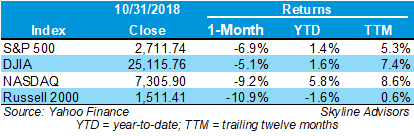

US equities rallied on the last day of the worst month for the S&P 500 since September 2011. The S&P 500 closed the month down 6.9%, the Dow Jones Industrial Average (DJIA) closed down 5.1%, the NASDAQ ended down 9.2%, and the Russell 2000 finished down 10.9%. Before the last week of the month, both the DJIA and S&P 500 entered negative territory for the year. Holding true to the ‘October Effect,’ a theory that the stock market tends to be negative during the month of October (the Panic of 1907; Black Tuesday, Thursday, and Monday [1929]; the Great Crash of 1987; and the days leading to the Great Recession in 2008), markets were no different this month, with the S&P 500 trading nearly three-quarters of its trading sessions lower, while the DJIA closed down 13 of its 23 trading days. The S&P 500 lost $1.91 trillion in value during the month, according to S&P Dow Jones Indices analyst Howard Silverblatt.

Despite that nearly eight in ten companies reported better-than-expected earnings during the month, according to Bespoke Investment Group, companies, such as Caterpillar, 3M, and DowDuPont, saw declines in their stock after making statements on increased costs from global risks of increasing interest costs, a strengthening dollar, and trade war implications. The FANG stocks – Facebook, Apple, Netflix, and Google – also suffered heavy losses in market value. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed