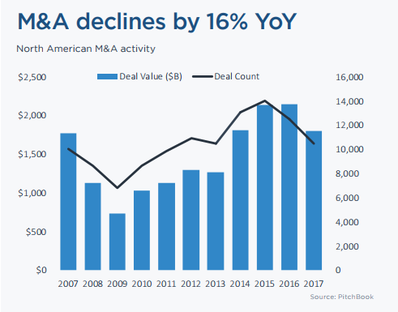

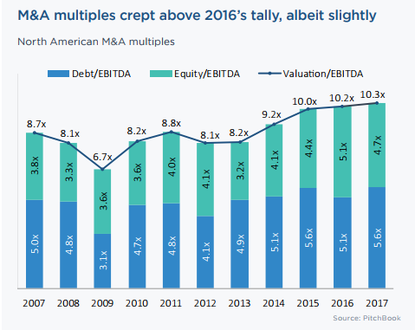

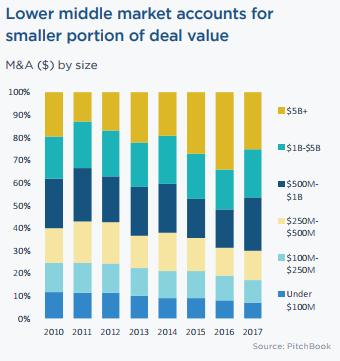

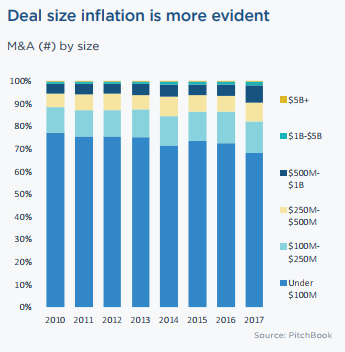

North American mergers and acquisition activity totaled $1.8 trillion across 10,465 deals in 2017, according to PitchBook. Value and volume were down from 2016 by 16.0% and 16.1%, respectively, as buyers struggle to deal with rising valuations and quality prospects as well and are placing their focus on integrating previous acquisitions. The slowing in activity occurred even as the economy heated.  Recent tax legislation and the repatriation of foreign cash balances is expected to be a boon for M&A activity in 2018. GBH Insights estimates that US corporations will bring in $300 to $400 billion in cash from abroad, which is expected to be used for further M&A, dividends, and share buybacks. An uptick in activity may lead to higher price multiples, although they are already at record levels. The median valuation to EBITDA multiple in North America in 2017 was 10.3x, an increase from 2016’s 10.2x. (Note that varies slightly from the 10.5x estimate in the U.S. that we referenced in our recent post on PitchBook’s 2017 private equity data.) Deals fetching valuations of $100 million or less accounted for over 60% of total volume in 2017, yet represented less than 10% of total value. Technology continues to be the “hot sector,” accounting for 17.8% of all 2017 M&A volume. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed