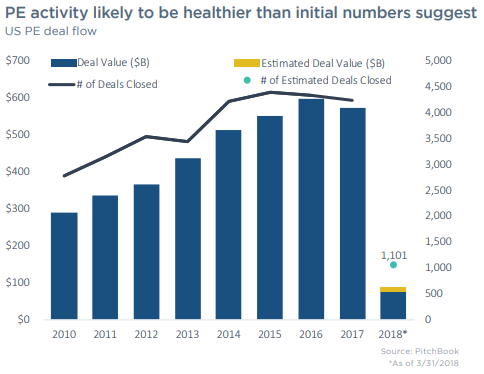

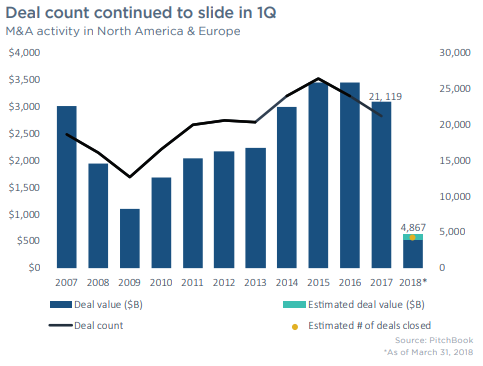

Private equity activity slowed in the first quarter of 2018, according to Pitchbook. At 1,101 completed transactions in the first quarter, deal volume declined 4.0% from the first quarter of 2017. Surprisingly, deal value, at $88.8 billion, fell 32.8% over the same period. Pitchbook noted an expectation for an uptick in the value in the coming months, as information regarding private transactions is slow to surface.  Mergers and acquisitions (M&A) activity trended down substantially in the first quarter of 2018, according to data from Pitchbook. In North America and Europe, 4,867 M&A transactions were completed, representing approximately $617 billion in value, in the first quarter. Year over year, deal volume was down 18%, and deal value was down 25%. In just North America, there were 2,402 transactions with an estimated value of $323 billion. Weakness in housing measures highlighted last week’s economic news, as pending home sales barely inched up, and home sales and mortgage applications declined. In other news, the Federal Reserve kept its federal funds rate unchanged.

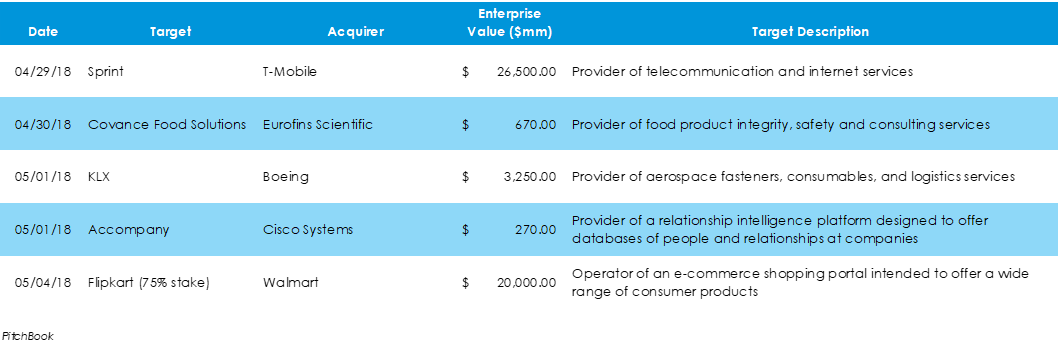

Last week was off to a big start in terms of mergers and acquisitions activity, as T-Mobile announced over the weekend that it would acquire Sprint. The week also ended on a significant note, as Walmart successfully bid $15 billion to acquire a 75% stake in Flipkart, which competed head-to-head with Amazon in India.

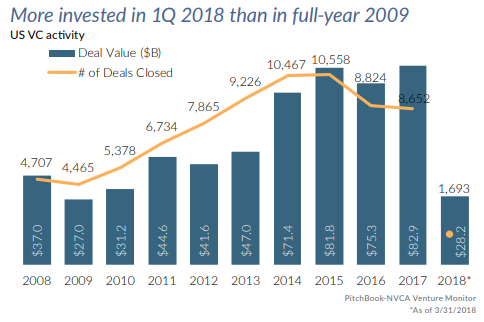

In the first quarter of 2018, 1,683 companies raised $28.2 billion in venture capital funding, according to data provider Pitchbook. The quarter marked the fourth consecutive quarter of more than $20 billion invested and the largest amount invested in a single quarter since at least 2006. Continuing the trend from 2017, more value was spread across fewer deals. Two healthcare companies led last week’s initial public offering activity, with Inspire Medical Systems and Unity Biotechnology both fetching valuations in the hundreds of millions of dollars. Meanwhile, nVent Electric spun out of Pentair to trade separately.

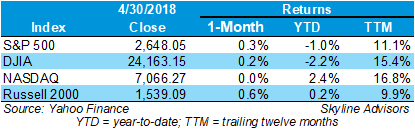

Major indices, with the exception of the Nasdaq, slightly increased in the month of April. The Russell 2000 led major indices with a gain of 0.6%, while the Nasdaq lagged with a flat return. Year to date, returns on the S&P 500, Dow Jones Industrial Average (DJIA), Nasdaq, and Russell 2000 are fairly mixed. Trailing-twelve-month returns are still in positive territory, thanks to strong returns in 2017. Of all economic news last week, perhaps the most intriguing are the jobless claims and GDP reports. Jobless claims fell to the lowest level since 1961, and GDP for the first quarter of 2018 slipped on consumer spending weakness.

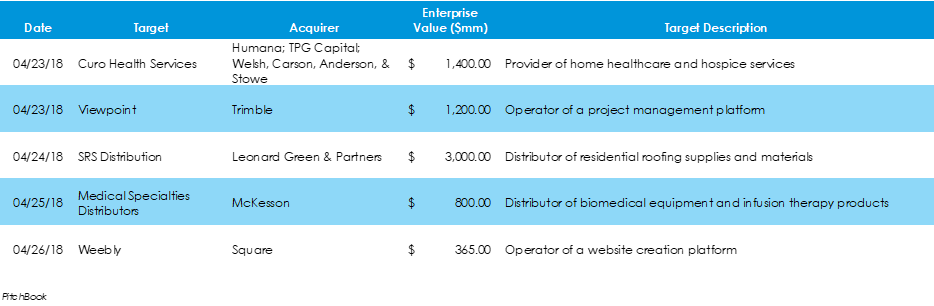

Two distribution deals were made last week, with private equity group Leonard Green & Partners buying SRS Distribution and McKesson acquiring Medical Specialties Distributors. Other deals in the week included Humana teaming with private equity groups to acquire Curo Health Services, Trimble buying Viewpoint, and Square announcing its acquisition of Weebly.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed