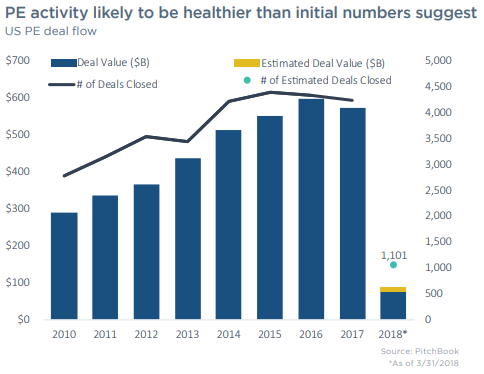

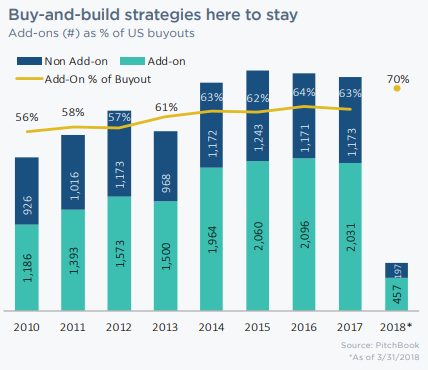

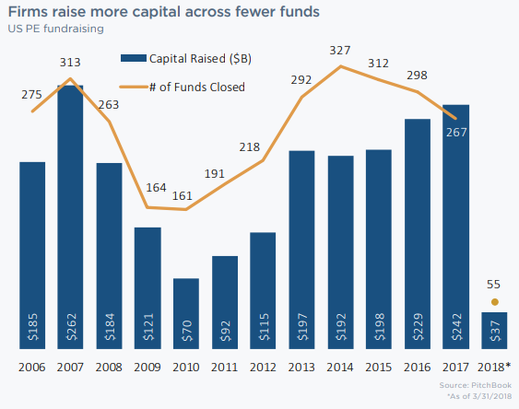

Private equity activity slowed in the first quarter of 2018, according to Pitchbook. At 1,101 completed transactions in the first quarter, deal volume declined 4.0% from the first quarter of 2017. Surprisingly, deal value, at $88.8 billion, fell 32.8% over the same period. Pitchbook noted an expectation for an uptick in the value in the coming months, as information regarding private transactions is slow to surface.  An interesting observation in Pitchbook’s first quarter report is that add-on activity set a record high of 70% of buyout activity. The author suggests that debt repayment and multiple expansion have become less useful, as managers seek buy-and-build strategies. Nearly one-third of PE-backed companies will acquire a company as an add-on, compared to roughly 20% in the early 2000s.  Along with a decline in general activity, fundraising among private equity firms also declined, at $36.6 billion across 55 vehicles. Firms seeking to raise $1 billion or more accounted for over half of capital raised in the first quarter. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed