|

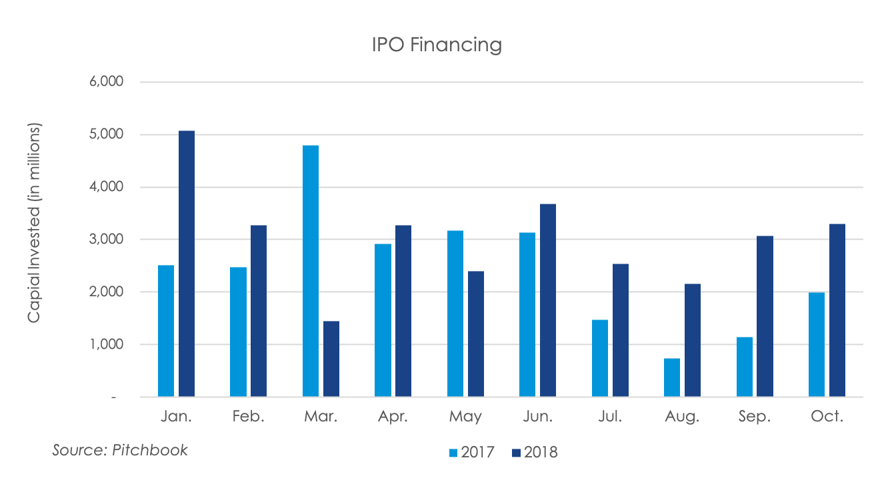

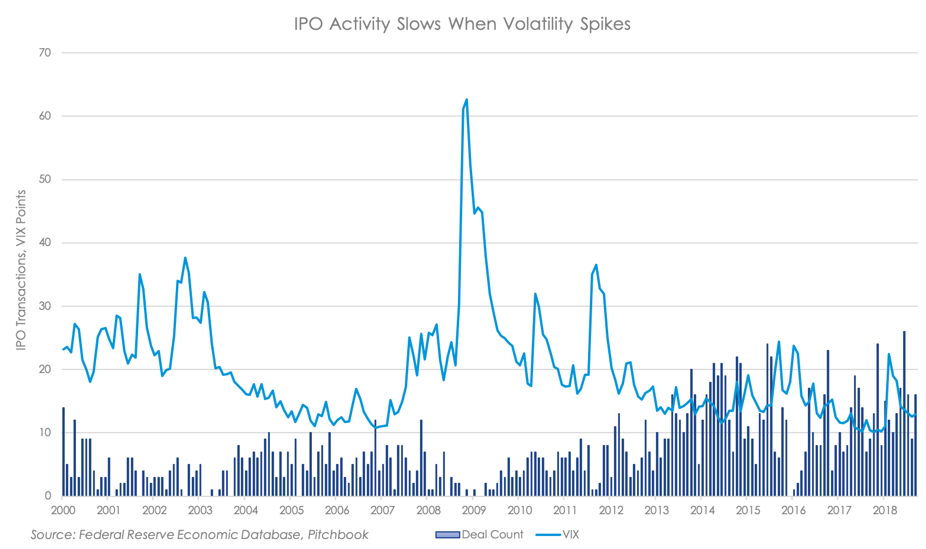

Sixteen companies went public on the Nasdaq and New York Stock Exchange in October, raising a total of $3.3 billion, or 7.5% more than the previous month. On an annualized basis, there was a 65.6% increase in capital raised from one year prior on four more IPOs. Year-to-date 2018 has seen 23.9% more deals and 23.9% more capital invested than the same period in 2017. In absolute terms, $30.2 billion has been raised this calendar year through 145 deals. Five of the IPOs were for technology, media, and telecommunications companies, and all 16 deals were under $500 million. The climb in IPO activity last month is surprising considering the dramatic rise in market volatility. The CBOE VIX, a proxy index for volatility, climbed as high as 25.23 points in October and maintained a level around 20 points throughout the month after floating around 13 points through the summer and most of the fall. When there is uncertainty in capital markets, investors become reluctant to invest new capital and prefer to manage their existing portfolios. This keeps potential IPO candidates out of markets until stability returns, as to maximize exit returns and funds raised.

The highlights from our weekly IPO market updates during October 2018 included: Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed