|

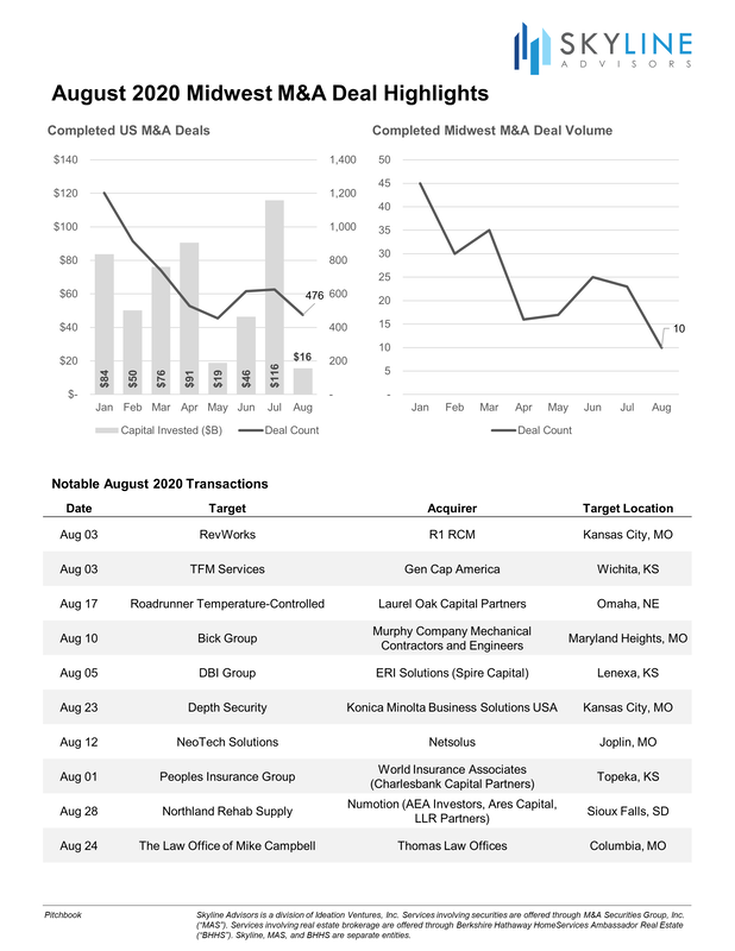

Preliminary data from PitchBook suggests that August was a slow month for national and Midwest merger and acquisition (M&A) activity. In the US, fewer than 500 deals were completed during the month, a nearly 25% reversal of the recovery we began to see after May’s lows. Similarly, M&A activity in the Midwest fell to the lowest level of the year. However, the data may not be as dreary as a first glance shows – more than 150 deals were announced in the US during the month, estimated to account for over $110 billion in transaction value. Furthermore, the Midwest had one deal announced during the month that topped $1 billion – Waystar Health announced during the month that it would acquire Overland Park-based eSolutions for an estimated $1.35 billion. Given the length of time it takes to close some transactions, August may have represented a lagging indicator of the lull in the deal pipeline during the second quarter as May deals paused due to uncertainty. However, it a sharp contrast from the rebound in deal counts and aggregate deal values closed in July. The announced (but not yet closed) deals in August does suggest that activity may continue to strengthen. Other factors, such as change-in-control restrictions in PPP loans and recommendations by many professionals to wait to apply for PPP forgiveness for middle market companies, may also be influencing a slowing rate of new deals closing in the lower-middle and middle markets.

Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed