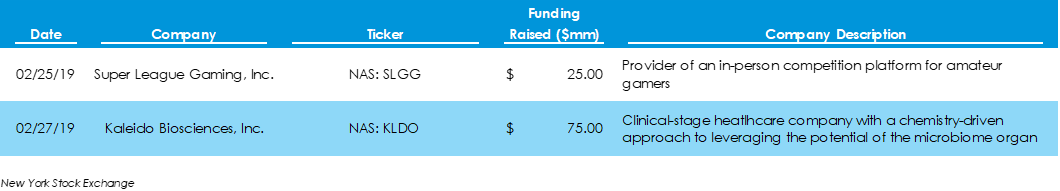

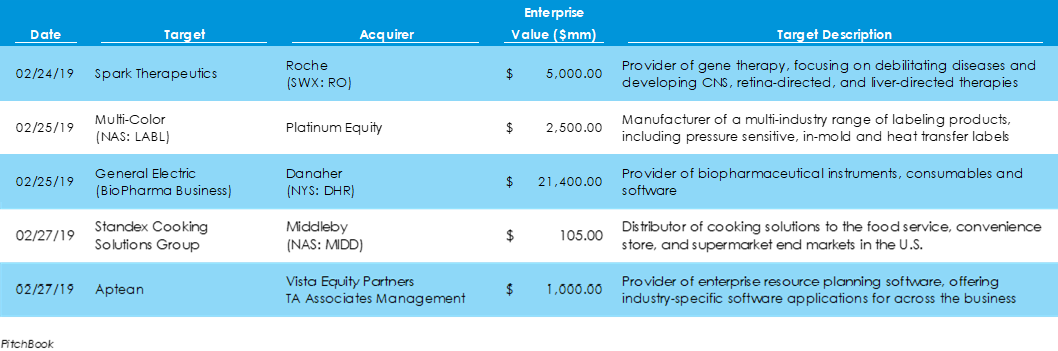

Initial Public Offerings: Lyft Files for IPOLast week, Super League Gaming (live streaming of in-person amateur gamer competitions) and Kaleido Bioscience (clinical-stage healthcare company focused on the human microbiome) completed their initial public offerings. Super League is the first e-sports company to go public. Lyft officially filed for an IPO late last week, reporting $2.16 billion in revenue in 2018. Mergers & Acquisitions: Over $2.5 Billion Transacted for SaaS Companies Last WeekData from Pitchbook indicates that $32.3 billion was spent on 37 M&A transactions last week, up $24.9 billion for the same number of deals the prior week. Much of the increase in spending can be attributed to large deals, including a $21.4-billion acquisition bid by manufacturing and healthcare conglomerate Danaher for General Electric’s biopharmaceutical business. In another major M&A deal of the week, Illinois-based Alight Solutions acquired global information technology firm Wipro’s stake in Workday and Cornerstone OnDemand. The deal was among the $2.5 billion spent for SaaS firms last week. Economy: Strong Dollar Helps Trade Deficit Reach 10-Year Record Among news last week:

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed