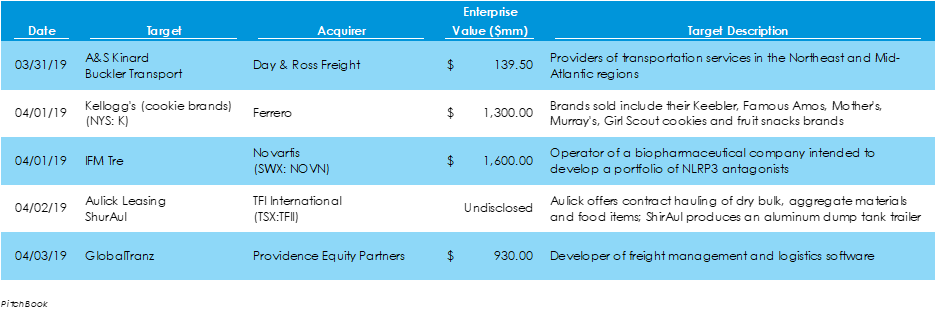

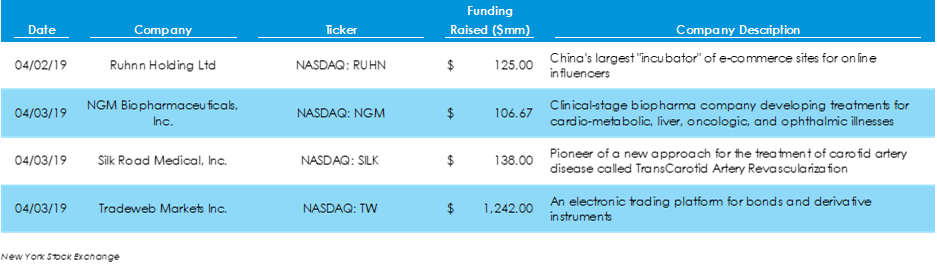

Transportation Space Highlights Last Week’s M&A ActivityData from Pitchbook shows that $15.2 billion of capital was invested across 29 M&A deals last week, $4.4 billion less capital on two more deals than the previous week. The largest two deals during the week were Stonepeak Infrastructure Partners’ $3.6 billion LBO of Oryx Midstream Partners and the $2.44 billion acquisition of AmeriGas Partners by UGI Utilities. AmeriGas is a publicly traded propane distributor, and Oryx is a natural gas collection group. The transportation space was an active sector, as A&S Kinard and Buckler Transport were acquired by Day & Ross Freight; TFI International acquired Nebraska-based Aulick Leasing and its manufacturing business, ShurAul; and Providence Equity Partners acquired transportation software provider GlobalTranz. iHeartMedia Files for IPO amid Finalization of Bankruptcy ProceedingsAccording to the New York Stock Exchange, four companies joined U.S. public markets last week, all on the Nasdaq exchange. The four companies – Ruhnn Holdings, NGM Bio, Silk Road Medical and Tradeweb Markets – raised a combined $1.6 billion, with most of it going to the fixed-income trading platform Tradeweb. Other news includes Slack announcing an expected date for its IPO sometime in June or July and iHeartMedia filing for a $100-million IPO as it emerges from bankruptcy restructuring. Payroll Additions in March Rebound after Soft February ReportAmong economic news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed