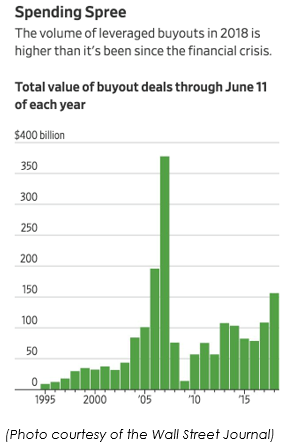

Leveraged buyout, or LBO, activity has been booming in 2018. According to an article from the Wall Street Journal last week, 2018 is on pace to have the highest dollar volume of LBOs since 2007, before the Great Recession. LBO activity for the year is up 44% from the same time-period last year. Overall M&A activity in 2018, at $2.1 trillion, is on pace to break the current record high for global M&A activity, set in 2007 at $4.3 trillion. Firms are pointing to large corporate deals - such as AT&T and Time Warner, the pending battle between Disney and Comcast for Twenty-First Century Fox, and Bayer’s takeover of Monsanto - as being a driving force behind the increase in activity. Activist investors or regulators may force the sale of assets to allow a corporate deal to take place, leaving more “orphaned” businesses for private equity firms to pursue. Also, debt is still relatively cheap, and the economy is strong, creating a greater incentive to acquire companies and select assets. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed