|

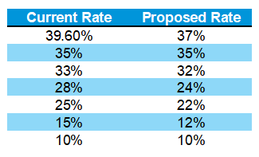

After weeks of compromising their respective bills of the forthcoming tax reform, House and Senate Republicans released their joint tax bill yesterday afternoon. With votes planned early in the upcoming week, the bill may become law within days. Below are some key features of the bill.  Tax rates The bill retains seven personal tax rate brackets but generally lowers each bracket rate. Proposed rates are as follows: Corporate tax rates would lower from 35% to 21%, and foreign earnings would be taxed 15.5% on liquid assets and 8% on illiquid assets. Changes personal to tax rates would be temporary, initiating in 2018 and expiring in 2025.

Standard deduction The bill proposes to raise the standard deduction to $12,000 for single filers, up from $6,500; to $18,000 for heads of households, up from $9,550; and to $24,000 for married joint filers, up from $13,000. These changes would expire in 2025. Personal exemption Personal exemption, currently set at $4,150 in 2018, would be suspended until 2025. Healthcare The bill calls for an end in 2019 of Obamacare's mandate that penalizes individualizes who do not carry health insurance coverage, and the penalty, while still technically in place, in 2018 would fall to $0. The Congressional Budget Office estimates 13 million fewer people will have health insurance a decade after the mandate is eliminated, and health insurance premiums could rise up to 10%. Child tax credit The child tax credit is proposed at $2,000, with a maximum of $1,400 refundable against payroll taxes. Not all filers would be entitled to the $1,400, as the figure scales up with income level. Estate tax The minimum point for individual estate tax would double from the current level to $5.5 million for single filers. Mortgage Interest Deduction Current qualifying mortgage interest deductions are capped at $1 million, plus $100,000 for home equity debt. Under the new bill, new mortgages deductions will be capped at $750,000 through 2025. The deduction on interest for home equity debt will be eliminated through 2025. While this is not an exhausted list, the 1,097-page bill can be read online here. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed