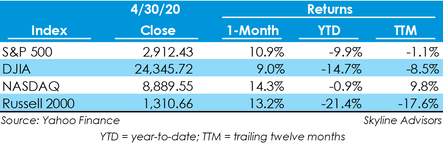

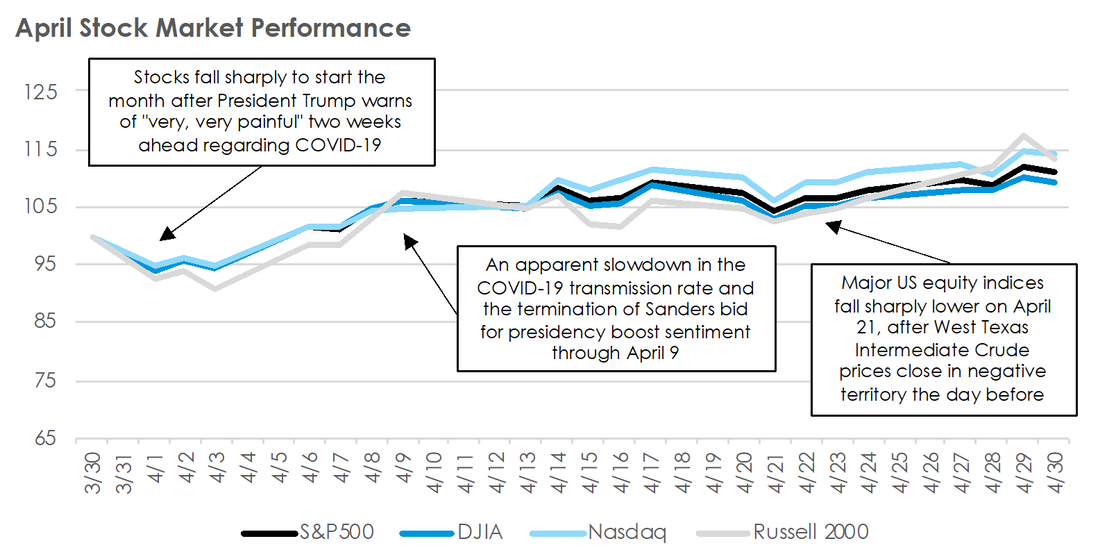

The effects of the novel coronavirus have continued to disrupt financial markets worldwide. Uncertainty over how long the pandemic will last has kept markets in flux, with the CBOE Volatility Index (VIX) averaging 41.45 points in April, which is down from March’s average but significantly greater than the 2019 average of 15.39 points. Moreover, unprecedented activity in oil markets added more context to the possible depth of the economic slowdown. However, during the month, markets seemed to rebound from a major pullback in the first quarter, with three of the four major indices growing by double-digit percentages.

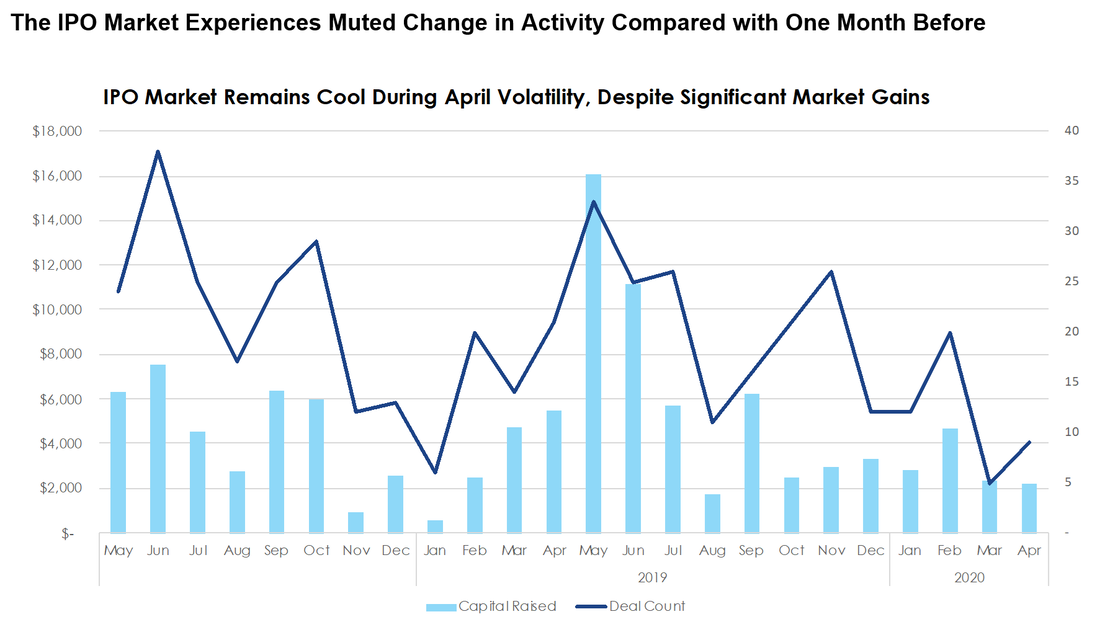

The IPO Market Experiences Muted Change in Activity Compared with One Month Before As mentioned previously, coronavirus-related market volatility has continued to spook corporations looking to list publicly. Compared with March, the number of new listings in April nearly doubled from five to nine, while the level of total funds raised slid slightly from $2.4 billion to $2.2 billion. Year-to-date, $1.2 billion less has been raised and one-quarter fewer firms have been listed compared to the same period in 2019. Five of the nine IPOs listed year-to-date were for special purpose entities who have been raising funds for acquisitions or special partnerships, three of the nine were healthcare firms going public, and the ninth firm was WiMi Hologram Cloud Inc., a developer of augmented-reality holographic products and services.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed