|

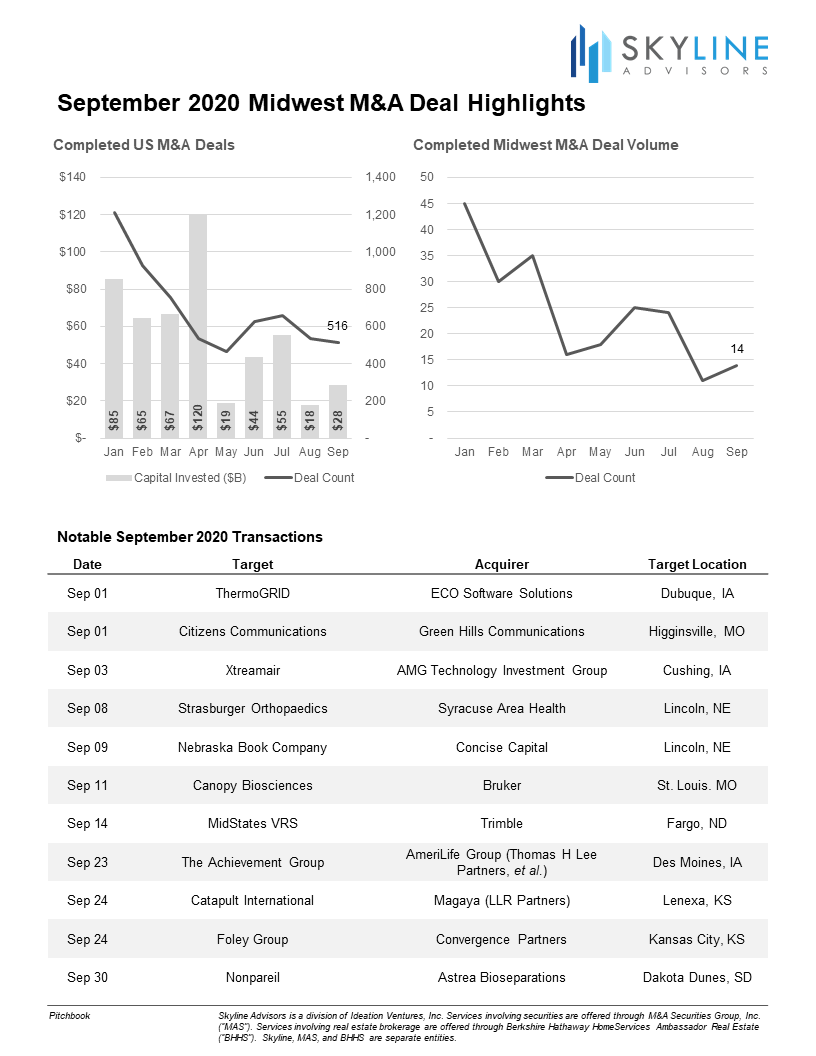

Sluggish merger and acquisition (M&A) activity carried over into September, as just over 500 transactions were completed in the US during the month. Despite an apparent leveling off of deals (more September deals will certainly be reported as there is a lag in reporting), preliminary data from PitchBook suggests that overall transaction value climbed roughly 60% month over month. In the Midwest, 14 transactions were preliminarily reported, a slight increase from August’s 11 deals. Deals in the information technology space were favored, accounting for six of the 14 completed. The late-summer slowdown in M&A activity may be caused by a few factors:

With the improving prospects for PPP loans no longer preventing transactions, we expect deal volumes to pick up over October and November. This will further improve when/if the political limbo of whether or not there will be additional stimulus is resolved. The economic recovery, which we previously expected to be very uneven, will continue to vary significantly by industry and geography. Despite the slowing in deal-making, deals are still getting closed. Investors are actively seeking quality investments and have significant cash reserves to invest. Companies that are thriving in this tough environment are receiving heavy interest. As covered in our Second Quarter M&A Report, fewer deals in general are being completed, but the focus on higher quality deals is generally resulting in near record-high valuation multiples. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed