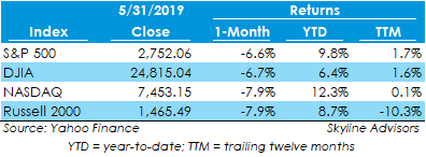

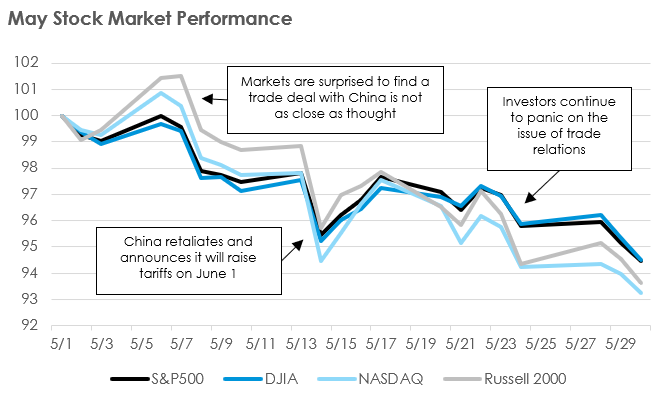

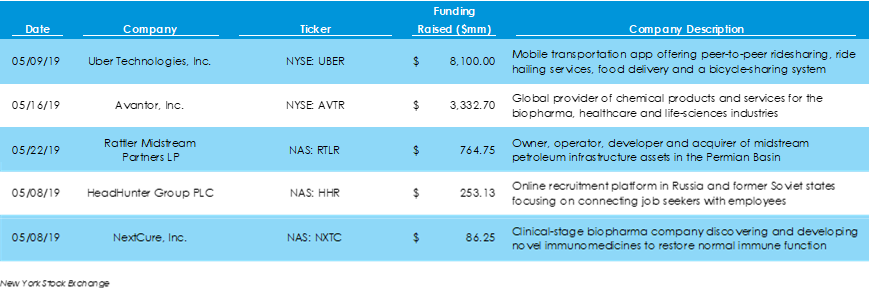

Stock markets dropped in May due to the on-going trade tensions with China. The S&P 500 dropped 6.6% to 2,752, while the Dow Jones Industrial Average, NASDAQ, and Russell 2000 each declined 6.7%, 7.9%, and 7.9%, respectively. May marked the first month of broad index declines for the year, though returns are still up considerably year to date. During the month, there were several signs of the economy slowing, causing investors to load up on treasuries. According to HIS Markit, US manufacturing activity grew in May at its slowest pace since September 2009. In addition, the Commerce Department reported new home sales for April in May, noting a decline of 6.9% from March. Perhaps the largest source of market volatility since the start of 2018, relations with international trade partners will likely drive market movements in the near term. Uber and Avantor Boost May IPO Activit Thirty-three companies joined the Nasdaq and New York Stock Exchange in May, raising just over $16 billion in public equity financing, $10.6 billion more than the 21 companies that went public in April. Much of that difference comes out of the highly anticipated Uber IPO, which raised $8.1 billion. In May 2018, $6.3 billion was raised among 24 IPOs. May also listed the two largest IPOs of the year in Uber and Avantor, which are two of the $5+ billion-dollar IPOs thus far in 2019.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed