|

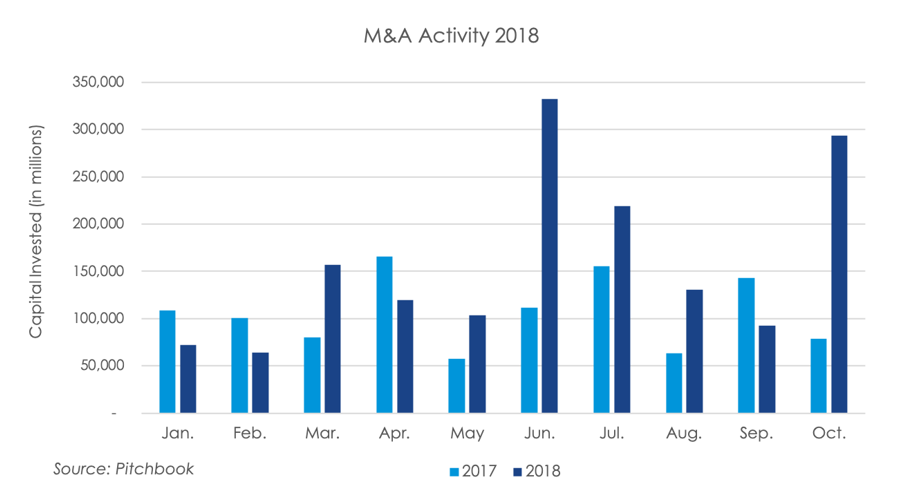

Total announced dollars spent on mergers and acquisitions activity spiked suddenly last month, reaching the second-highest mark for the calendar year on the back of a few mega-deals. Corporations and buyout firms announced total acquisition expenditures of $293.6 billion on 873 deals, a 272.0% increase from one year prior and a 218.1% spike from September, per preliminary data supplied by Pitchbook. The spike may be attributed to a high concentration of deals for more than $1 billion. $270.7 billion, or 92.2% of capital was for ten-figure deals. Overall, 277 transactions involved business-to-business firms and $101.6 billion was invested into information technology companies. Year-to-date, $1.6 trillion capital was announced for 9,045 transactions, a 48.97% and 1.69% increase in dollars and deals, respectively, from the year-to-date period of 2017. Buyout and acquisition price tags are maintaining their high levels this year. Last month alone there were 51 deals were for over $1 billion and 25 were greater than $2.5 billion. In fact, three acquisitions – RedHat, Energy Transfer Partners, and Andeavor – were for more than $20 billion.

There seems to be uncertainty across the market regarding the M&A outlook. A survey published by accounting firm EY earlier this year revealed that 90% of participants see the M&A market improving over the next 12 months and 46% have expectations of pursuing a deal within the next year. Both are signs of a strong M&A outlook. However, in the October 2018 Tech M&A Leaders’ Survey published by law firm Morrison & Foerster, 43% percent of participants saw a rise in M&A activity, a drop from 66% in April 2018, and 16% predict a decrease in activity. This survey signals a rather pessimistic view of the M&A outlook, demonstrating confusion in capital markets. The highlights from our weekly M&A market updates during October 2018 included: Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed