|

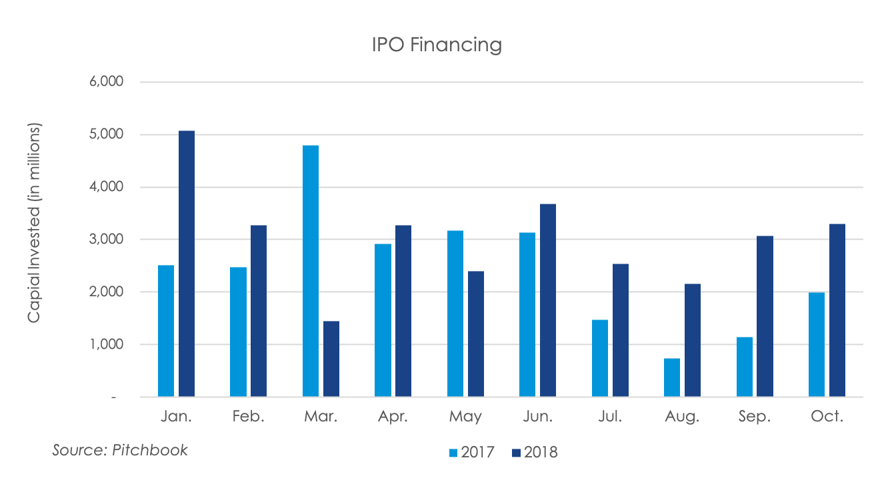

Sixteen companies went public on the Nasdaq and New York Stock Exchange in October, raising a total of $3.3 billion, or 7.5% more than the previous month. On an annualized basis, there was a 65.6% increase in capital raised from one year prior on four more IPOs.

Last week brought third quarter GDP results that narrowly beat economists’ expectations, thanks, in part, to strong annualized consumer spending and low inflation. The Personal Consumption Expenditure price index, which is used by the Fed, underperformed the Fed target in October. However, the Producer-Price Index grew 2.9% annually, driven by producer and supplier margin increases. The JOLT Survey revealed that job openings decreased slightly in September, while the economy yielded a significant net employment gain.

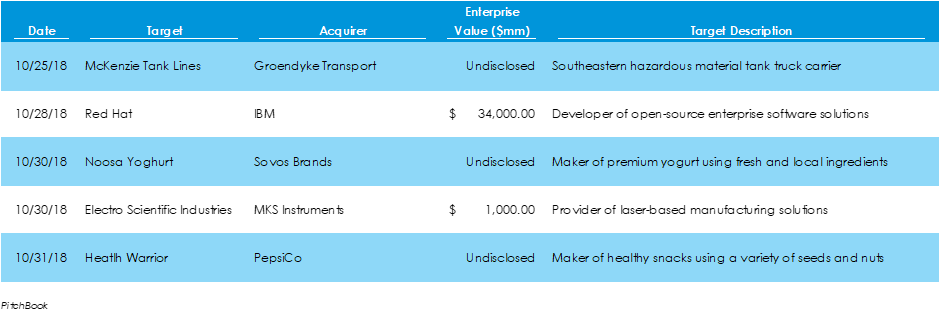

Last week, a total of $43.6 billion was invested in M&A markets through 79 deals. That’s over two times as many deals as last week, but for $8.8 billion less capital. Of those 79 deals, 10 were in the manufacturing sector and another 10 were for SaaS firms, with $2.25 billion and $1.8 billion invested, respectively. However, the technology, media, and telecommunications sector was the busiest again, with $35.8 billion invested across 31 deals, equaling roughly $1.15 billion per deal. The week also brought antitrust approval for Broadcom’s $19 billion acquisition of CA Technologies.

Last week’s economic news showed consumer confidence reaching a sudden 18-year high, lending hope to the possibility of continued economic expansion. Also, worker productivity grew only slightly in October, thanks in part to employers’ need to hire lower-skilled workers. On Friday, the Labor Department announced job growth far exceeded expectations, unemployment held constant, and wage growth also increased.

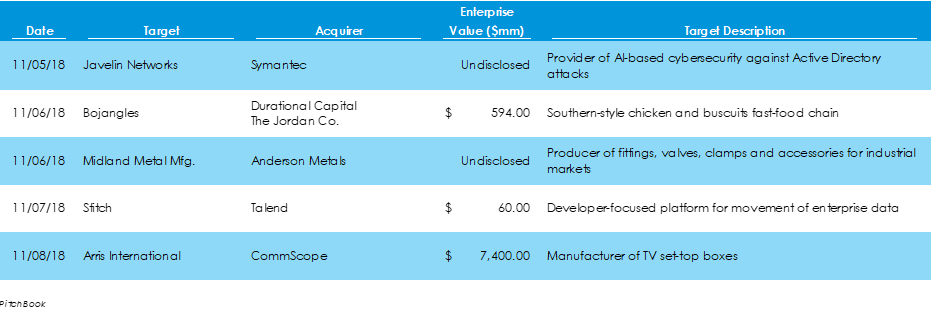

There were 36 M&A transactions during the week ended November 3rd, representing a total invested capital amount of $52.4 billion. The largest deal, at $34 billion, was IBM’s acquisition of Red Hat. Below are highlighted deals within Skyline’s industry focuses.

Last week, three health care companies made their Nasdaq trading debut, raising a total of $390 million in equity capital. Twist Bioscience and Axonics Modulation Technologies, both from California, along with Orchard Therapeutics from London, debuted their initial public offerings despite a volatile couple weeks in the stock market.

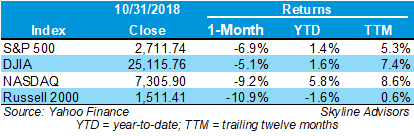

US equities rallied on the last day of the worst month for the S&P 500 since September 2011. The S&P 500 closed the month down 6.9%, the Dow Jones Industrial Average (DJIA) closed down 5.1%, the NASDAQ ended down 9.2%, and the Russell 2000 finished down 10.9%. Before the last week of the month, both the DJIA and S&P 500 entered negative territory for the year. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed