|

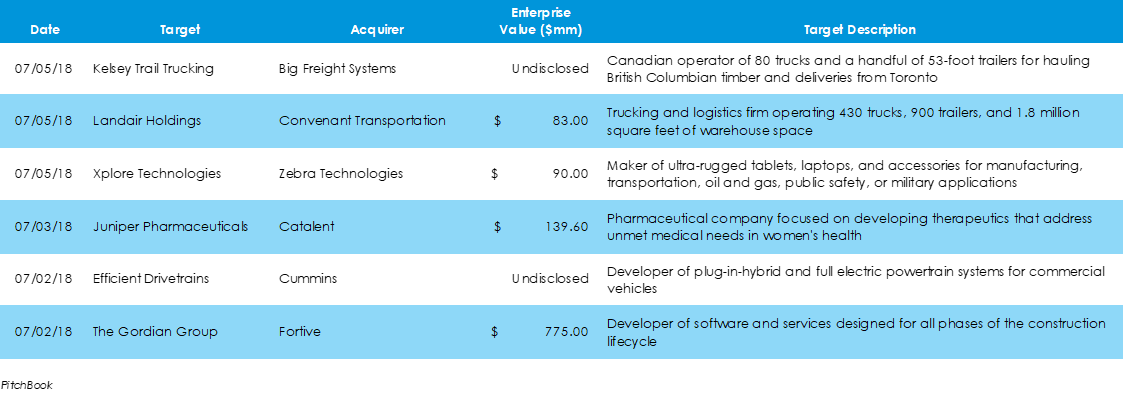

Last week, two mid-sized trucking firms, Kelsey Trail Trucking and Landair Holdings, merged with larger counterparts Big Freight Systems and Covenant Transportation, respectively. Xplore Technologies, the rugged device maker, was bought out by Zebra Technologies. Juniper Pharmaceuticals was acquired by healthcare solutions company Catalent. Cummins continued its electric transformation by purchasing Efficient Drivetrains. Finally, The Gordian Group, a construction tech frim, was acquired by holding-company Fortive.

While no US-based companies officially debuted shares this week through initial public offerings, a few companies made news in the IPO arena. Dell has returned to public markets through an unordinary $22 billion deal after going private in 2013. Wireless speaker maker Sonos filed for an IPO Friday with the Securities Exchange Commission. Also, doubts have begun to grow around Saudi Aramco’s initial public offering.

Last week, consumer confidence (slightly below expectations) and consumer sentiment (up slightly) measures were released by the Conference Board. These readings provided an indication of whether citizens have enough faith in the economy to make a big purchase. Also, the Kansas City Fed Manufacturing Index (down slightly) gave a reading on manufacturing and industrial economic performance throughout the Western Great Plains. Lastly, the Mortgage Bankers Association released their weekly Mortgage Applications Survey (down).

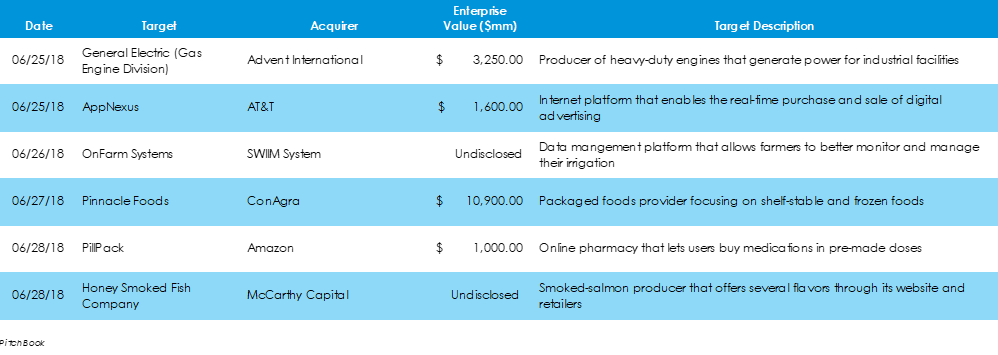

Last week, a number of Fortune 500 companies either made acquisitions or sold off portions of their business. ConAgra acquired Pinnacle Foods to expand its packaged foods business. GE, amid a selloff of business segments at the firm, sold its gas engine division to private equity firm Advent International. Amazon made a huge splash in the pharmaceutical business with its acquisition of online pharmacy PillPack. AT&T made yet another major deal to modernize its media business with the acquisition of AppNexus. Finally, OnFarm Systems, a farmer-focused data management service, was acquired by SWIIM System.

Last week, the NASDAQ saw several significant IPOs in the Healthcare industry. Five pharmaceutical and therapeutic companies debuted, four of which went public on Thursday. On Wednesday, Neon Therapeutics had its shares listed, followed by Tricida, Neuronetics, Forty Seven, and Translate Bio on Thursday.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed