|

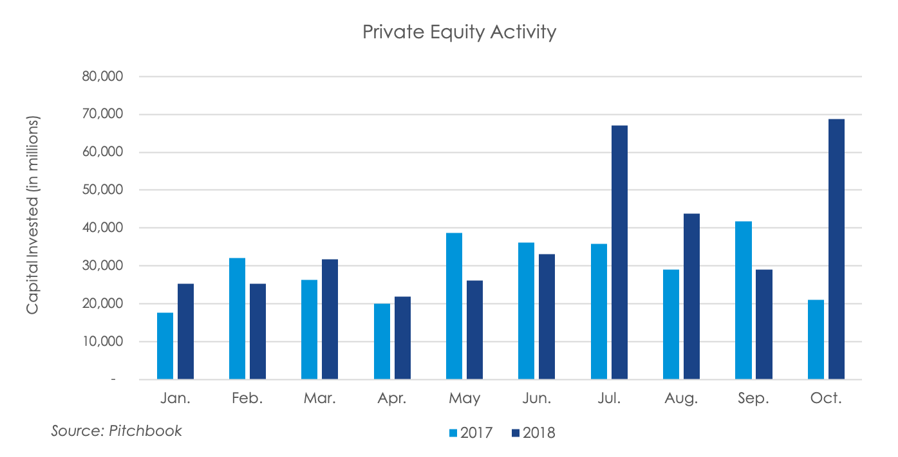

Private equity activity, in line with M&A spending, made a sudden upward spike in October, climbing 137% from September and 228% from October 2017 to $68.8 billion, the highest monthly level in 2017 and 2018, as shown by preliminary data supplied by Pitchbook. Like M&A activity, the jump in private equity spending appears to have been driven by 17 deals worth over $1 billion, which accounted for $58.6 billion, 85.2% of the monthly total. For the 4,427 deals in 2018, $371.8 billion in capital has been invested, a 24.7% increase in capital on an increase of just 2.4% in total deals. This figure is likely also driven by the high concentration of investments in $1 billion and larger deals. Fifty-four of the month’s buyouts were within the industrials vertical, totaling $10.2 billion, and made-up six of the 17 ten-figure deals. A mere 11 deals were in the Midwest. However, 90 deals were from the Mid-Atlantic and 88 were from the Great Lakes.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed