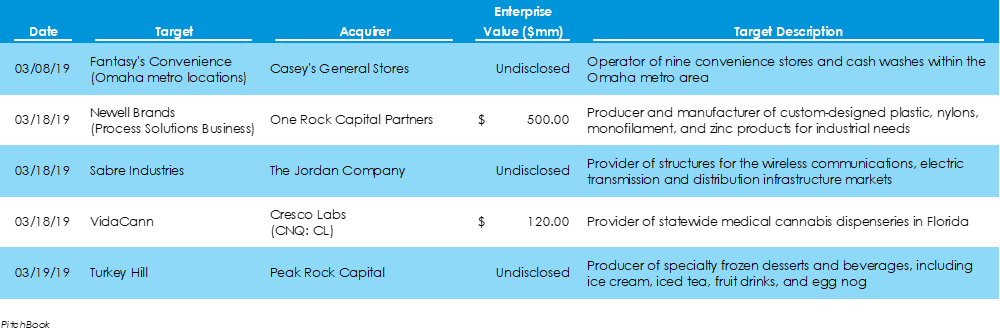

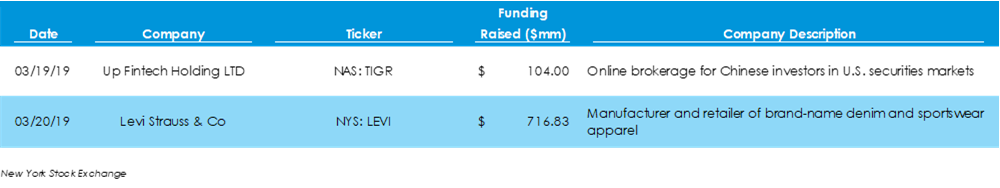

FIS Acquires Worldpay in the Payment Industry’s Largest Deal EverPitchbook data reveals there were 15 M&A deals in the U.S. last week for combined capital of $36.8 billion, eight fewer deals than the week before but for $19.5 billion more in capital consideration. Fidelity Information Services’ $43-billion acquisition of Worldpay, a leading provider of payment processing services, was the largest deal of the week. Also, Peugeot, a French auto manufacturer, reportedly approached Fiat Chrysler about a merger earlier this year. Fiat Chrysler rebuffed the deal that would’ve formed a $45-billion industry giant. Levi Strauss Goes Public, Pricing Their IPO Above the Initial Target RangeAccording to the New York Stock Exchange website, two companies went public last week: blue jean retailer Levi Strauss and Chinese online brokerage firm Up Fintech Holding. The two companies raised a combined $820.8 million, with about $717 million going to Levi Strauss. This is Levi’s second time going public. Also, Lyft is set to finally debut on the Nasdaq in the middle of next week and Pinterest revealed its S-1 filing for going public sometime in April. Federal Reserve Elects to Keep Rates Unchanged Amid Slowing Domestic GrowthAmong news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed