|

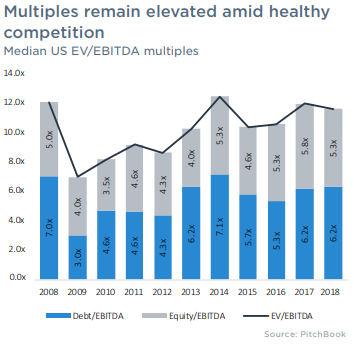

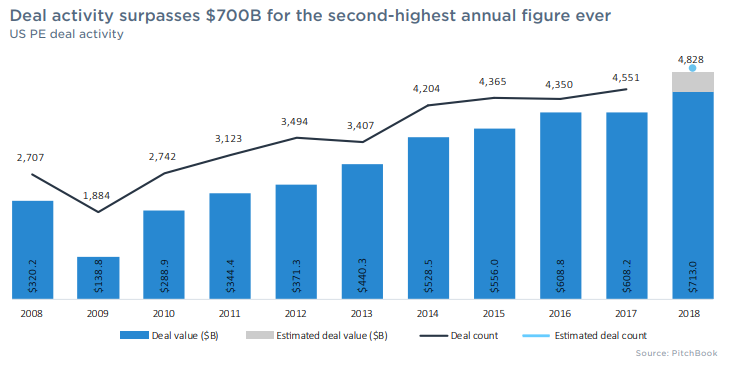

US private equity firms completed an estimated 4,828 deals worth a combined $713 billion in 2018, according to data provider Pitchbook. The figures were the highest deal count and second-highest value on record and represent increases of 5.5% and 7.2%, respectively, from 2017 levels. Notable deals during the year included Blackstone’s majority buyout of Thomson Reuters’ Financial & Risk Business (now called Refinitiv), BDT Capital Partners’ and JAB Holdings’ acquisition of Dr. Pepper Snapple, and Veritas Capital’s and Evergreen Coast Capital’s buyout of Athenahealth.  Median valuations, measured as a multiple of earnings before interest, taxes, depreciation, and amortization (EBITDA), fell to 11.6x from 11.9x in 2017. However, the proportion of deals priced above 10.0x was the highest in Pitchbook’s records at 61.4%. Easy access to financing and high levels of dry powder, or funds ready to be invested, led to increased competition for assets and healthy valuations. PE firms exited 1,049 investments worth a combined $365.4 billion in 2018, a 16.3% decline and a 0.1% increase from 2017. The median exit size of $330 million is the largest on record, and the 46.7% increase in year-over-year median growth is the largest since 2010.

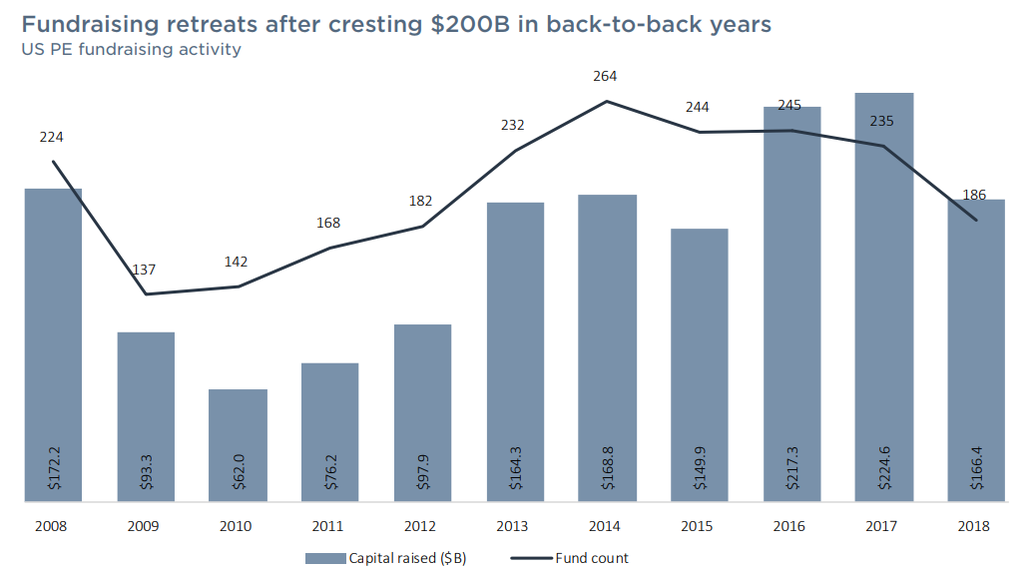

Fundraising among private equity firms retreated after two consecutive years above $200 billion. Fundraising in 2018 came in at $166.4 billion across 186 funds – 25.9% and 20.9% declines compared to 2017. The decline in fundraising is largely due to fewer mega-funds closing; only five closed in 2018, with a total value of $52.8 billion, compared to 2017, in which ten closed, with a total value of $107 billion. Comments are closed.

|

Archives

May 2023

Categories

All

|

|

Skyline Advisors is a division of Ideation Ventures, Inc. Services involving securities are offered through M&A Securities Group, Inc.4151 N Mulberry Drive Suite 252, Kansas City, MO, 64116 (“MAS") . Services involving real estate brokerage are offered through Berkshire Hathaway HomeServices Ambassador Real Estate ("BHHS"). Skyline, MAS, and BHHS are separate entities.

COPYRIGHT 2024. ALL RIGHTS RESERVED. |

RSS Feed

RSS Feed