|

This past week, the Bureau of Labor Statistics released its jobs report. Major news involved the biggest year-over-year increase in wages since the recession, a 10-year Treasury-note yields jump, roughly 200,000 jobs being added in January alone, and the Dow Jones Industrial Average dropping over 600 points.

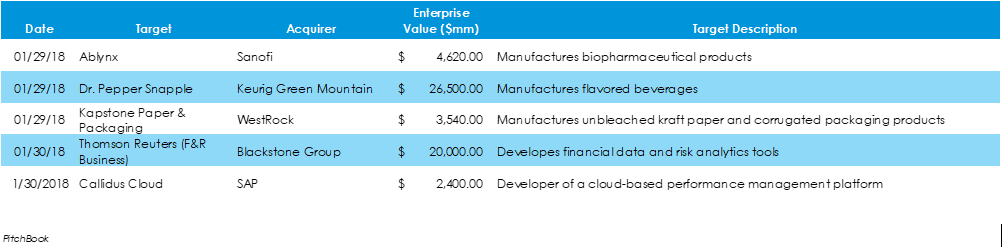

The last week of January saw multiple billion-dollar mergers and acquisition (M&A) deals. Notable deals include the potentially largest U.S. merger since 2016; another biotech acquisition from pharma firm, Sanofi; the German software megafirm, SAP, accelerating its cloud presence; and Blackstone Group leading a group to control 55% of Thomson Reuters' Financial & Risk (F&R) division.

Initial public offerings (IPOs) from Hudson Group, Corporacion America Airports, Central Puerto, and VICI Properties highlighted a week that ended with a sharp drop in the market. Additionally, we saw top management fallout and delayed IPO sentiments at AirBnB, one of the year's most highly anticipated multi-billion-dollar public offerings.

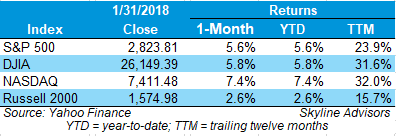

Major stock market indices had a great start to the year in January, as the S&P 500, Dow Jones Industrial Average (DJIA), and the NASDAQ all recording more than 5% gains. Most notable was the NASDAQ, which reached a 7.4% return over the month. Similarly, these returns bolstered the trailing-twelve-month returns of the respective indices, as the DJIA and NASDAQ have exceeded over 30%. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed