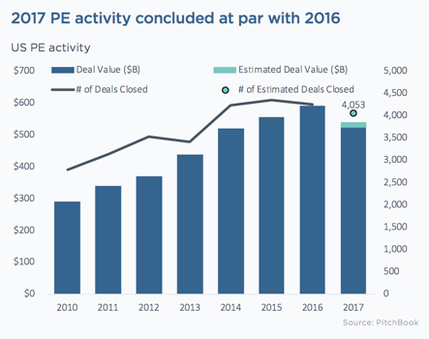

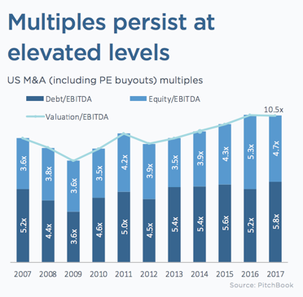

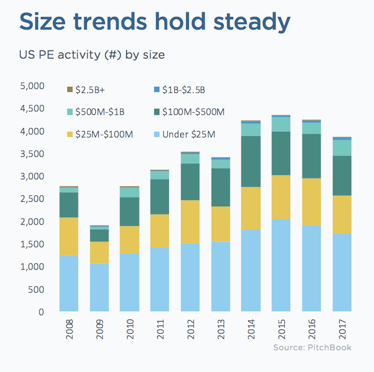

Pitchbook released its 2017 Annual US PE Breakdown report this week. The total value of private equity (PE) deals completed in the US in 2017 was estimated at $538 billion across 4,053 deals. This activity is down 8.9% from 2016, which is a bit counterintuitive at first since PE funds have record amounts of “dry powder” to invest. Three quarters of the follow-on funds raised by private equity funds during the year were larger than their predecessor funds. PitchBook’s recent 2018 Crystal Ball Survey report found that private equity firms had two main concerns. The first was a perceived “high-priced” environment, with the median EBITDA (earnings before interest taxes depreciation and amortization) in 2017 coming in at 10.5x. The second was a perceived lack of “quality” targets being on the market after the record volume of deals over the last several years.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed