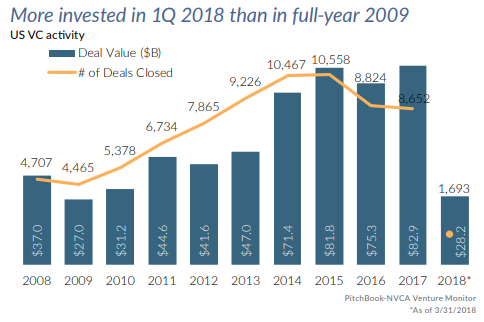

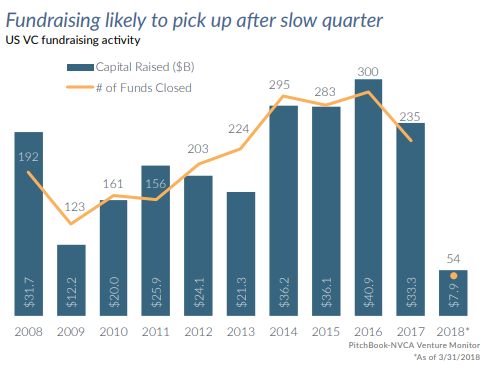

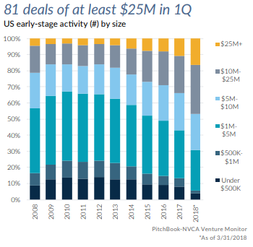

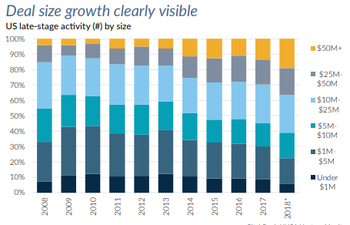

In the first quarter of 2018, 1,683 companies raised $28.2 billion in venture capital funding, according to data provider Pitchbook. The quarter marked the fourth consecutive quarter of more than $20 billion invested and the largest amount invested in a single quarter since at least 2006. Continuing the trend from 2017, more value was spread across fewer deals. Angel and seed financings were a significant driver for the decline in activity, yet deal value for these financings remained at heightened levels. In fact, in every quarter since the fourth quarter of 2012, more than $1 billion has been allocated to angel and seed deals. Prior to this, only three times has the $1 billion mark been reached, according to Pitchbook data. Both early and late-stage financings reached record highs in terms of deal value, as the trend towards larger deal sizes continues a clear path of growth.  Fundraising was slow in the quarter, with VC funds closing an estimated $8 billion across 54 vehicles. Fifty percent of closed funds in the first quarter were under $50 million, which pulled down the median fund size. It was the first time since 2015 that sub-$50-million funds accounted for 50% of fund count. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed