|

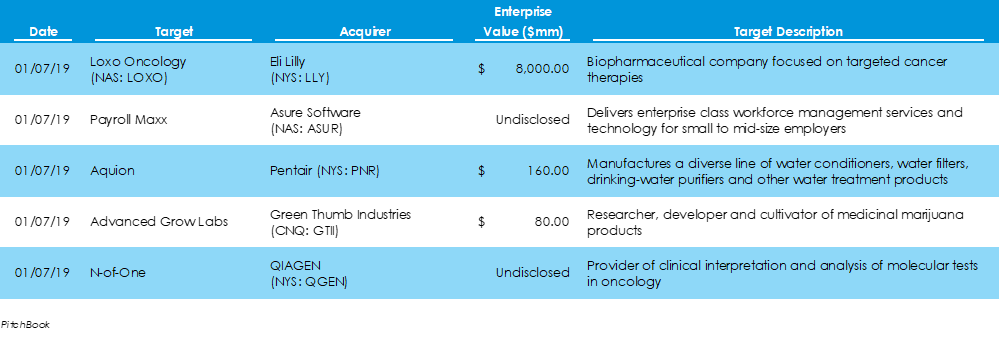

According to preliminary data supplied by Pitchbook, there were 24 M&A deals this last week, totaling $9.31 billion in deal spending. The largest announced transaction of the week was Eli Lilly’s buyout of publicly traded Loxo Oncology for $8 billion. Nine of the week’s deals were for healthcare companies and another nine were for business-to-business deals. Seven transactions were valued in the $100-millionto-$500-million range and only one deal was valued over $1 billion.

The government shutdown drags on and the lack of resources at the SEC and Department of Justice is putting a hold on M&A closures. One such example is the court review process for CVS’s buyout of health insurer Aetna. CVS’s buyout offer was extended over one year ago in December 2017 and has been under DOJ and antitrust review since. However, global law firm King & Spalding suggests financing for M&A deals should remain intact throughout the shutdown. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed