|

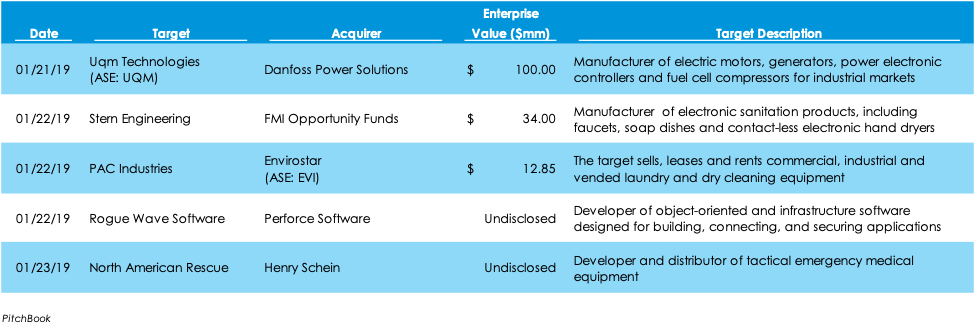

According to data from Pitchbook, there were 25 M&A deals announced last week for a total price tag of $1.56 billion. The largest deal was Dai-Ichi Life Insurance’s $1.2-billion acquisition of Denver-based Great-West Life & Annuity Insurance Company. Great West operates the nation’s second largest provider of retirement plans, Empower Retirement. Among all M&A deals in the week, twelve of the deals were to acquire financial services firms, about half of which are commercial banks. Another eight deals were in the business-to-business services space. The mid-Atlantic states, including the states from New York to Virginia and D.C., were the busiest area of activity last week, producing eight deals.

Ratings and research giant Nielsen (NYS: NLSN) is restarting the process to sell itself, as buyout firm Blackstone expresses interest in the 95-year-old firm. The company, which is best known for its TV-ratings reports, is looking for a sale price near $10 billion. The firm’s TV-ratings segment is beginning to struggle amid the eruption of cable cutting, but the firm also boasts a growing consumer-goods research segment that sells data to manufacturers and retailers. Ultimately, however, the growing presence of e-commerce players, such as Amazon, is putting competitive pressure on Nielsen. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed