Broadcom's Takeover of Qualcomm Blocked by the Committee on Foreign Investment in US (CFIUS)3/20/2018

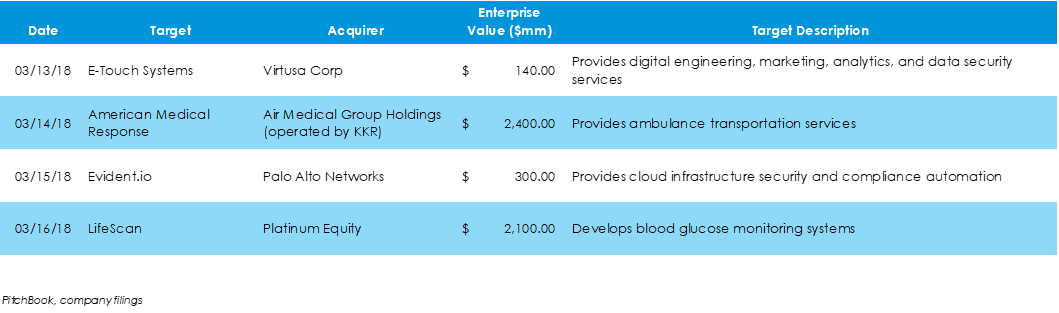

Last week was quite tumultuous in the M&A space. The most notable event was the CFIUS' denial of Singapore-based Broadcom's acquisition of U.S.-based Qualcomm. Other major events included the bankruptcies of debt-ridden iHeartMedia and Toys ‘R’ Us, a few healthcare-related corporate divestitures, and two technology deals.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed