|

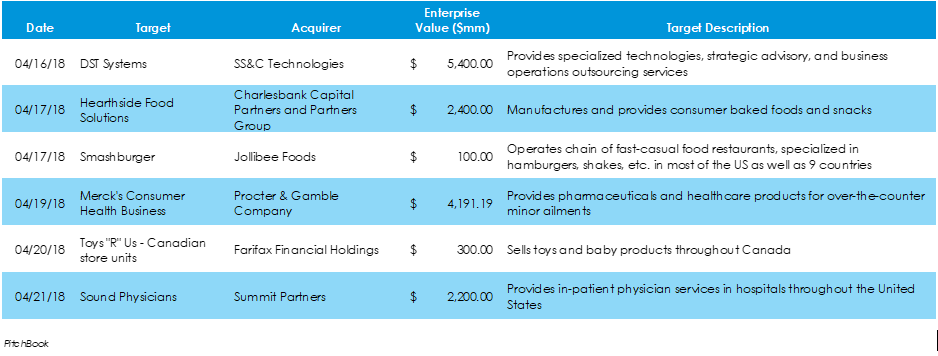

Last week, there were a number of M&A deals that fell in Skyline's industries of focus: food and agriculture, technology, healthcare, and industrials, broadly speaking. Within technology, one of the week's largest valued deals was SS&C Technologies acquisition of DST's financial services and healthcare segments. Within domestic healthcare, Tacoma-based Sound Physicians agreed to be bought out by Boston-based PE firm, Summit Partners. Within food, Hearthside Food Solutions and Smashburger engaged in transactions. Notable global market deals include Procter & Gamble’s acquisition of Merck's consumer health business and the liquidation auction of Toys "R" Us' Canadian stores.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed