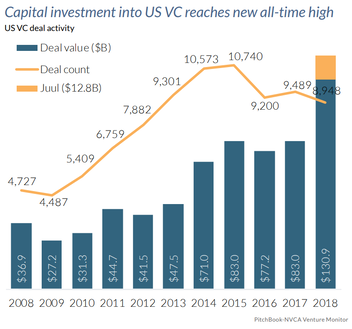

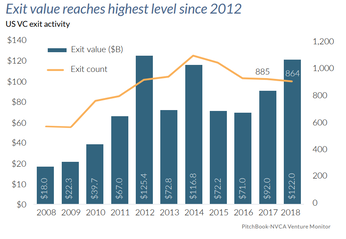

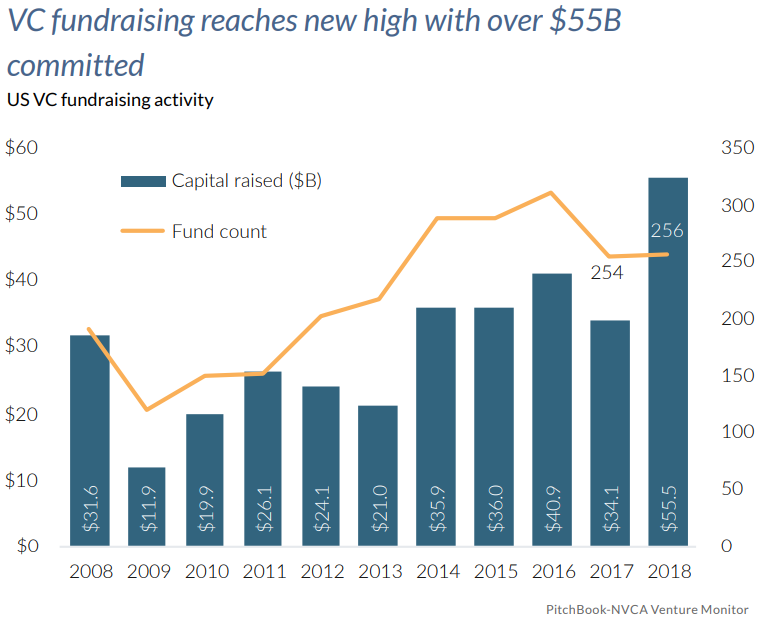

Annual venture capital investment has hit $100 billion for the first time since the dot-com era, according to Pitchbook. Deal value in VC-led deals reached $130.9 billion, up 57.7% from 2017’s value of $83 billion. The number of financings completed, however, fell to 8,948 from 9,489. The last time venture capital investment topped $100 billion was in 2000, when investment reached $105 billion, according to data from Thomson Reuters. Pitchbook included Altria’s $12.8 billion financing of Juul in its calculation.  The West Coast and Mid-Atlantic regions captured the most attention by VCs, as the West accounted for 39.5% of deal volume and 61.7% of deal volume, while the Mid-Atlantic accounted for 20.1% of volume and 14.9% of value. The Midwest accounted for 1.7% of deals made and 0.5% of total deal value in 2018. Pharma & biotech and software continued to be the most sought-after sectors. VC funds exited 864 investments, worth a combined $122 billion, or the highest level since 2012. The number of exits was nearly unchanged from last year, dipping to just 864 exits from 885 in 2017. Fundraising hit a record high in 2018, with 256 funds raising $55.5 billion. In 2017, 254 funds raised $34.1 billion. VCs have begun to raise out-sized funds to accommodate demand for larger rounds brought by more-mature startups.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed