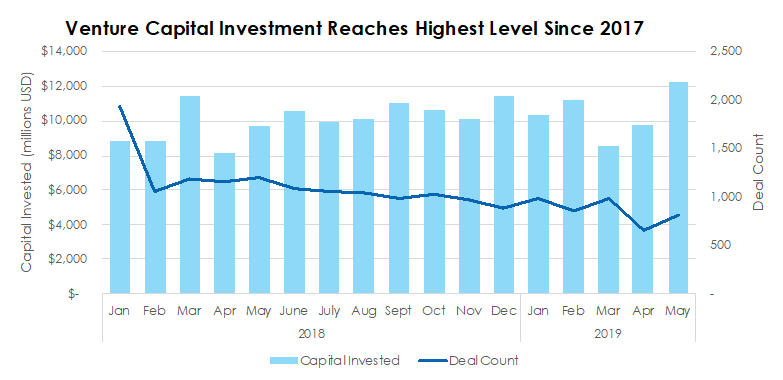

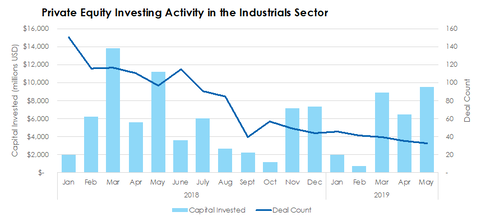

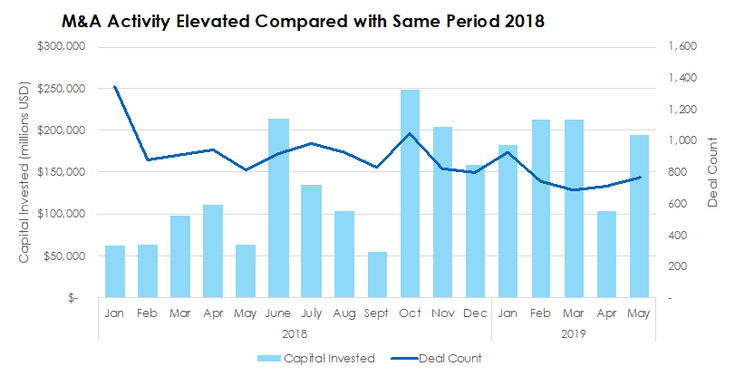

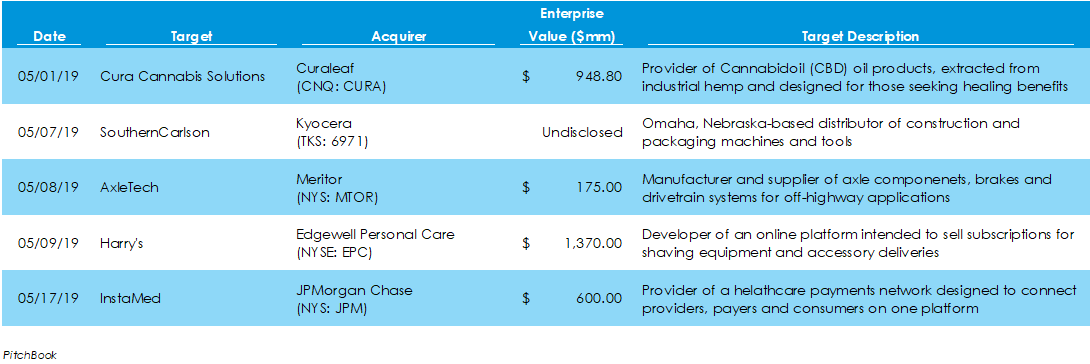

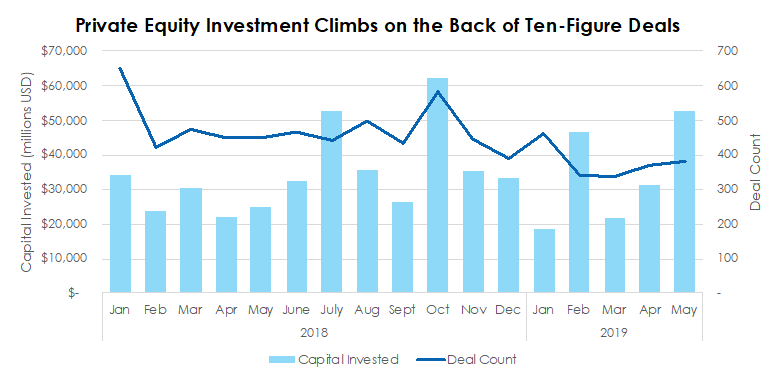

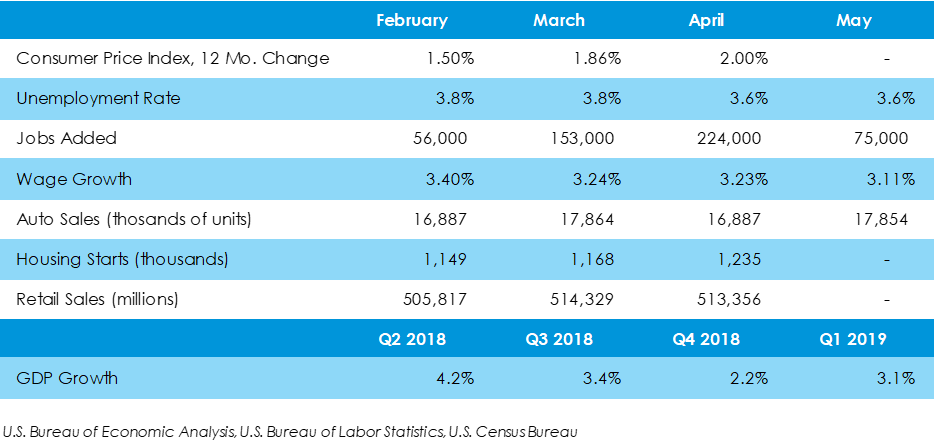

M&A Activity Picks Up in May Despite Weaker Year than 2018There were 720 M&A deals valued at a combined $194 billion in May, according to Pitchbook. For the year through the end of the May, there were 3,756 deals for $906 billion capital, roughly 1,140 fewer deals and $506 billion less value for the same period in 2018. The Midwest region constituted 37 deals and $2.1 billion of May’s deals, or 1.08% of total May M&A value. The largest LBO across the country was the $14.3-billion buyout of Boulder, Colorado’s Zayo Group (NYS: ZAYO). In terms of active sectors, there were twelve deals worth $1.2 billion in the legal cannabis space in the US in May. In the past year, M&A activity in the vertical has experienced a strong upswing in deal count and deal value. In 2019 alone, there have been 87 deals for $7.4 billion, on pace with 2018’s deal count but almost four times as much capital invested. VC Deal Value Up 12% in May Venture capitalists closed 849 deals in May, valued at nearly $13 billion, up 11.9% from April’s total deal value. Year to date, deal activity has been subdued, with deal count falling a third from the same period in 2018. Deal value, on the other hand, has increased 13% from year-to-date 2018. Several big-name brands received venture funding last month: DoorDash, SpaceX, SoFi, and Impossible Foods, which raised an aggregate of $1.9 billion. Private Equity Activity Soars in May Despite Weakness in Industrial Investments Private equity investment value nearly doubled in May from the month before, as investors took advantage of the Federal Reserve hitting pause on interest rate hikes. In May, there were 406 private equity deals valued at a cumulative $59.7 billion. Year-to-date, U.S. buyout shops have completed $189 billion in deals, $55 billion more than the same period in 2018. In May, eleven of the eighty-six deals with disclosed valuations were for more than one billion dollars.  Private equity investing in industrial companies in the U.S. has tapered off significantly this year towards deal count levels not seen since the wake of the financial crisis. This year, there have been only 210 deals, a third of the 622 in the same period of 2018. It could be interpreted that investors are wary of the industrial impacts of a Chinese trade war, and they fear an impending economic recession will weigh heavily on U.S. industry. Economy Sends Mixed Signals on Higher Credit-Fueled Purchases and Fewer-than-Expected Jobs The U.S. economy has begun to face headwinds in the Spring, resulting in a softening labor market in May.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed