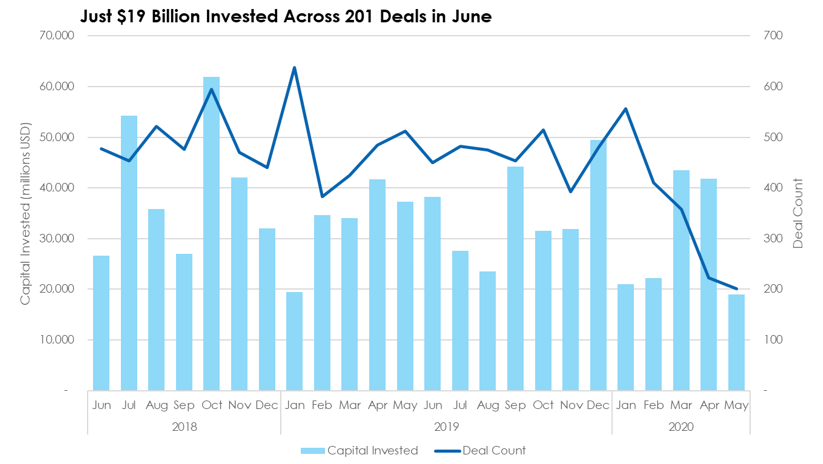

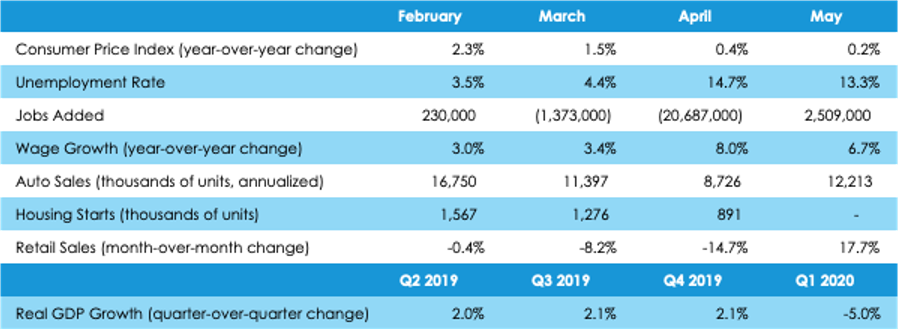

Capital Spent on Mergers and Acquisitions in May Falls to $12 Billion After four months of large M&A deals keeping invested capital levels afloat, capital markets experienced an absolute drop off in M&A activity. According to preliminary Pitchbook data, there were only 269 deals for a total of $12.2 billion, representing a 23% and 85% decline, respectively. Compared against the same period one year ago, May’s totals are roughly half. It has been well reported that the COVID-19 pandemic has significantly slowed business activity across the country. However, the pandemic has also had its effect on M&A deal-making activity in 2020. In 2019, the average month had 561 deals completed with invested capital of $91.2 billion. However, so far this year, each month has averaged only 486 deals and $66.1 billion in invested capital. Venture Capital Investment Surges in May to Record Levels Resulting from Large Scale Deals Venture capital investing activity took a sudden positive turn last month, despite the continued decline in deal counts. In fact, during May, there were 105 deals with sizes over $25 million and two deals over $1 billion. This led to a total of $16 billion invested across 841 deals during the month, representing a 48% increase in invested capital over the monthly average during the previous 12 months. The largest deal of the month was Alphabet’s Waymo, an autonomous driving and artificial intelligence technology subsidiary. The deal was a $3-billion investment from a syndicate of VC firms. Other notable deals include SpaceX, Lime, Magic Leap, and MasterClass. Private Equity Firms Complete Just 201 Deals in May Along with corporate M&A transactions, private equity deal making has fallen off amid the COVID-19 pandemic. Deal count reached a twelve-month high in January of this year at 556, which compares to just 201 deals in May. Value was also the lowest since January of 2019, falling to $18.9 billion. The slowdown in the American economy, along with its businesses, has left private equity firms with fewer buyout deals to pursue. However, the economic struggle has left many businesses cash-strapped and in need of a capital infusion. The Job Market and Retail Spending Categories Begin Recoveries in May

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed