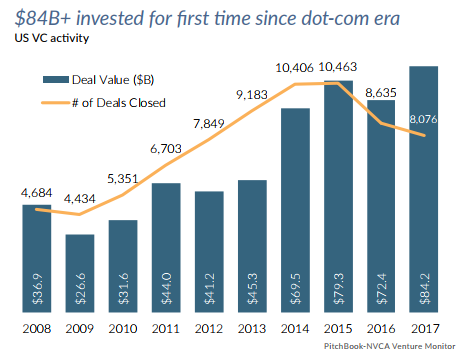

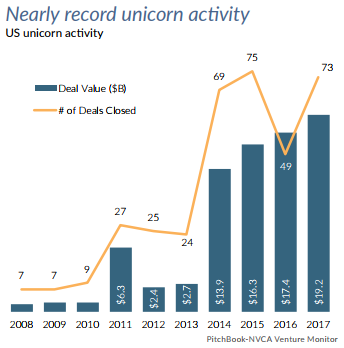

The fourth quarter of 2017 marked the third consecutive quarter with at least $20 billion invested in US venture-backed companies. Investment in 2017, as a whole, reached $84 billion, which is the first time venture investment has eclipsed $80 billion since the dot-com boom. The $84 billion was spread over 8,076 deals, reflecting a 6% drop in deal count from 2016 but a 16% improvement in total value.  Larger valuations may have led to an increasing trend towards larger financings. In 2007, less than 20% of all VC financings were $50 million or greater, yet they accounted for nearly half of financings in 2017. Round sizes have also increased; Series D or later valuations jumped more than 85% to $250 million last year from $135 million in 2016. Furthermore, unicorn activity (companies with valuations in excess of $1 billion) hit near-record levels at more than $19 billion in value across 73 deals. The West Coast continued to be the most attractive region for VC funding, receiving 40.3% of all deals and 55.4% of all value in the fourth quarter of 2017. Software continued to be the most attractive space to invest in, though the attractiveness seems to be slipping, as software deal count has steadily declined from 2014, and deal value among software companies slipped from 2016’s high. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed