|

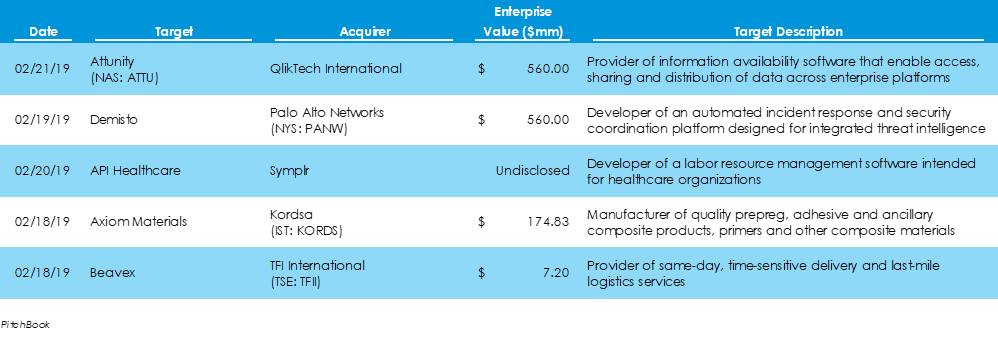

Pitchbook data revealed that last week there 37 M&A deals for a total value of $2.48 billion, four more deals for $7.4 billion less capital invested than the prior week. The two largest deals of the week were QlikTech International’s public-to-private buyout of Attunity and Palo Alto Networks’ acquisition of Demisto, both of which were for $560 million in value. Pearson (NYS: PSO), the British publishing and assessment service for schools and corporations, has sold off its U.S. textbooks division to private equity firm Nexus Capital Management for $250 million. The K-12 U.S. courseware business provides textbooks and instructional resources for teachers and classrooms. Pearson has been looking to offload the brand during the last year in an effort to focus on digital.

According to CNBC, Kraft Heinz has hired Credit Suisse in an effort to evaluate strategic options for its Maxwell House coffee brand, which could fetch as much as $3 billion. Coffee businesses have struggled in recent years as teas and other health-conscious options have grown in popularity. However, private equity companies throughout the years have grown accustomed to acquiring large but rundown brands and revamping them. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed