|

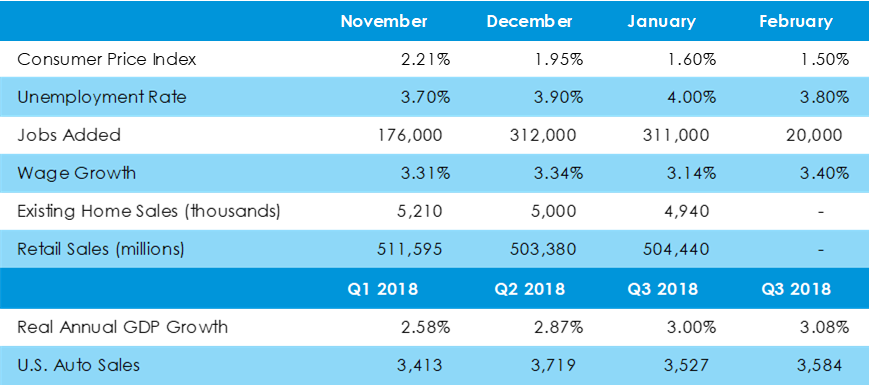

The U.S. economy has continued to show signs of slowdown in February, as recessionary fears for 2020 continue to mount. Labor market growth hit a sudden slump as only 20,000 jobs were added in February. Analysts and economists suggest that such a low figure is mostly an anomaly but that job growth should continue to slow headed into 2019. The unemployment rate fell by 0.2% while non-farm wages grew 3.4% for the year ended February, a strong reading and prompting hope for higher consumer demand in the coming months. It was also reported that worker productivity reached record highs in the fourth quarter of 2018, lending more credence to higher output forecasts for this year. Retail sales in January stayed at a consistent level from a month before in December, rising only 0.2%. However, excluding volatile categories such as gas and food services, the increase jumps to 1.1% after being down 2.3% in December. December’s statistics were also downwardly revised, potentially having an impact on the government’s fourth-quarter output estimates. Big ticket purchases such as housing and autos showed mixed results in the first two months of the year. Auto sales in February appear to be generally lower compared to late 2018 results. Reports released in February show home sales for both new and existing units grew in December. However, many believe that the increase is only a residual effect of increased mortgage applications in the Fall. Mortgage applications have been increasing year-over-year during the last four weeks heading into the busy Spring buying season.

Major stock indices continued to rebound in February, with the Nasdaq closing up 3.4% and the S&P 500 up 3.0%. The highlights from our weekly economic updates during February 2019 included:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed