|

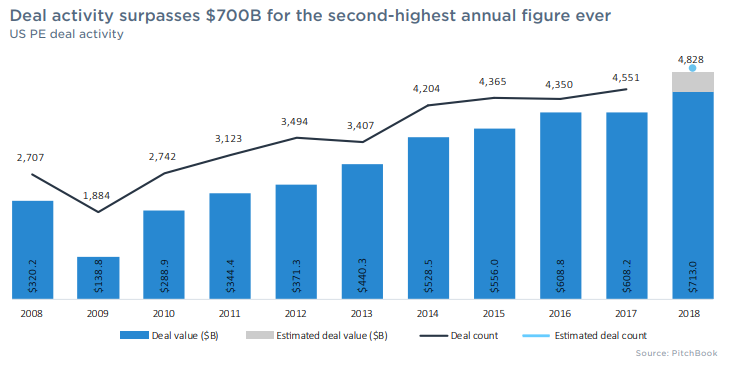

US private equity firms completed an estimated 4,828 deals worth a combined $713 billion in 2018, according to data provider Pitchbook. The figures were the highest deal count and second-highest value on record and represent increases of 5.5% and 7.2%, respectively, from 2017 levels. Notable deals during the year included Blackstone’s majority buyout of Thomson Reuters’ Financial & Risk Business (now called Refinitiv), BDT Capital Partners’ and JAB Holdings’ acquisition of Dr. Pepper Snapple, and Veritas Capital’s and Evergreen Coast Capital’s buyout of Athenahealth.

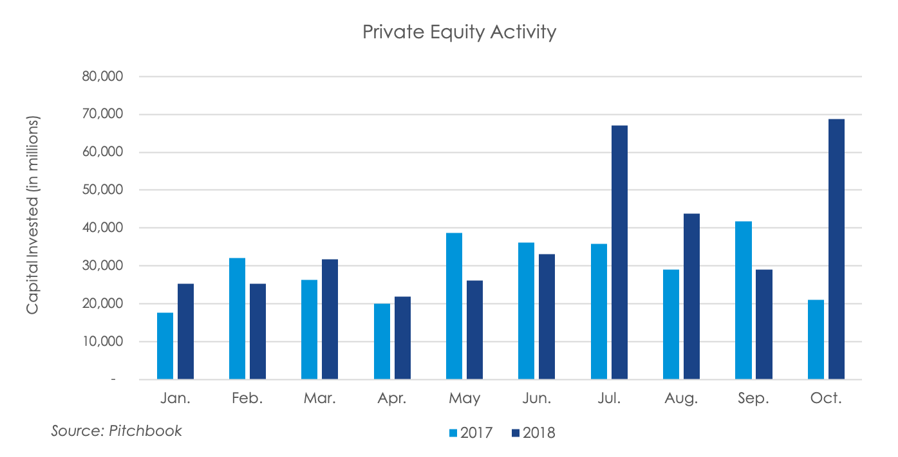

Private equity activity, in line with M&A spending, made a sudden upward spike in October, climbing 137% from September and 228% from October 2017 to $68.8 billion, the highest monthly level in 2017 and 2018, as shown by preliminary data supplied by Pitchbook. Like M&A activity, the jump in private equity spending appears to have been driven by 17 deals worth over $1 billion, which accounted for $58.6 billion, 85.2% of the monthly total.

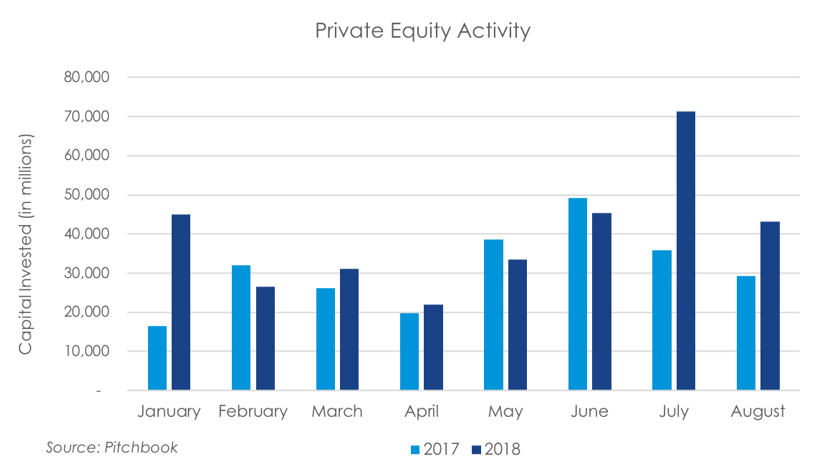

In August, private equity deal making fell from the 2018 highs set in July, according to Pitchbook data. For the month, private equity investment for U.S. companies totaled $43.1 billion among 379 deals. This is down 39.6% from $71.26 billion invested in July but up 46.8% from $29.35 billion invested in August 2017. For the year through August, PE investment has totaled $317.69 billion among 3,382 deals, an increase of $70.23 billion over the same period of 2017.

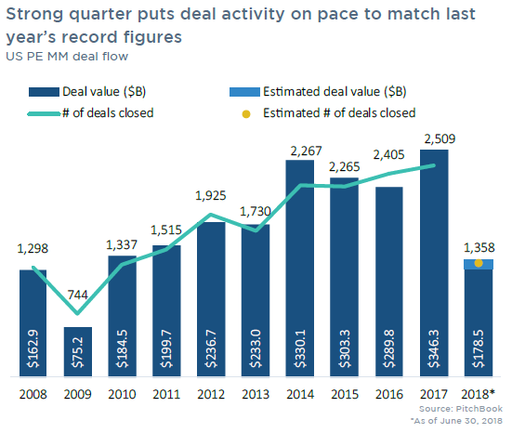

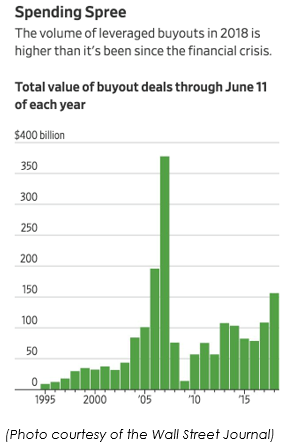

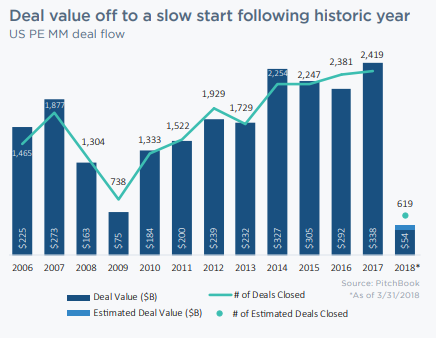

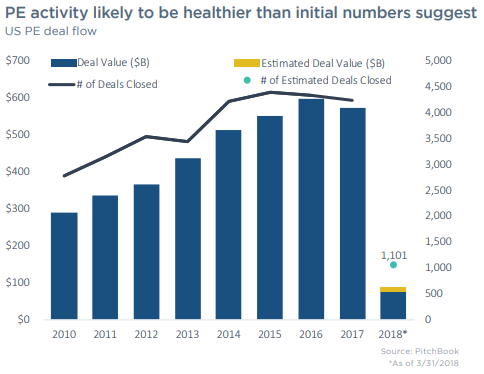

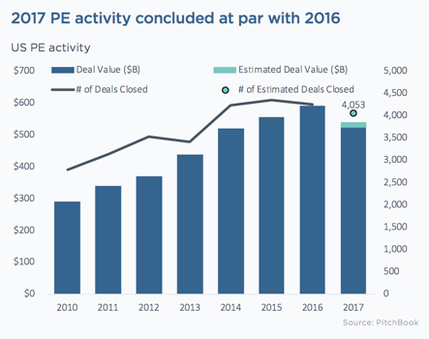

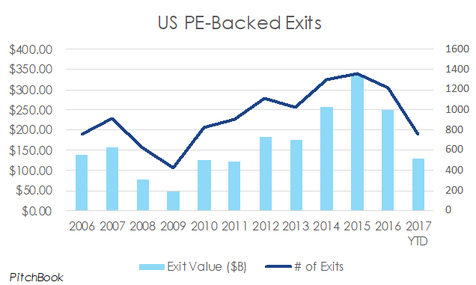

According to data provider Pitchbook, 654 US middle-market private equity (PE) transactions closed in the second quarter, with a total value of $87.6 billion. This represents decreases of 7.0% and 3.6%, respectively, from the first quarter.  Leveraged buyout, or LBO, activity has been booming in 2018. According to an article from the Wall Street Journal last week, 2018 is on pace to have the highest dollar volume of LBOs since 2007, before the Great Recession. LBO activity for the year is up 44% from the same time-period last year. Overall M&A activity in 2018, at $2.1 trillion, is on pace to break the current record high for global M&A activity, set in 2007 at $4.3 trillion. Firms are pointing to large corporate deals - such as AT&T and Time Warner, the pending battle between Disney and Comcast for Twenty-First Century Fox, and Bayer’s takeover of Monsanto - as being a driving force behind the increase in activity. Activist investors or regulators may force the sale of assets to allow a corporate deal to take place, leaving more “orphaned” businesses for private equity firms to pursue. Also, debt is still relatively cheap, and the economy is strong, creating a greater incentive to acquire companies and select assets.  Middle-market private equity firms completed 619 transactions in the first quarter of 2018, representing $53.6 billion in deal value, according to Pitchbook. Compared to the first quarter of the 2017, completed transactions increased 17%, while deal value declined 40%, signaling a shift toward smaller transactions.  Private equity activity slowed in the first quarter of 2018, according to Pitchbook. At 1,101 completed transactions in the first quarter, deal volume declined 4.0% from the first quarter of 2017. Surprisingly, deal value, at $88.8 billion, fell 32.8% over the same period. Pitchbook noted an expectation for an uptick in the value in the coming months, as information regarding private transactions is slow to surface.  Pitchbook released its 2017 Annual US PE Breakdown report this week. The total value of private equity (PE) deals completed in the US in 2017 was estimated at $538 billion across 4,053 deals. This activity is down 8.9% from 2016, which is a bit counterintuitive at first since PE funds have record amounts of “dry powder” to invest. Three quarters of the follow-on funds raised by private equity funds during the year were larger than their predecessor funds. PitchBook’s recent 2018 Crystal Ball Survey report found that private equity firms had two main concerns. The first was a perceived “high-priced” environment, with the median EBITDA (earnings before interest taxes depreciation and amortization) in 2017 coming in at 10.5x. The second was a perceived lack of “quality” targets being on the market after the record volume of deals over the last several years.  According to PitchBook, mergers and acquisitions (M&A) by private equity (PE) funds trended down in the third quarter of 2017 with an estimated 959 deals closed, valued at approximately $163 billion. This is a subset of the overall M&A market, as this only includes deals by PE firms and excludes acquisitions by strategic buyers. For the first three quarters of the year, deal value and closings are both down 11% from the first three quarters of 2016. This comes as a surprise, as fundraising continues to be strong, and private equity “dry powder” (the capital that the funds have raised but not yet deployed) is at an estimated $556 billion. Fewer numbers of investments being made and lower aggregate deal value may be the effect of fewer quality deals on the market and less flexibility in price. |

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed