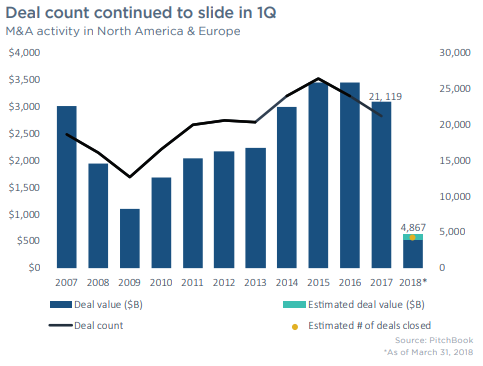

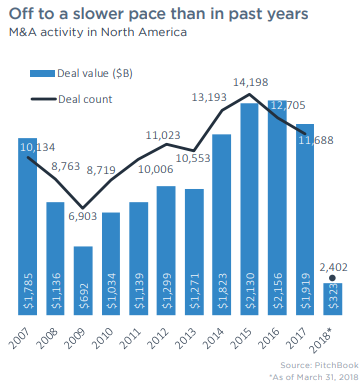

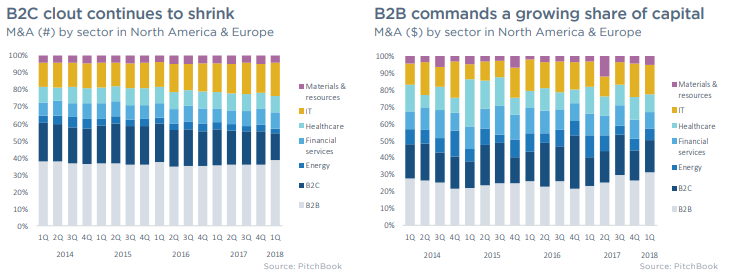

Mergers and acquisitions (M&A) activity trended down substantially in the first quarter of 2018, according to data from Pitchbook. In North America and Europe, 4,867 M&A transactions were completed, representing approximately $617 billion in value, in the first quarter. Year over year, deal volume was down 18%, and deal value was down 25%. In just North America, there were 2,402 transactions with an estimated value of $323 billion.  Though deal count fell, there are a number of high-profile transactions that are announced but are awaiting close. Effects of tax cuts and large cash positions should continue to bolster M&A activity. Business-to-business (B2B) and information technology (IT) sectors saw increases in their proportions of total M&A activity, at 19.5% and 38.6%, respectively. IT continues to play a large role in M&A, as innovation threatens the competitive landscape, forcing companies to invest more in research & development or acquire new or advanced technologies. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed